AT&T Results Presentation Deck

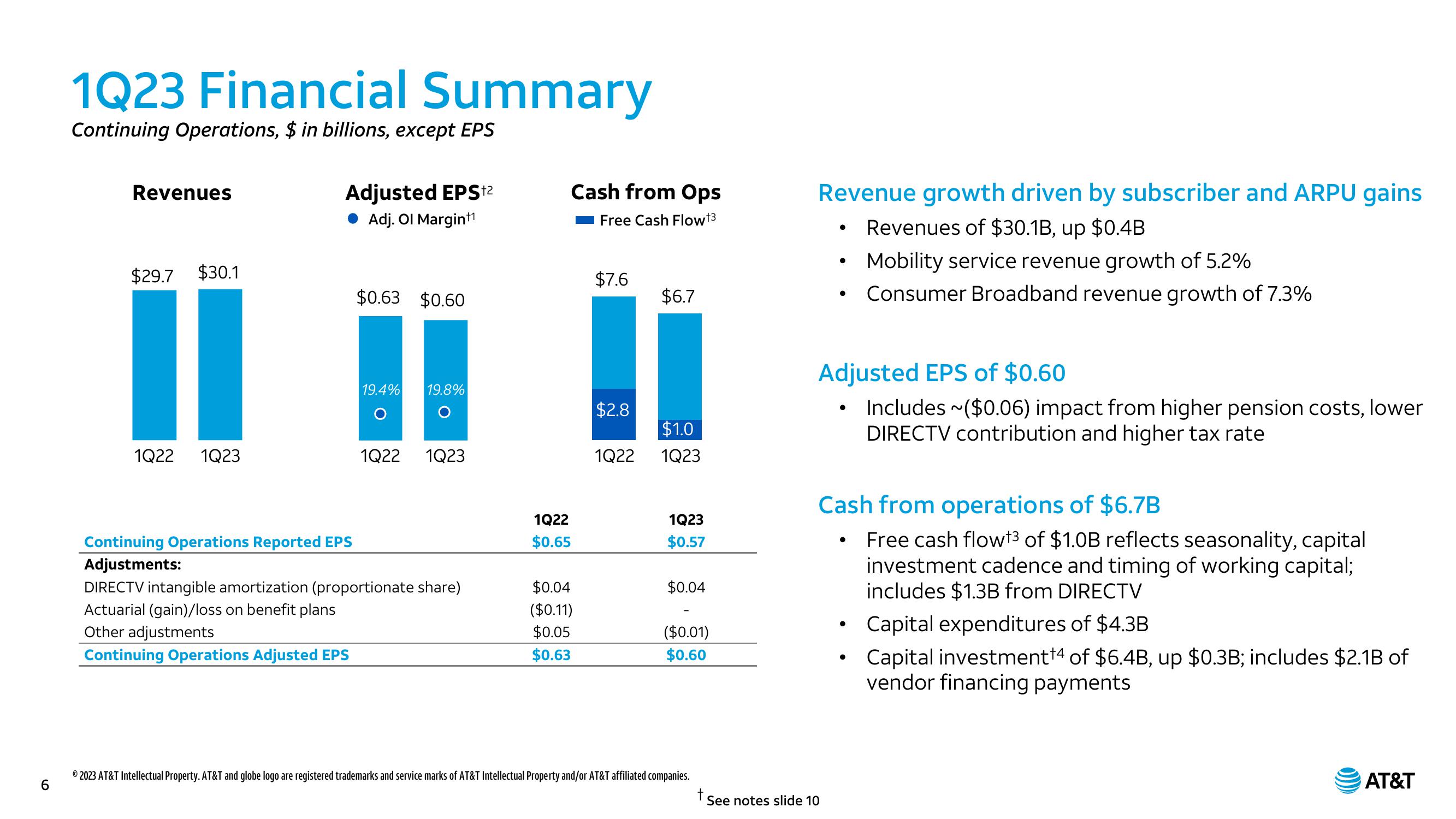

1Q23 Financial Summary

Continuing Operations, $ in billions, except EPS

Revenues

$29.7 $30.1

1Q22 1Q23

Adjusted EPS+²

Adj. Ol Margin¹¹

Continuing Operations Reported EPS

Adjustments:

$0.63 $0.60

19.4% 19.8%

O

1Q22 1Q23

DIRECTV intangible amortization (proportionate share)

Actuarial (gain)/loss on benefit plans

Other adjustments

Continuing Operations Adjusted EPS

1Q22

$0.65

Cash from Ops

Free Cash Flow +3

$0.04

($0.11)

$0.05

$0.63

$7.6

$2.8

$6.7

$1.0

1Q22 1Q23

1Q23

$0.57

$0.04

($0.01)

$0.60

© 2023 AT&T Intellectual Property. AT&T and globe logo are registered trademarks and service marks of AT&T Intellectual Property and/or AT&T affiliated companies.

6

Revenue growth driven by subscriber and ARPU gains

Revenues of $30.1B, up $0.4B

Mobility service revenue growth of 5.2%

Consumer Broadband revenue growth of 7.3%

●

Adjusted EPS of $0.60

Includes ~($0.06) impact from higher pension costs, lower

DIRECTV contribution and higher tax rate

t

See notes slide 10

●

Cash from operations of $6.7B

Free cash flowt3 of $1.0B reflects seasonality, capital

investment cadence and timing of working capital;

includes $1.3B from DIRECTV

●

Capital expenditures of $4.3B

●

• Capital investment¹4 of $6.4B, up $0.3B; includes $2.1B of

vendor financing payments

●

AT&TView entire presentation