Snap Inc Results Presentation Deck

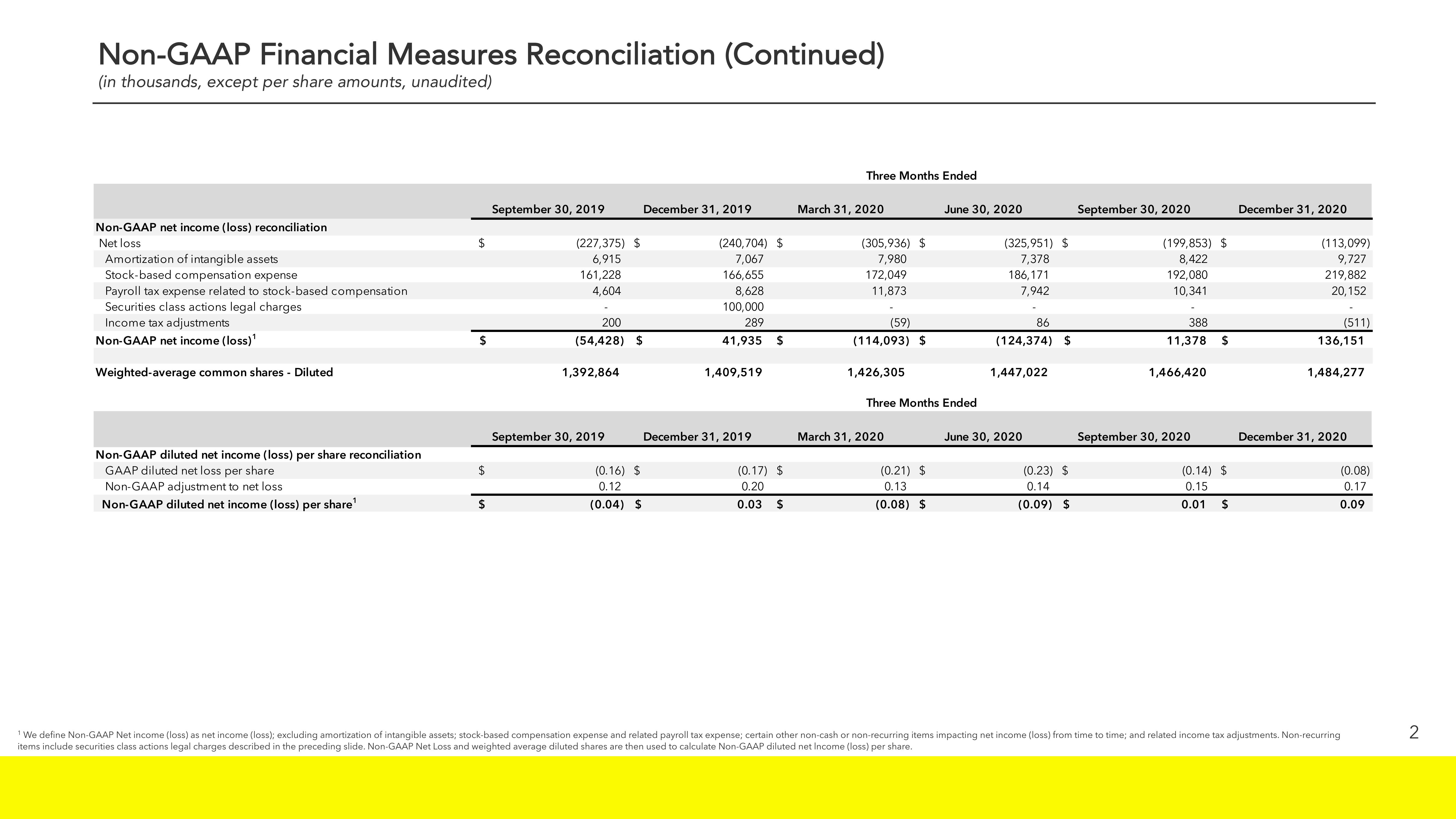

Non-GAAP Financial Measures Reconciliation (Continued)

(in thousands, except per share amounts, unaudited)

Non-GAAP net income (loss) reconciliation

Net loss

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Securities class actions legal charges

Income tax adjustments

Non-GAAP net income (loss) ¹

Weighted-average common shares - Diluted

Non-GAAP diluted net income (loss) per share reconciliation

GAAP diluted net loss per share

Non-GAAP adjustment to net loss

Non-GAAP diluted net income (loss) per share¹

$

$

$

$

September 30, 2019

(227,375) $

6,915

161,228

4,604

200

(54,428) $

1,392,864

September 30, 2019

December 31, 2019

(0.16)

0.12

(0.04) $

(240,704) $

7,067

166,655

8,628

100,000

289

41,935

1,409,519

December 31, 2019

$

(0.17) $

0.20

0.03

$

Three Months Ended

March 31, 2020

(305,936) $

7,980

172,049

11,873

(59)

(114,093) $

1,426,305

Three Months Ended

March 31, 2020

June 30, 2020

(0.21) $

0.13

(0.08) $

(325,951) $

7,378

186,171

7,942

86

(124,374) $

1,447,022

June 30, 2020

(0.23) $

0.14

(0.09) $

September 30, 2020

(199,853) $

8,422

192,080

10,341

388

11,378 $

1,466,420

September 30, 2020

(0.14) $

0.15

0.01

$

December 31, 2020

(113,099)

9,727

219,882

20,152

(511)

136,151

1,484,277

December 31, 2020

(0.08)

0.17

0.09

¹ We define Non-GAAP Net income (loss) as net income (loss); excluding amortization of intangible assets; stock-based compensation expense and related payroll tax expense; certain other non-cash or non-recurring items impacting net income (loss) from time to time; and related income tax adjustments. Non-recurring

items include securities class actions legal charges described in the preceding slide. Non-GAAP Net Loss and weighted average diluted shares are then used to calculate Non-GAAP diluted net Income (loss) per share.

2View entire presentation