Credit Suisse Investment Banking Pitch Book

CREDIT SUISSE DOES NOT PROVIDE ANY TAX ADVICE | MATERIALS ARE PRELIMINARY AND SUBJECT TO FURTHER CHANGE AND DEVELOPMENTS (WHICH MAY BE MATERIAL)

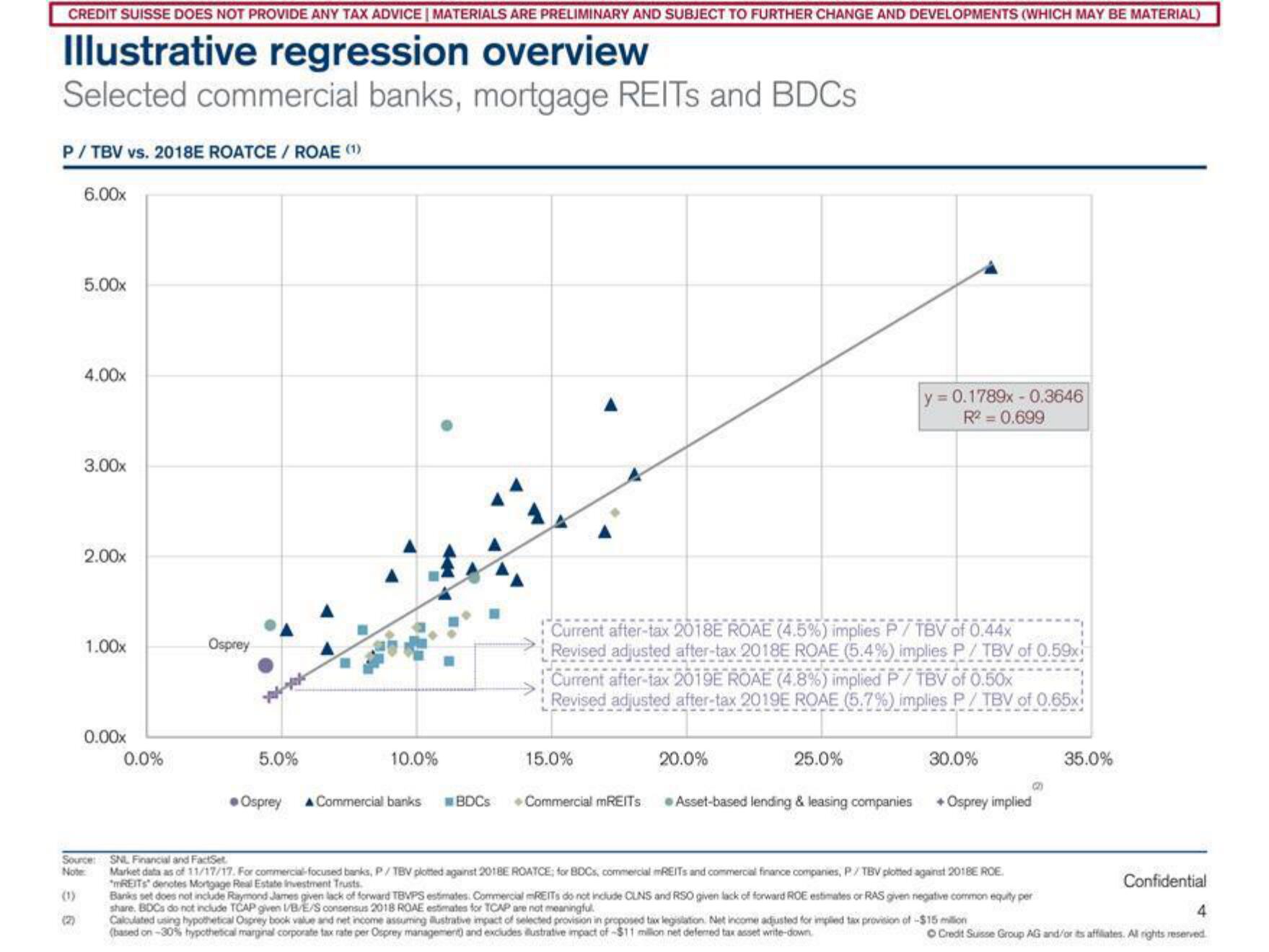

Illustrative regression overview

Selected commercial banks, mortgage REITS and BDCs

P/TBV vs. 2018E ROATCE / ROAE (1)

6.00x

5.00x

33

4.00x

3.00x

2.00x

1.00x

0.00x

0.0%

Osprey

5.0%

●Osprey

10.0%

Commercial banks

BDCs

Currer after 2018E ROAE (4.5%) implies P/TBV of 0.44x

Revised adjusted after-tax 2018E ROAE (5.4%) implies P/TBV of 0.59x

Current after-tax 2019E ROAE (4.8%) implied P/TBV of 0.50x

Revised adjusted after-tax 2019E ROAE (5.7%) implies P/TBV of 0.65x

15.0%

Commercial mREITS

20.0%

y = 0.1789x -0.3646

R² = 0.699

25.0%

30.0%

3

Asset-based lending & leasing companies +Osprey implied

Source: SNL Financial and FactSet

Note:

Market data as of 11/17/17. For commercial focused banks, P/TBV plotted against 2018E ROATCE; for BDCs, commercial

"REITS denotes Mortgage Real Estate Investment Trusts.

REITs and commercial finance companies, P/TBV plotted against 2018E ROE.

Banks set does not include Raymond James given lack of forward TBVPS estimates Commercial REITs do not include CLNS and RSO given lack of forward ROE estimates or RAS given negative common equity per

share. BDCs do not include TCAP given I/B/E/S consensus 2018 ROAE estimates for TCAP are not meaningful

Calculated using hypothetical Osprey book value and net income assuming alustrative impact of selected provision in proposed tax legislation. Net income adjusted for implied tax provision of -$15 million

(based on-30% hypothetical marginal corporate tax rate per Osprey management) and excludes illustrative impact of -$11 million net deferred tax asset write-down

35.0%

Confidential

4

O Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation