jetBlue Results Presentation Deck

FOCUSING ON CAPITAL PRESERVATION AND MAINTAINING LIQUIDITY

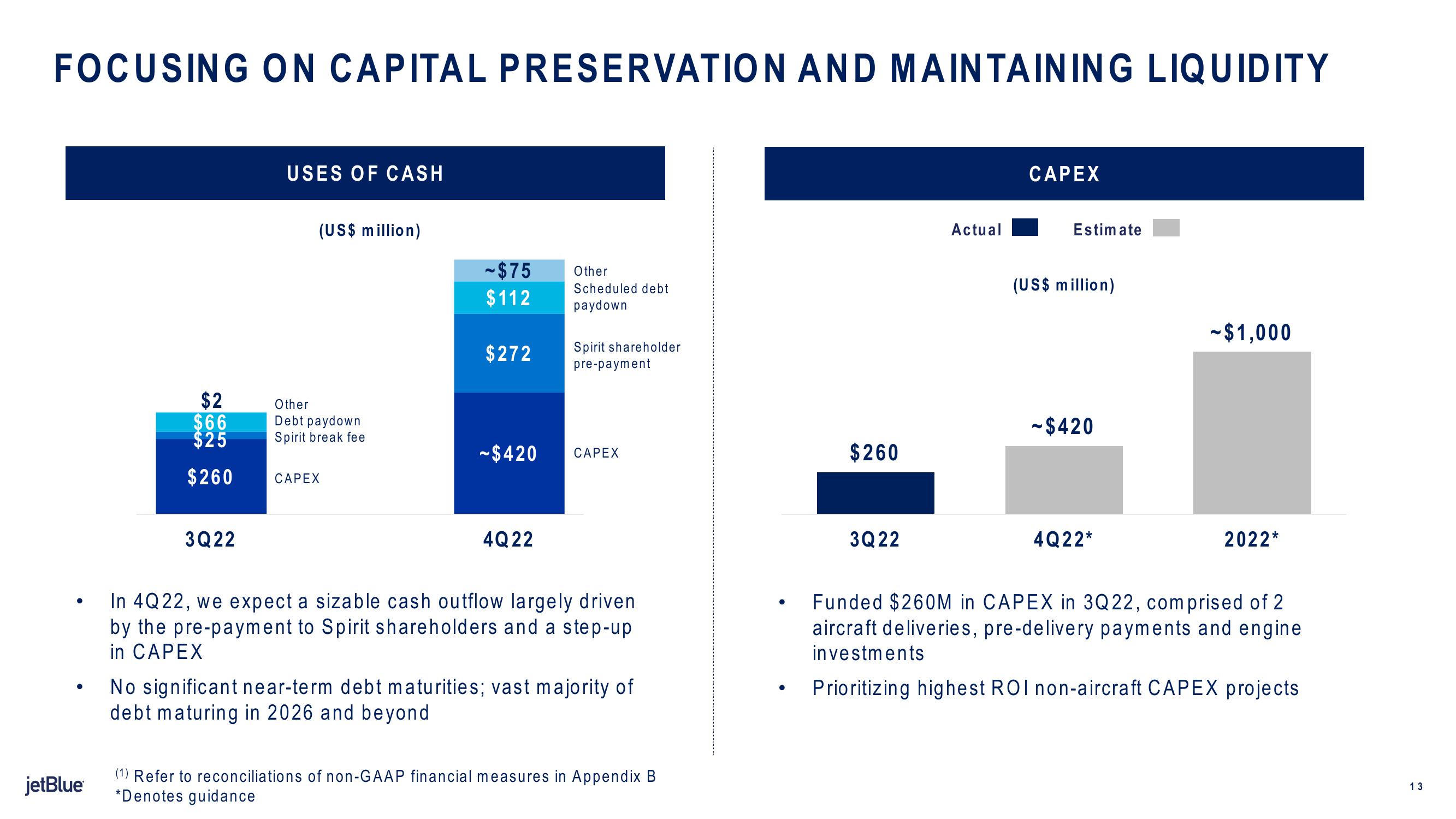

●

jetBlue

$2

$66

$25

$260

3Q22

USES OF CASH

(US$ million)

Other

Debt paydown

Spirit break fee

CAPEX

~$75

$112

$272

-$420

4Q22

Other

Scheduled debt

paydown

Spirit shareholder

pre-payment

CAPEX

In 4Q22, we expect a sizable cash outflow largely driven

by the pre-payment to Spirit shareholders and a step-up

in CAPEX

No significant near-term debt maturities; vast majority of

debt maturing in 2026 and beyond

(1) Refer to reconciliations of non-GAAP financial measures in Appendix B

*Denotes guidance

●

$260

3Q22

Actual

CAPEX

Estimate

(US$ million)

-$420

4Q22*

-$1,000

2022*

Funded $260M in CAPEX in 3Q22, comprised of 2

aircraft deliveries, pre-delivery payments and engine

investments

Prioritizing highest ROI non-aircraft CAPEX projects

13View entire presentation