Allwyn Results Presentation Deck

Q1 2021 highlights

■

■

4

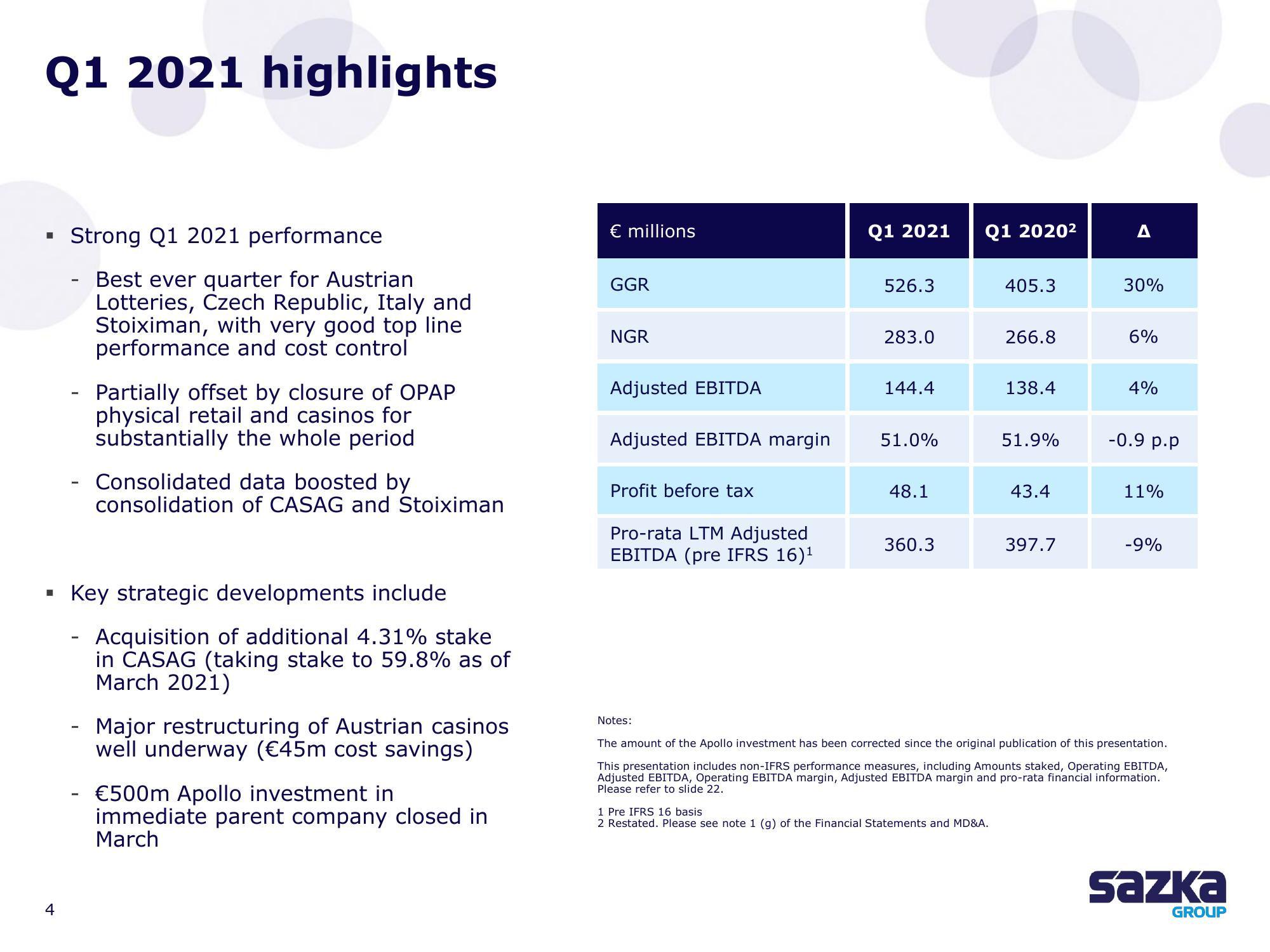

Strong Q1 2021 performance

Best ever quarter for Austrian

Lotteries, Czech Republic, Italy and

Stoiximan, with very good top line

performance and cost control

Partially offset by closure of OPAP

physical retail and casinos for

substantially the whole period

Consolidated data boosted by

consolidation of CASAG and Stoiximan

Key strategic developments include

- Acquisition of additional 4.31% stake

in CASAG (taking stake to 59.8% as of

March 2021)

Major restructuring of Austrian casinos

well underway (€45m cost savings)

- €500m Apollo investment in

immediate parent company closed in

March

€ millions

GGR

NGR

Adjusted EBITDA

Adjusted EBITDA margin

Profit before tax

Pro-rata LTM Adjusted

EBITDA (pre IFRS 16)¹

Q1 2021

526.3

283.0

144.4

51.0%

48.1

360.3

Q1 2020²

405.3

1 Pre IFRS 16 basis.

2 Restated. Please see note 1 (g) of the Financial Statements and MD&A.

266.8

138.4

51.9%

43.4

397.7

A

30%

6%

4%

-0.9 p.p

11%

-9%

Notes:

The amount of the Apollo investment has been corrected since the original publication of this presentation.

This presentation includes non-IFRS performance measures, including Amounts staked, Operating EBITDA,

Adjusted EBITDA, Operating EBITDA margin, Adjusted EBITDA margin and pro-rata financial information.

Please refer to slide 22.

Sazka

GROUPView entire presentation