J.P.Morgan Investment Banking Pitch Book

VALUATION SUMMARY

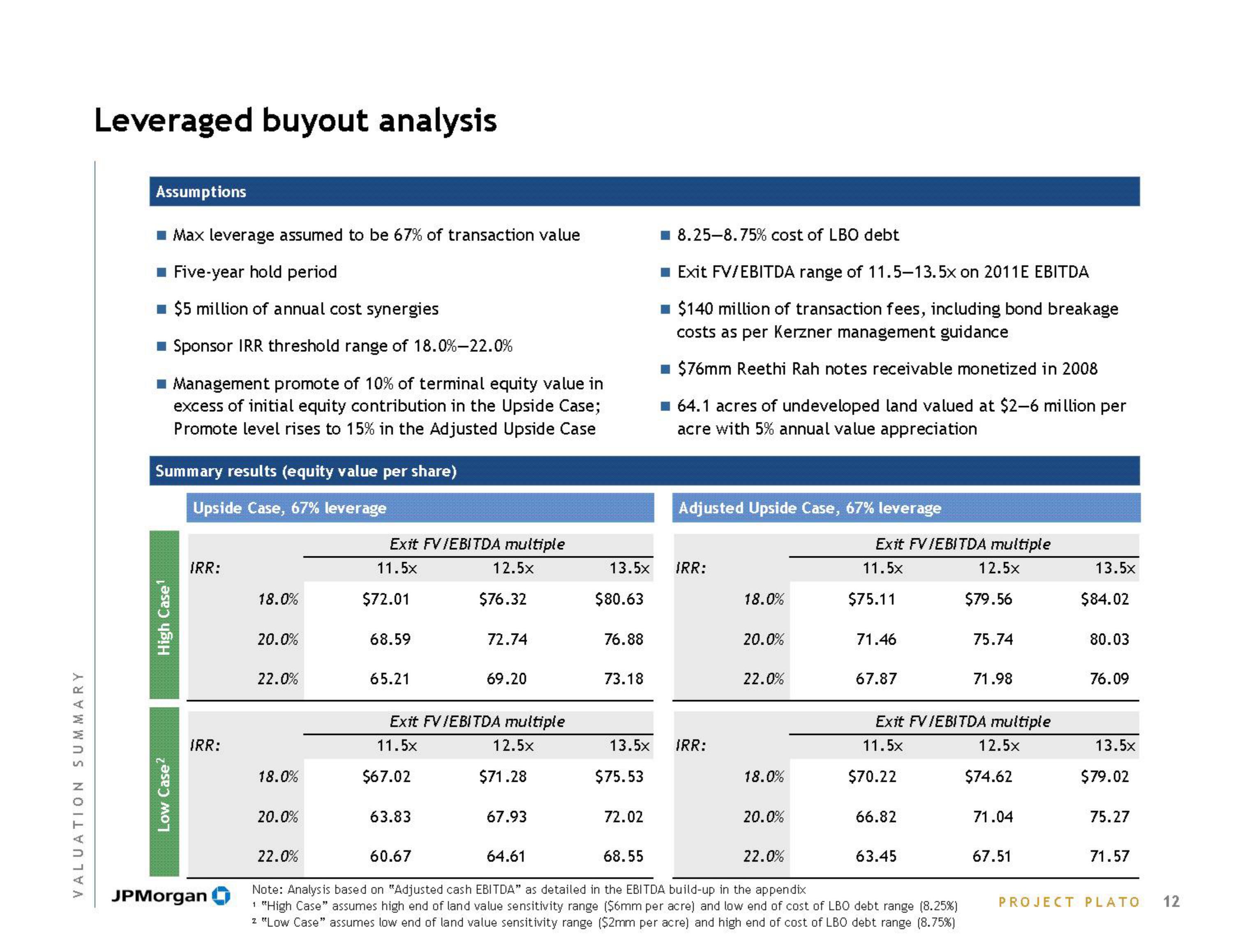

Leveraged buyout analysis

Assumptions

Max leverage assumed to be 67% of transaction value

■ Five-year hold period

■ $5 million of annual cost synergies

■ Sponsor IRR threshold range of 18.0%-22.0%

■Management promote of 10% of terminal equity value in

excess of initial equity contribution in the Upside Case;

Promote level rises to 15% in the Adjusted Upside Case

Summary results (equity value per share)

Upside Case, 67% leverage

High Case¹

Low Case²

IRR:

IRR:

JPMorgan

18.0%

20.0%

22.0%

18.0%

20.0%

Exit FV/EBITDA multiple

11.5×

12.5×

22.0%

$72.01

68.59

65.21

$67.02

63.83

$76.32

Exit FV/EBITDA multiple

11.5×

12.5×

72.74

60.67

69.20

$71.28

67.93

13.5×

$80.63

76.88

73.18

$75.53

72.02

8.25-8.75% cost of LBO debt

■Exit FV/EBITDA range of 11.5-13.5x on 2011 E EBITDA

■ $140 million of transaction fees, including bond breakage

costs as per Kerzner management guidance

■ $76mm Reethi Rah notes receivable monetized in 2008

☐ 64.1 acres of undeveloped land valued at $2-6 million per

acre with 5% annual value appreciation

13.5× IRR:

Adjusted Upside Case, 67% leverage

68.55

IRR:

18.0%

20.0%

22.0%

18.0%

20.0%

Exit FV/EBITDA multiple

11.5×

12.5×

22.0%

$75.11

71.46

67.87

64.61

Note: Analysis based on "Adjusted cash EBITDA" as detailed in the EBITDA build-up in the appendix

1 "High Case" assumes high end of land value sensitivity range ($6mm per acre) and low end of cost of LBO debt range (8.25 %)

z "Low Case" assumes low end of land value sensitivity range ($2mm per acre) and high end of cost of LBO debt range (8.75%)

$70.22

66.82

Exit FV/EBITDA multiple

11.5×

12.5×

$79.56

63.45

75.74

71.98

$74.62

71.04

67.51

13.5×

$84.02

80.03

76.09

13.5×

$79.02

75.27

71.57

PROJECT PLATO

12View entire presentation