Clearbanc Start Up

CLEARBANC

Clearbanc is creating a

whole new asset class

While VC funding can be an important

part of a company's growth plans, it

should not be used to fund repeatable

parts of growth

Clearbanc is creating a new asset class to

fund the predictable, measurable parts of

growth like FB and Google ads

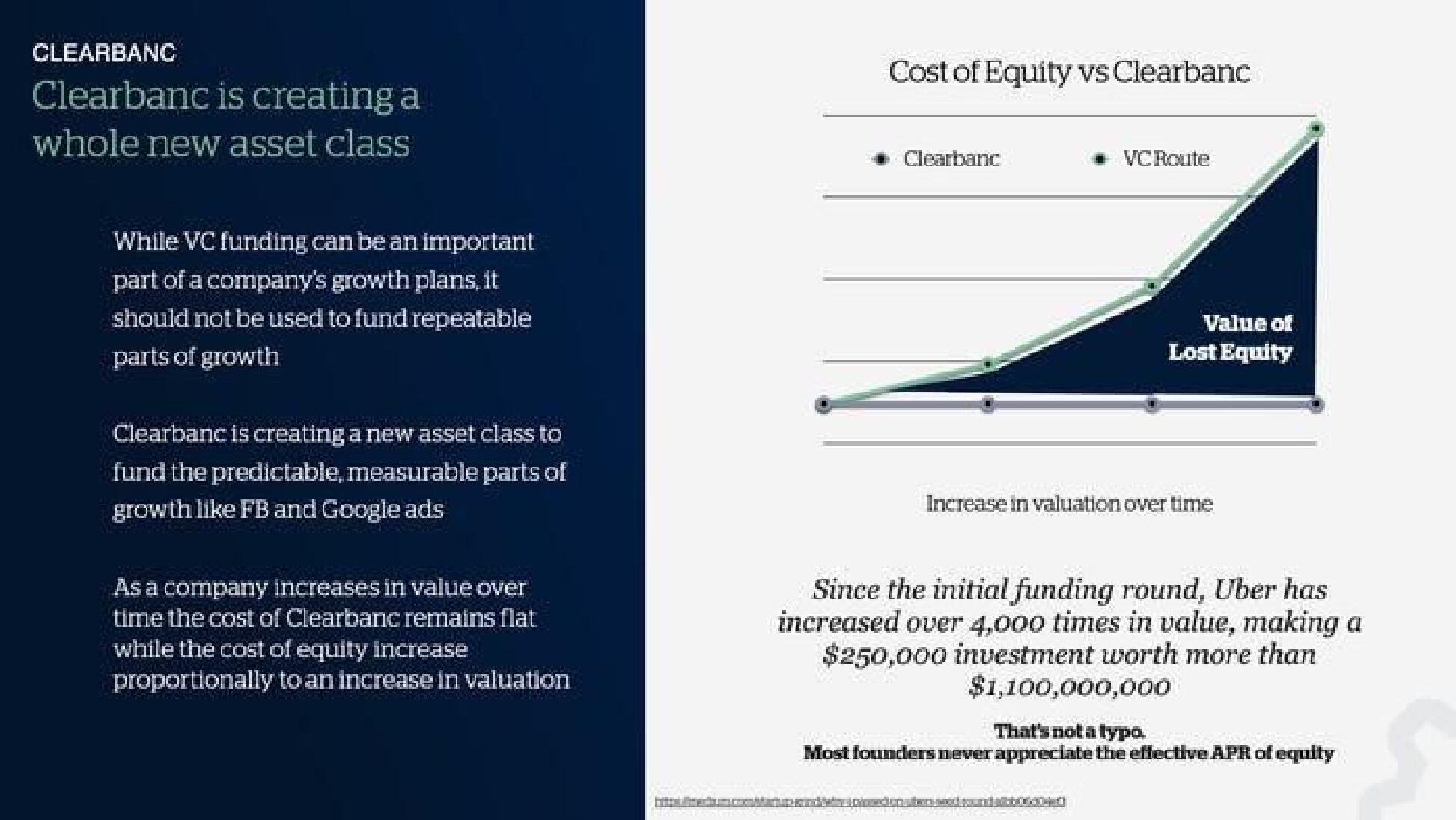

As a company increases in value over

time the cost of Clearbanc remains flat

while the cost of equity increase

proportionally to an increase in valuation

with

Cost of Equity vs Clearbanc

Clearbanc

VC Route

Value of

Lost Equity

Increase in valuation over time

Since the initial funding round, Uber has

increased over 4,000 times in value, making a

$250,000 investment worth more than

$1,100,000,000

That's not a typo.

Most founders never appreciate the effective APR of equityView entire presentation