WeWork Investor Day Presentation Deck

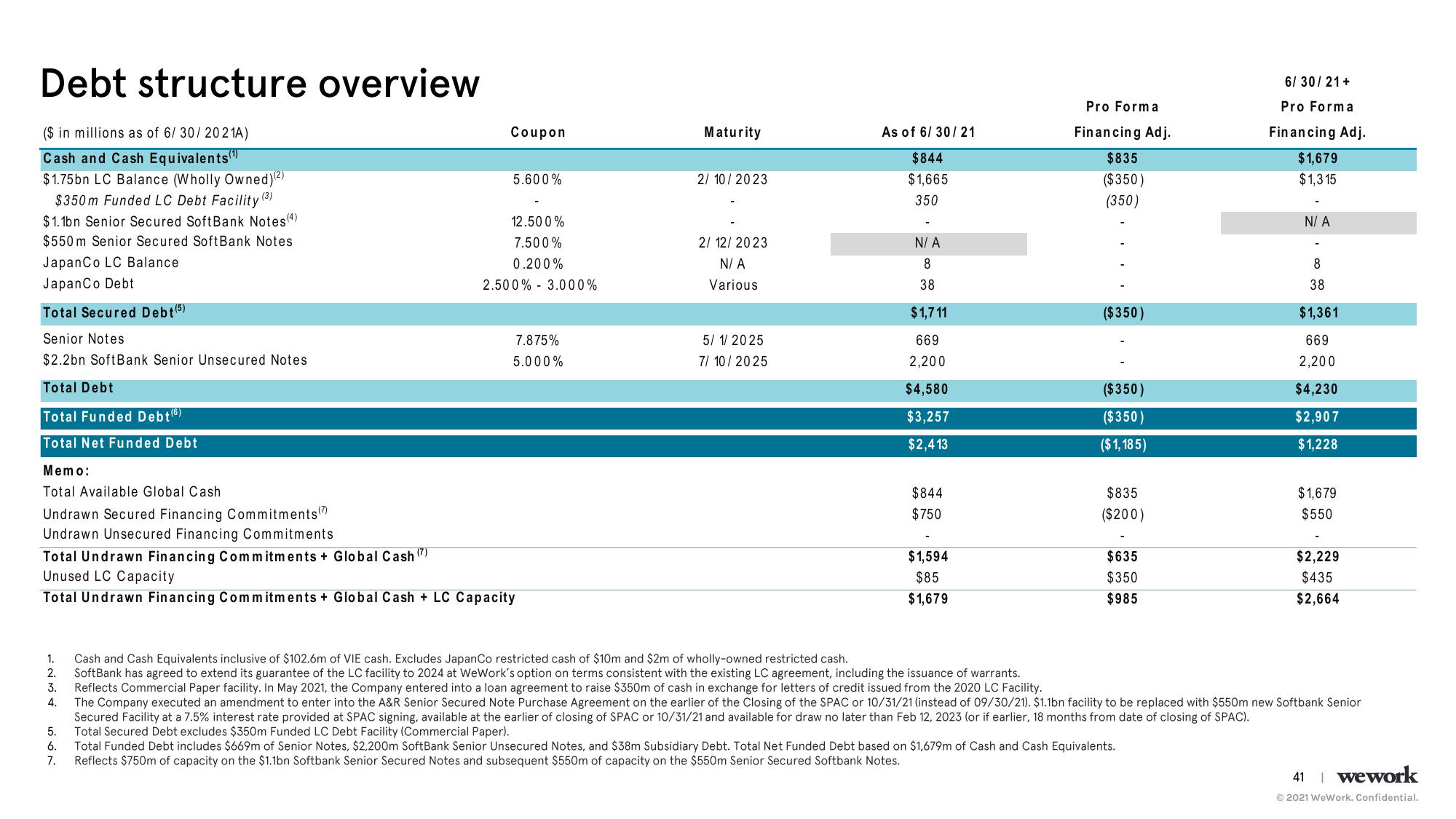

Debt structure overview

($ in millions as of 6/30/2021A)

Cash and Cash Equivalents¹

$1.75bn LC Balance (Wholly Owned) (²)

(3)

$350m Funded LC Debt Facility'

$1.1bn Senior Secured SoftBank Notes (4)

$550 m Senior Secured SoftBank Notes

JapanCo LC Balance

JapanCo Debt

Total Secured Debt (5)

Senior Notes

$2.2bn SoftBank Senior Unsecured Notes

Total Debt

Total Funded Debt (6)

Total Net Funded Debt

Memo:

Total Available Global Cash

Undrawn Secured Financing Commitments(7)

Undrawn Unsecured Financing Commitments

1234

Coupon

5.

6.

567

5.600%

12.500%

7.500%

0.200%

Total Undrawn Financing Commitments + Global Cash (7)

Unused LC Capacity

Total Undrawn Financing Commitments + Global Cash + LC Capacity

2.500% 3.000%

7.875%

5.000%

Maturity

2/10/2023

2/ 12/ 2023

N/A

Various

5/1/2025

7/10/2025

As of 6/30/21

$844

$1,665

350

N/A

8

38

$1,711

669

2,200

$4,580

$3,257

$2,413

$844

$750

$1,594

$85

$1,679

Pro Forma

Financing Adj.

$835

($350)

(350)

($350)

($350)

($350)

($ 1,185)

$835

($200)

$635

$350

$985

6/30/21 +

Pro Forma

Financing Adj.

$1,679

$1,315

N/A

8

38

$1,361

669

2,200

$4,230

$2,907

$1,228

1. Cash and Cash Equivalents inclusive of $102.6m of VIE cash. Excludes JapanCo restricted cash of $10m and $2m of wholly-owned restricted cash..

2. SoftBank has agreed to extend its guarantee of the LC facility to 2024 at WeWork's option on terms consistent with the existing LC agreement, including the issuance of warrants.

3. Reflects Commercial Paper facility. In May 2021, the Company entered into a loan agreement to raise $350m of cash in exchange for letters of credit issued from the 2020 LC Facility.

The Company executed an amendment to enter into the A&R Senior Secured Note Purchase Agreement on the earlier of the Closing of the SPAC or 10/31/21 (instead of 09/30/21). $1.1bn facility to be replaced with $550m new Softbank Senior

Secured Facility at a 7.5% interest rate provided at SPAC signing, available at the earlier of closing of SPAC or 10/31/21 and available for draw no later than Feb 12, 2023 (or if earlier, 18 months from date of closing of SPAC).

Total Secured Debt excludes $350m Funded LC Debt Facility (Commercial Paper).

4.

Total Funded Debt includes $669m of Senior Notes, $2,200m SoftBank Senior Unsecured Notes, and $38m Subsidiary Debt. Total Net Funded Debt based on $1,679m of Cash and Cash Equivalents.

7. Reflects $750m of capacity on the $1.1bn Softbank Senior Secured Notes and subsequent $550m of capacity on the $550m Senior Secured Softbank Notes.

$1,679

$550

$2,229

$435

$2,664

41 | wework

Ⓒ2021 WeWork. Confidential.View entire presentation