Embracer Group Results Presentation Deck

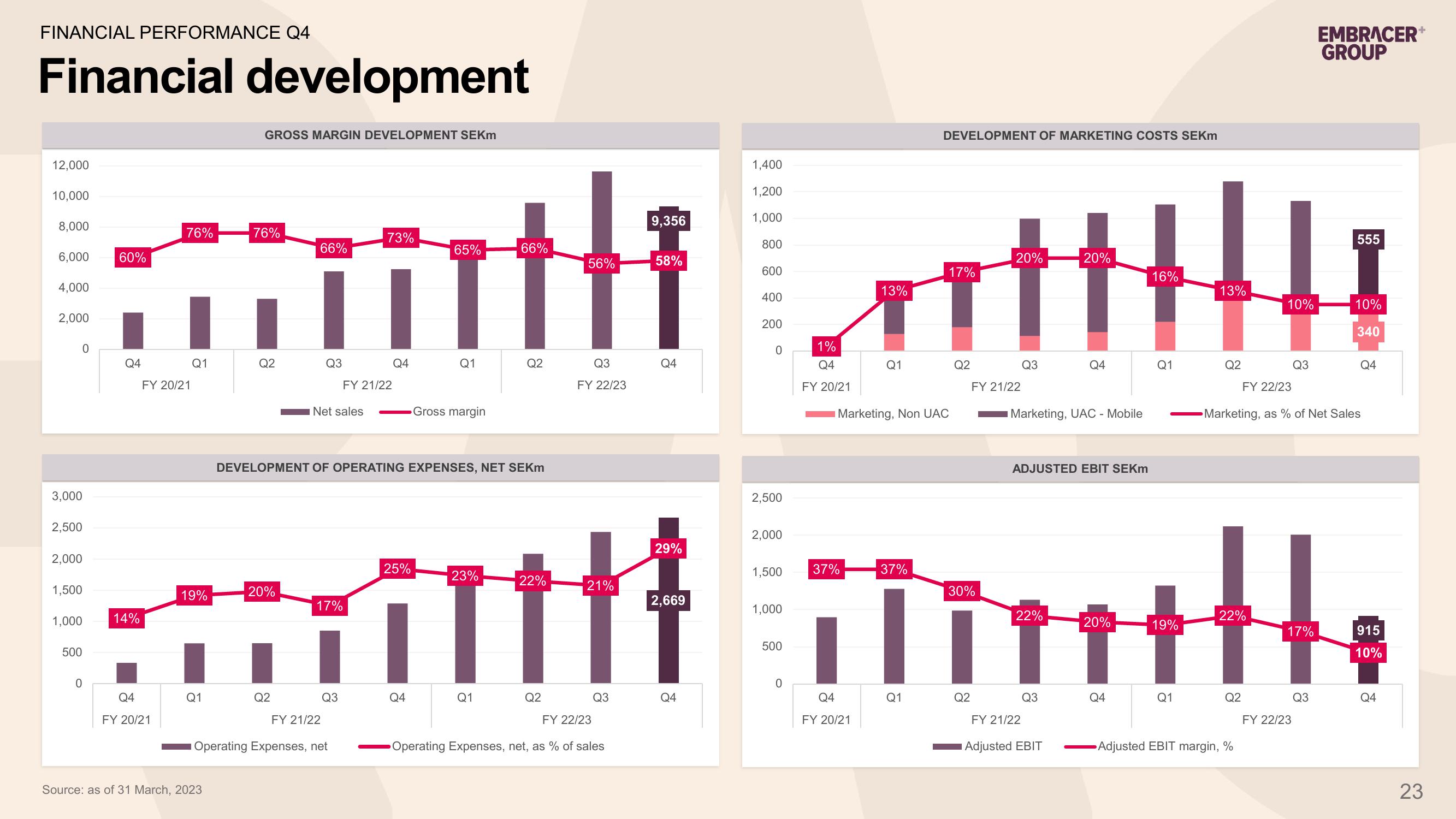

FINANCIAL PERFORMANCE Q4

Financial development

12,000

10,000

8,000

6,000

4,000

2,000

0

3,000

2,500

2,000

1,500

1,000

500

0

60%

Q4

14%

76%

FY 20/21

Q4

FY 20/21

Q1

19%

Q1

GROSS MARGIN DEVELOPMENT SEKm

Source: as of 31 March, 2023

76%

Q2

20%

66%

Q2

Q3

Net sales

FY 21/22

17%

DEVELOPMENT OF OPERATING EXPENSES, NET SEKm

Q3

Operating Expenses, net

73%

FY 21/22

65%

66%

atli attu

56%

20%

20%

16%

Q2

Q4

Q4

Q1

25%

Gross margin

Q4

Q3

FY 22/23

23%

22%

21%

att

Q2

Q1

FY 22/23

Q3

9,356

Operating Expenses, net, as % of sales

58%

Q4

29%

1,400

1,200

1,000

2,669

Q4

800

600

400

200

0

2,500

2,000

1,500

1,000

500

0

1%

Q4

FY 20/21

37%

13%

Q4

FY 20/21

Q1

Marketing, Non UAC

DEVELOPMENT OF MARKETING COSTS SEKM

37%

Q1

17%

Q2

FY 21/22

30%

Q2

Q3

Marketing, UAC - Mobile

ADJUSTED EBIT SEKM

22%

FY 21/22

Q3

Adjusted EBIT

20%

Q4

Q1

19%

Q1

13%

Q2

10%

Q2

FY 22/23

Adjusted EBIT margin, %

EMBRACER+

GROUP

Q3

FY 22/23

555

Marketing, as % of Net Sales

10%

340

H.

22%

17%

915

10%

Q3

Q4

Q4

23View entire presentation