BlackRock Global Long/Short Credit Absolute Return Credit

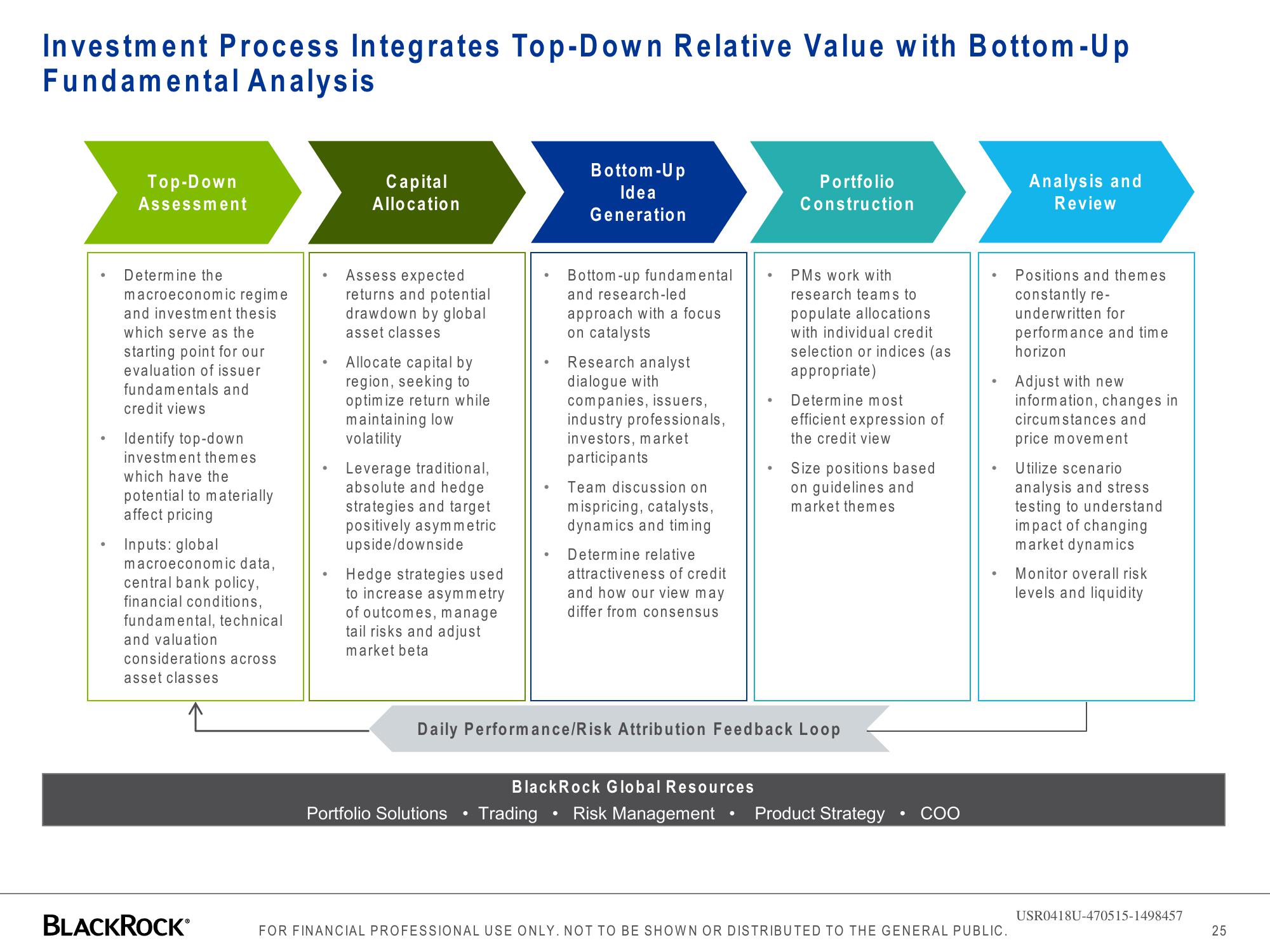

Investment Process Integrates Top-Down Relative Value with Bottom-Up

Fundamental Analysis

Top-Down

Assessment

Determine the

macroeconomic regime

and investment thesis

which serve as the

starting point for our

evaluation of issuer

fundamentals and

credit views

Identify top-down

investment themes

which have the

potential to materially

affect pricing

Inputs: global

macroeconomic data,

central bank policy,

financial conditions,

fundamental, technical

and valuation

considerations across

asset classes

BLACKROCK*

Capital

Allocation

Assess expected

returns and potential

drawdown by global

asset classes

Allocate capital by

region, seeking to

optimize return while

maintaining low

volatility

Leverage traditional,

absolute and hedge

strategies and target

positively asymmetric

upside/downside

Hedge strategies used

to increase asymmetry

of outcomes, manage

tail risks and adjust

market beta

Portfolio Solutions

Bottom-Up

Idea

Generation

Trading

Bottom-up fundamental

and research-led

approach with a focus

on catalysts

●

Research analyst

dialogue with

companies, issuers,

industry professionals,

investors, market

participants

Team discussion on

mispricing, catalysts,

dynamics and timing

Determine relative

attractiveness of credit

and how our view may

differ from consensus

BlackRock Global Resources

●

•

Portfolio

Construction

Daily Performance/Risk Attribution Feedback Loop

PMs work with

research teams to

populate allocations

with individual credit

selection or indices (as

appropriate)

Determine most

efficient expression of

the credit view

Size positions based

on guidelines and

market themes

Risk Management Product Strategy COO

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE GENERAL PUBLIC.

Analysis and

Review

Positions and themes

constantly re-

underwritten for

performance and time

horizon

Adjust with new

information, changes in

circumstances and

price movement

Utilize scenario

analysis and stress

testing to understand

impact of changing

market dynamics

Monitor overall risk

levels and liquidity

USR0418U-470515-1498457

25View entire presentation