Dragonfly Energy SPAC Presentation Deck

Notes:

Transaction Overview

E

Transaction Highlights

Transaction

Overview

Valuation

Earn-out

Cash Sources

Capital

Structure

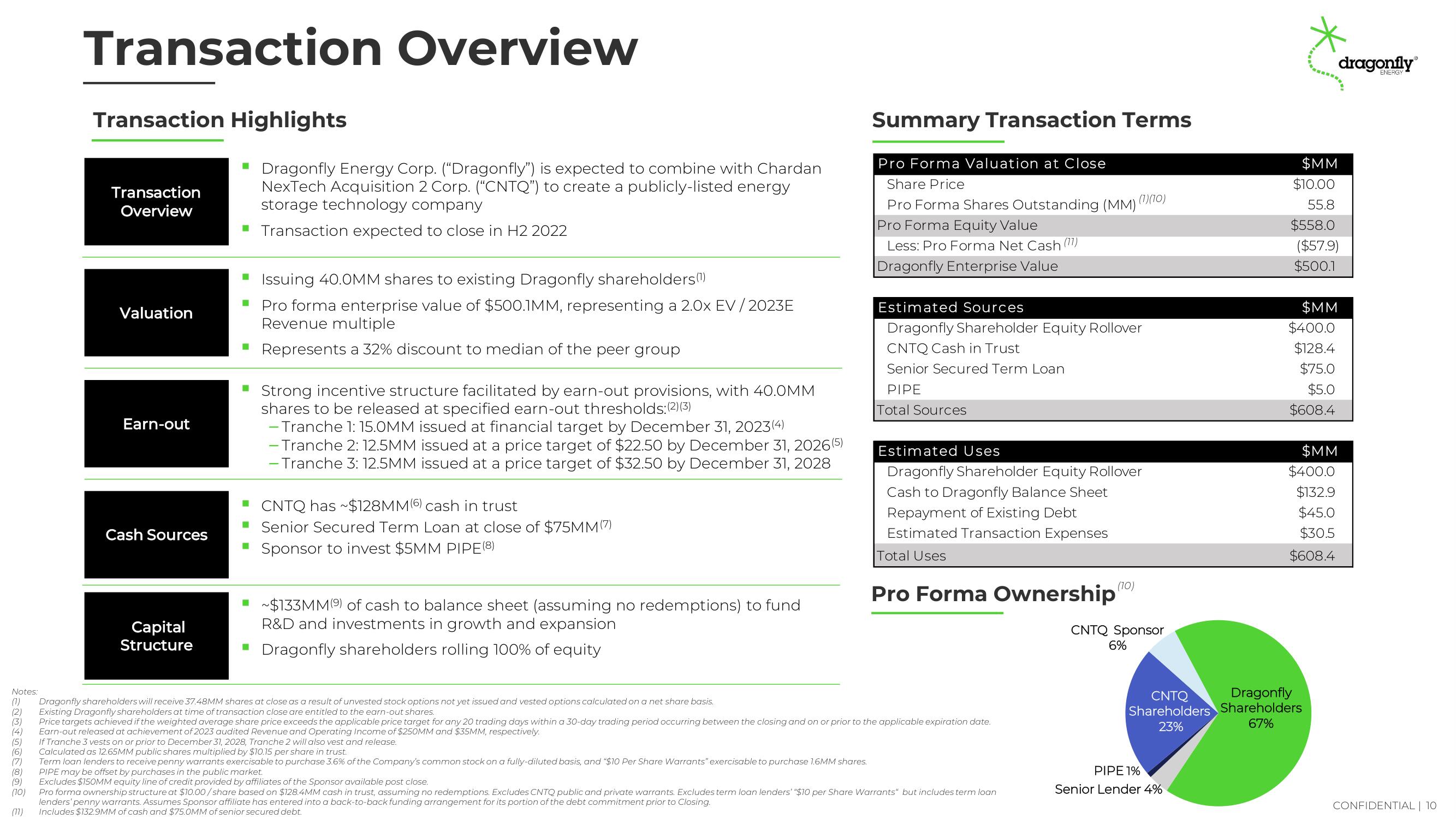

Dragonfly Energy Corp. ("Dragonfly") is expected to combine with Chardan

NexTech Acquisition 2 Corp. ("CNTQ") to create a publicly-listed energy

storage technology company

■ Transaction expected to close in H2 2022

■ Issuing 40.0MM shares to existing Dragonfly shareholders(¹)

■ Pro forma enterprise value of $500.1MM, representing a 2.0x EV / 2023E

Revenue multiple

▪ Represents a 32% discount to median of the peer group

Strong incentive structure facilitated by earn-out provisions, with 40.0MM

shares to be released at specified earn-out thresholds:(2)(3)

- Tranche 1: 15.0MM issued at financial target by December 31, 2023(4)

- Tranche 2: 12.5MM issued at a price target of $22.50 by December 31, 2026 (5)

- Tranche 3: 12.5MM issued at a price target of $32.50 by December 31, 2028

■ CNTQ has ~$128MM(6) cash in trust

Senior Secured Term Loan at close of $75MM(7)

Sponsor to invest $5MM PIPE(8)

~$133MM (⁹) of cash to balance sheet (assuming no redemptions) to fund

R&D and investments in growth and expansion

▪ Dragonfly shareholders rolling 100% of equity

Summary Transaction Terms

Pro Forma Valuation at Close

Share Price

Pro Forma Shares Outstanding (MM)

Pro Forma Equity Value

Less: Pro Forma Net Cash (77)

Dragonfly Enterprise Value

Estimated Sources

Dragonfly Shareholder Equity Rollover

CNTQ Cash in Trust

Senior Secured Term Loan

PIPE

Total Sources

(1)(10)

Estimated Uses

Dragonfly Shareholder Equity Rollover

Cash to Dragonfly Balance Sheet

Repayment of Existing Debt

Estimated Transaction Expenses

Total Uses

Pro Forma Ownership

Dragonfly shareholders will receive 37.48MM shares at close as a result of unvested stock options not yet issued and vested options calculated on a net share basis.

Existing Dragonfly shareholders at time of transaction close are entitled to the earn-out shares.

Price targets achieved if the weighted average share price exceeds the applicable price target for any 20 trading days within a 30-day trading period occurring between the closing and on or prior to the applicable expiration date.

Earn-out released at achievement of 2023 audited Revenue and Operating Income of $250MM and $35MM, respectively.

If Tranche 3 vests on or prior to December 31, 2028, Tranche 2 will also vest and release.

Calculated as 12.65MM public shares multiplied by $10.15 per share in trust.

Term loan lenders to receive penny warrants exercisable to purchase 3.6% of the Company's common stock on a fully-diluted basis, and "$10 Per Share Warrants" exercisable to purchase 1.6MM shares.

PIPE may be offset by purchases in the public market.

Excludes $150MM equity line of credit provided by affiliates of the Sponsor available post close.

(10) Pro forma ownership structure at $10.00/share based on $128.4MM cash in trust, assuming no redemptions. Excludes CNTQ public and private warrants. Excludes term loan lenders' "$10 per Share Warrants" but includes term loan

lenders' penny warrants. Assumes Sponsor affiliate has entered into a back-to-back funding arrangement for its portion of the debt commitment prior to Closing.

Includes $132.9MM of cash and $75.0MM of senior secured debt.

CNTQ Sponsor

6%

$MM

$10.00

PIPE 1%

Senior Lender 4%

55.8

$558.0

($57.9)

$500.1

$MM

$400.0

$128.4

$75.0

$5.0

$608.4

$MM

$400.0

$132.9

$45.0

$30.5

$608.4

CNTQ Dragonfly

Shareholders Shareholders

67%

23%

dragonfly

ENERGY

CONFIDENTIAL | 10View entire presentation