Sonos Results Presentation Deck

Q2 Financial Summary

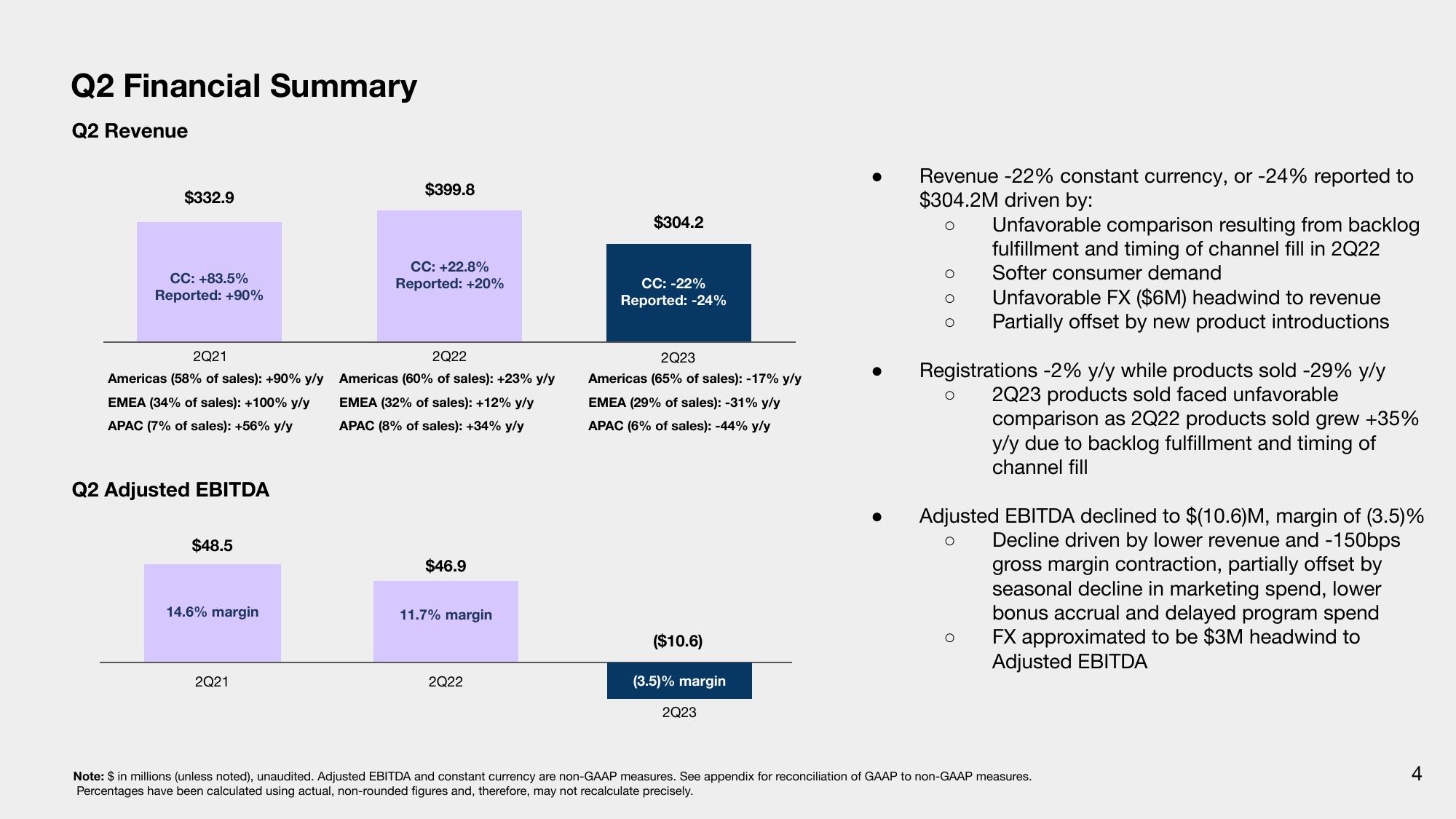

Q2 Revenue

$332.9

CC: +83.5%

Reported: +90%

2Q21

Americas (58% of sales): +90% y/y

EMEA (34% of sales): +100% y/y

APAC (7% of sales): +56% y/y

Q2 Adjusted EBITDA

$48.5

14.6% margin

2Q21

$399.8

CC: +22.8%

Reported: +20%

2Q22

Americas (60% of sales): +23% y/y

EMEA (32% of sales): +12% y/y

APAC (8% of sales): +34% y/y

$46.9

11.7% margin

2Q22

$304.2

CC: -22%

Reported: -24%

2Q23

Americas (65% of sales): -17% y/y

EMEA (29% of sales): -31% y/y

APAC (6% of sales): -44% y/y

($10.6)

(3.5)% margin

2Q23

Revenue -22% constant currency, or -24% reported to

$304.2M driven by:

O

O O O

O

Unfavorable comparison resulting from backlog

fulfillment and timing of channel fill in 2Q22

Softer consumer demand

Registrations -2% y/y while products sold -29% y/y

2Q23 products sold faced unfavorable

Unfavorable FX ($6M) headwind to revenue

Partially offset by new product introductions

O

comparison as 2Q22 products sold grew +35%

y/y due to backlog fulfillment and timing of

channel fill

O

Adjusted EBITDA declined to $(10.6)M, margin of (3.5)%

Decline driven by lower revenue and -150bps

gross margin contraction, partially offset by

seasonal decline in marketing spend, lower

bonus accrual and delayed program spend

FX approximated to be $3M headwind to

Adjusted EBITDA

Note: $ in millions (unless noted), unaudited. Adjusted EBITDA and constant currency are non-GAAP measures. See appendix for reconciliation of GAAP to non-GAAP measures.

Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

4View entire presentation