AG Direct Lending SMA

ANGELO

AG GORDON

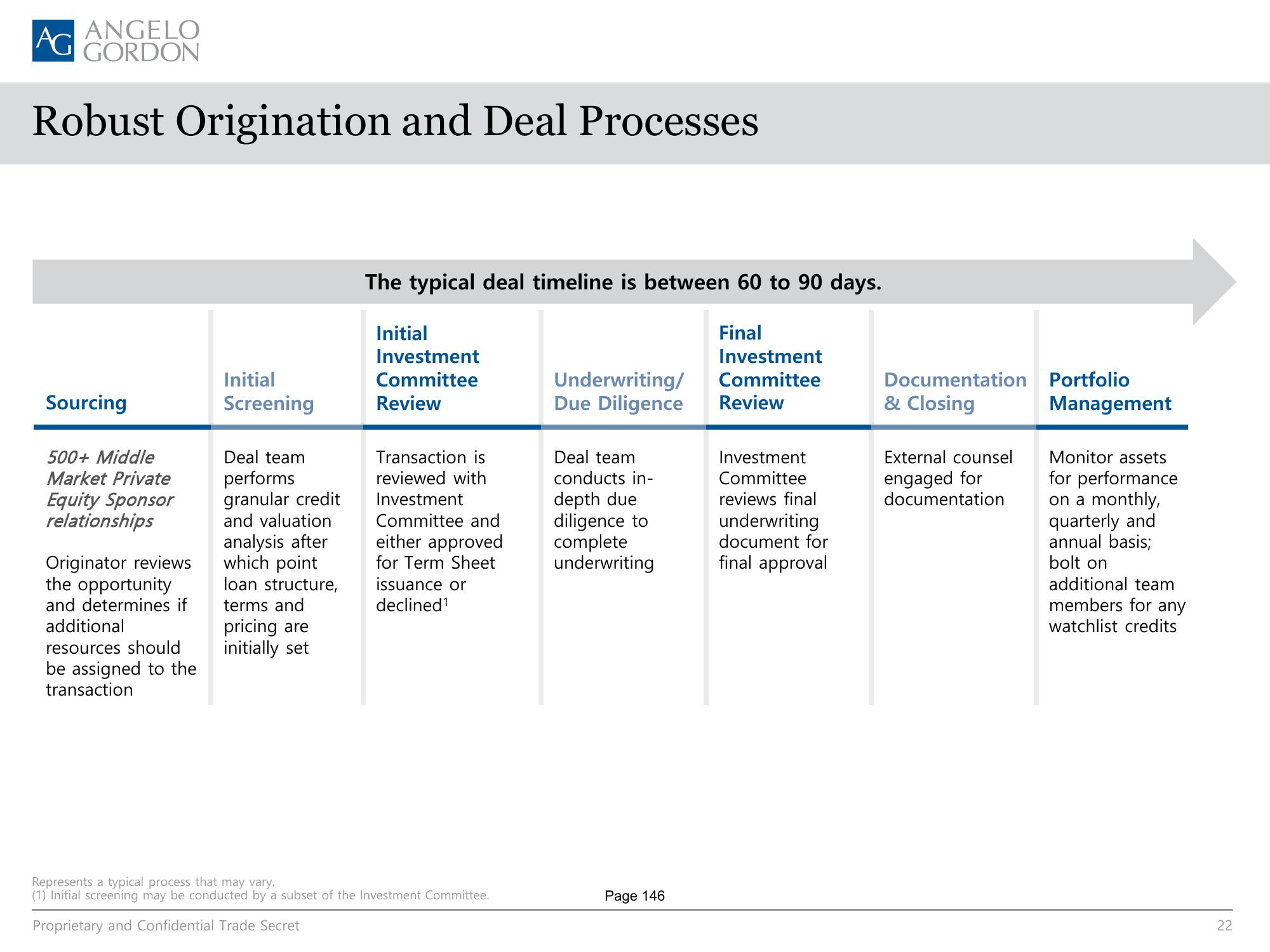

Robust Origination and Deal Processes

Sourcing

500+ Middle

Market Private

Equity Sponsor

relationships

Originator reviews

the opportunity

and determines if

additional

resources should

be assigned to the

transaction

Initial

Screening

Deal team

performs

granular credit

and valuation

analysis after

which point

loan structure,

terms and

pricing are

initially set

The typical deal timeline is between 60 to 90 days.

Final

Investment

Committee

Review

Initial

Investment

Committee

Review

Transaction is

reviewed with

Investment

Committee and

either approved

for Term Sheet

issuance or

declined¹

Represents a typical process that may vary.

(1) Initial screening may be conducted by a subset of the Investment Committee.

Proprietary and Confidential Trade Secret

Underwriting/

Due Diligence

Deal team

conducts in-

depth due

diligence to

complete

underwriting

Page 146

Investment

Committee

reviews final

underwriting

document for

final approval

Documentation

& Closing

External counsel

engaged for

documentation

Portfolio

Management

Monitor assets

for performance

on a monthly,

quarterly and

annual basis;

bolt on

additional team

members for any

watchlist credits

22View entire presentation