Ocado Results Presentation Deck

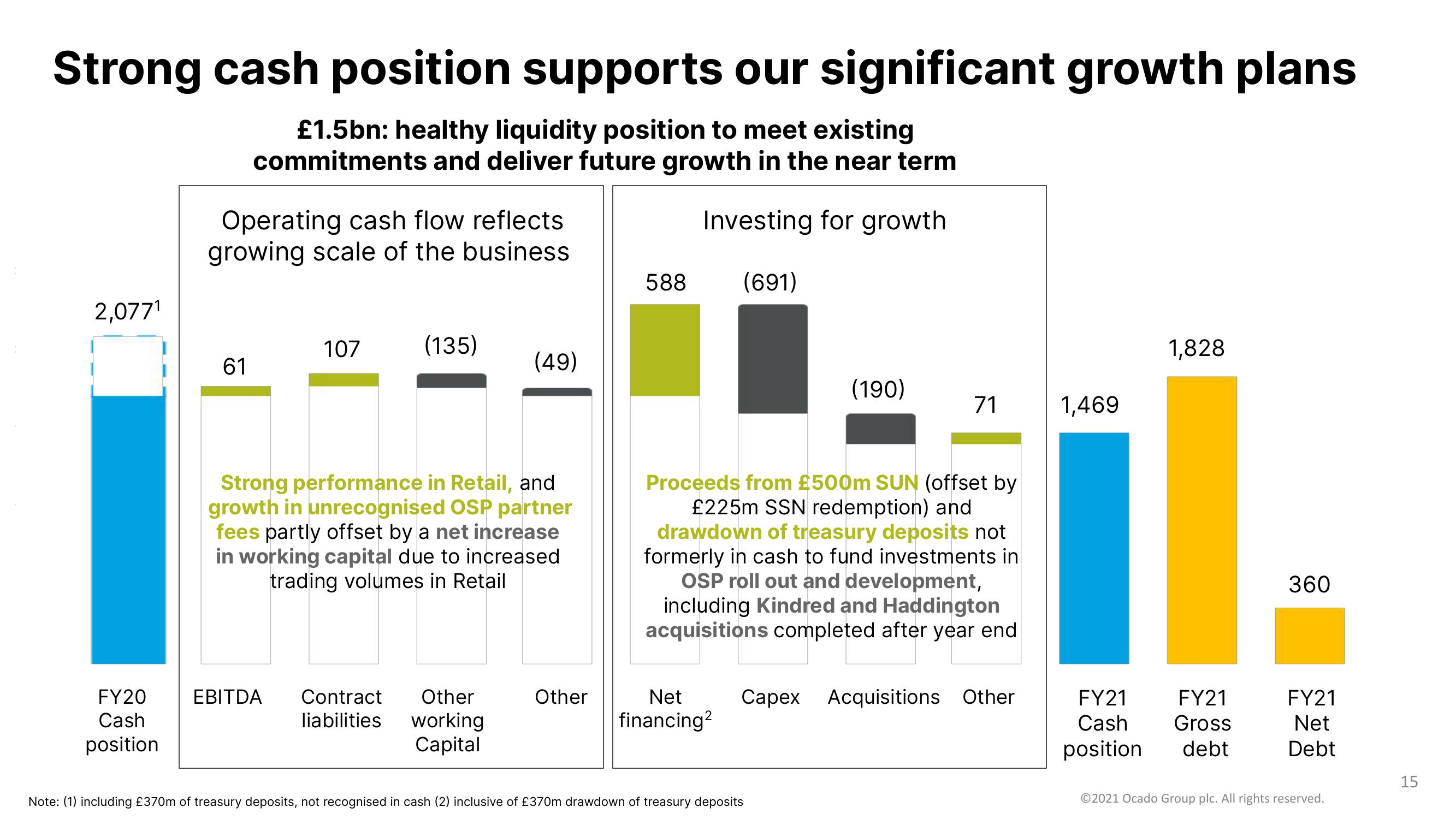

Strong cash position supports our significant growth plans

£1.5bn: healthy liquidity position to meet existing

commitments and deliver future growth in the near term

Investing for growth

2,077¹

FY20

Cash

position

Operating cash flow reflects

growing scale of the business

61

107

EBITDA

(135)

Strong performance in Retail, and

growth in unrecognised OSP partner

fees partly offset by a net increase

in working capital due to increased

trading volumes in Retail

(49)

Contract Other

liabilities

working

Capital

Other

588 (691)

Net

financing2

(190)

Proceeds from £500m SUN (offset by

£225m SSN redemption) and

drawdown of treasury deposits not

formerly in cash to fund investments in

OSP roll out and development,

including Kindred and Haddington

acquisitions completed after year end

71

Note: (1) including £370m of treasury deposits, not recognised in cash (2) inclusive of £370m drawdown of treasury deposits

Capex Acquisitions Other

1,469

1,828

FY21

FY21

Cash Gross

position

debt

360

FY21

Net

Debt

Ⓒ2021 Ocado Group plc. All rights reserved.

15View entire presentation