Livongo Investor Presentation Deck

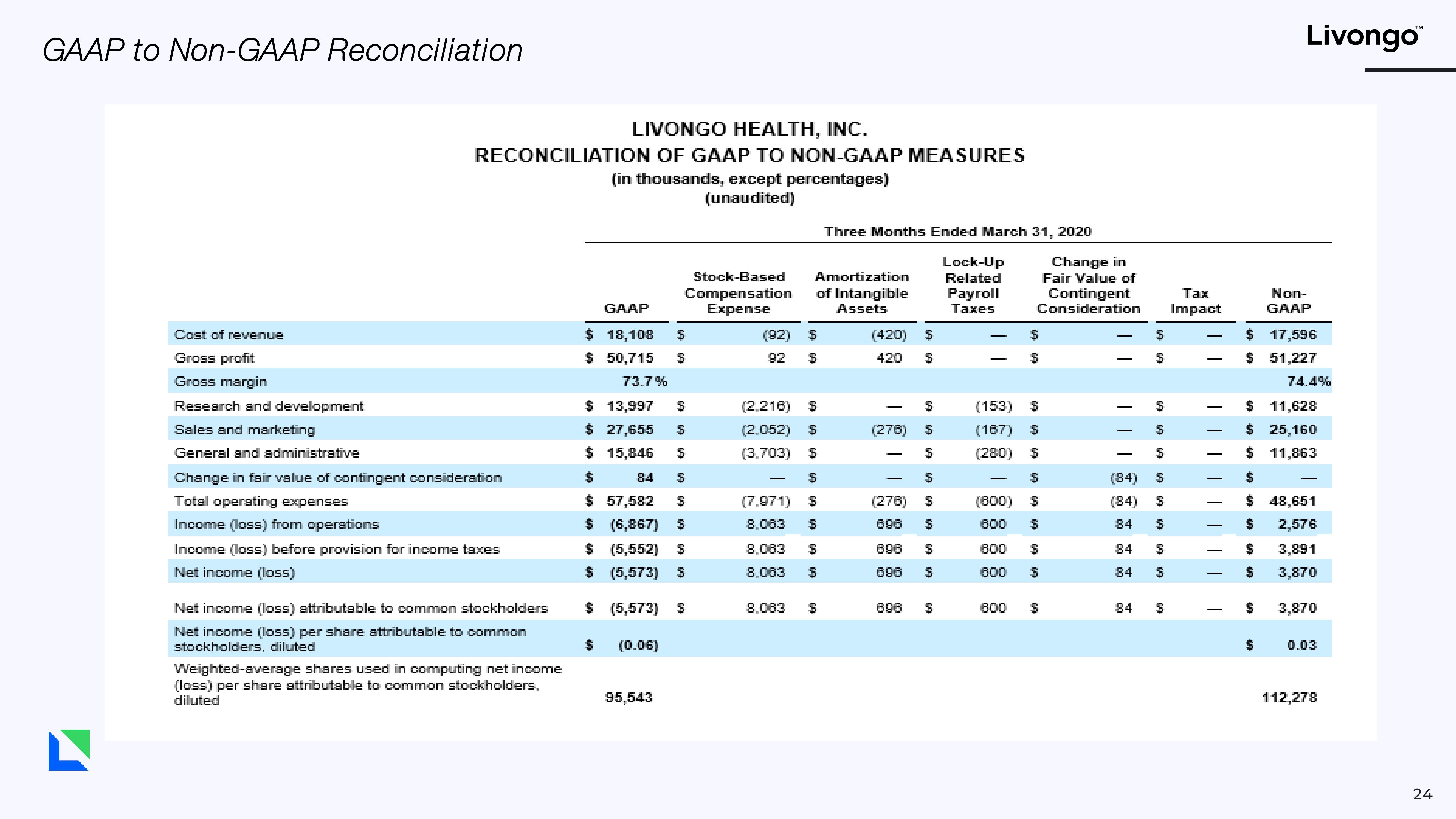

GAAP to Non-GAAP Reconciliation

LIVONGO HEALTH, INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

(in thousands, except percentages)

(unaudited)

Cost of revenue

Gross profit

Gross margin

Research and development

Sales and marketing

General and administrative

Change in fair value of contingent consideration

Total operating expenses

Income (loss) from operations

Income (loss) before provision for income taxes

Net income (loss)

Net income (loss) attributable to common stockholders

Net income (loss) per share attributable to common

stockholders, diluted

Weighted-average shares used in computing net income

(loss) per share attributable to common stockholders.

diluted

GAAP

$ 18,108 $

$ 50,715 $

73.7%

Stock-Based

Compensation

Expense

$ 13,997 5

$ 27,655 S

$

$ 15,846

$

84

S

$ 57,582

S

$ (6,867) $

$ (5,552) $

$ (5,573) $

$ (5,573)

(0.06)

$

95,543

Amortization

of Intangible

Assets

(92) S

92 $

(2.216) $

(2,052) $

(3.703) $

$

(7.971) S

8.083 S

8.083 $

8.083 $

Three Months Ended March 31, 2020

8,083 $

(420) S

420 $

(276)

-

(276)

696

696

696

696

S

$

$

69 69 69 69 60

$

Lock-Up

Related

Payroll

Taxes

Change in

Fair Value of

Contingent

Consideration

S

S

(153) S

(167) $

(280) S

800

$

(800) S

800 S

800 $

600 $

69

S

S

S

$

3

(84) S

(84) $

84

S

84

$

84 S

84 $

Tax

Impact

Livongo™

$ 17,596

$ 51,227

$

$

Non-

GAAP

$

$ 11,628

$ 25,160

$ 11,863

$

$

$

74.4%

-

48,651

2,576

3,891

3,870

3,870

0.03

112,278

24View entire presentation