Blackwells Capital Activist Presentation Deck

BENEFICIARY OF LONG-TERM SECULAR SHIFT TO E-COMMERCE

E-Commerce Growth Provides Long Runway for Strong Fundamental in Industrial Real Estate

Double-digit e-commerce growth and the ongoing supply chain evolution in retail over the last 5 years has drove steady

demand for industrial real estate assets

●

E-commerce fulfillment centers generally require 3x the warehouse space as a retail fulfillment center due to the wider

variety of goods sold on the internet compared to in-store and the additional space needed to pack or sort items for

delivery

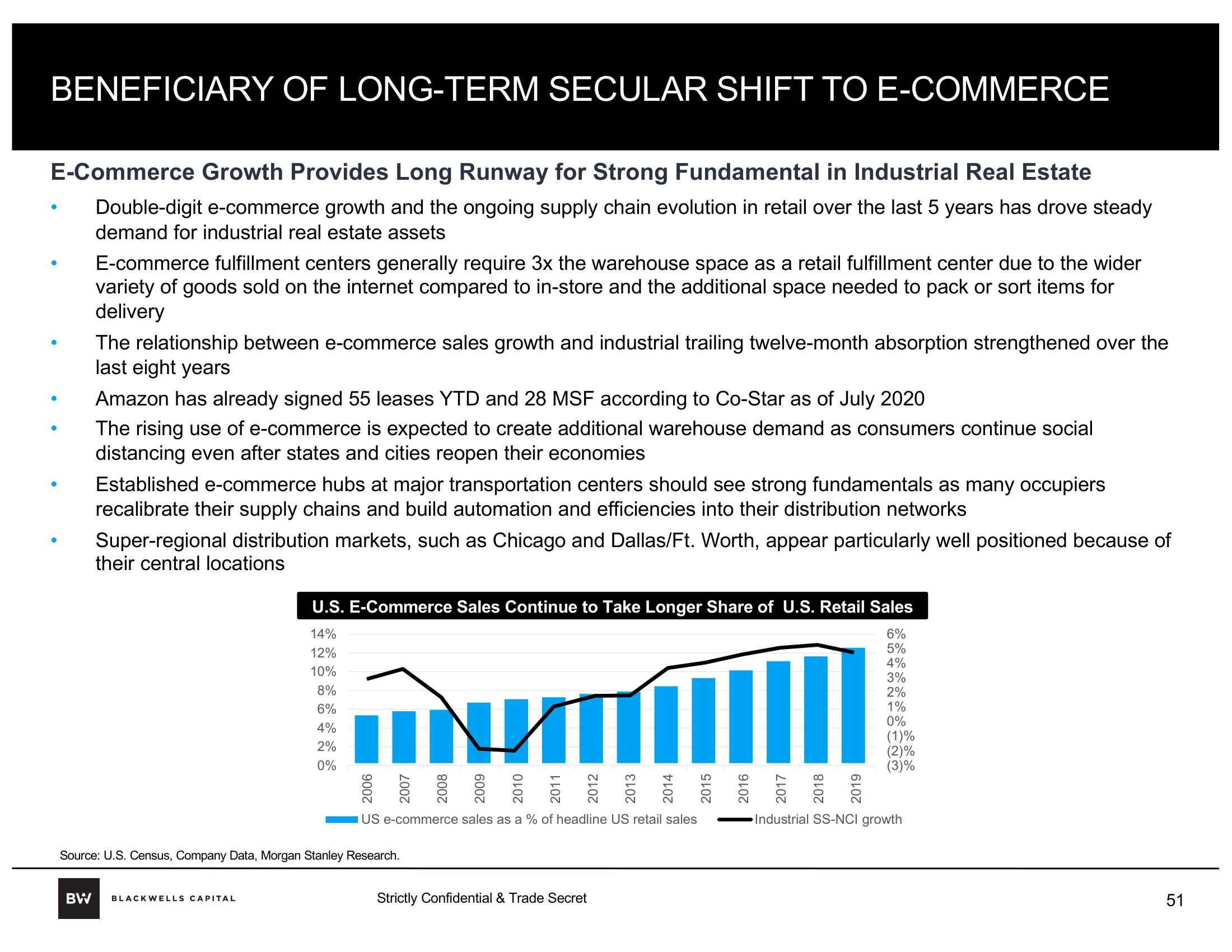

The relationship between e-commerce sales growth and industrial trailing twelve-month absorption strengthened over the

last eight years

Amazon has already signed 55 leases YTD and 28 MSF according to Co-Star as of July 2020

The rising use of e-commerce is expected to create additional warehouse demand as consumers continue social

distancing even after states and cities reopen their economies

Established e-commerce hubs at major transportation centers should see strong fundamentals as many occupiers

recalibrate their supply chains and build automation and efficiencies into their distribution networks

Super-regional distribution markets, such as Chicago and Dallas/Ft. Worth, appear particularly well positioned because of

their central locations

U.S. E-Commerce Sales Continue to Take Longer Share of U.S. Retail Sales

14%

6%

5%

12%

4%

10%

3%

8%

2%

6%

4%

2%

0%

BW BLACKWELLS CAPITAL

ТИТ

US e-commerce sales as a % of headline US retail sales

Source: U.S. Census, Company Data, Morgan Stanley Research.

Strictly Confidential & Trade Secret

||

1%

0%

(1)%

(2)%

(3)%

Industrial SS-NCI growth

51View entire presentation