First Quarter 2017 Financial Review

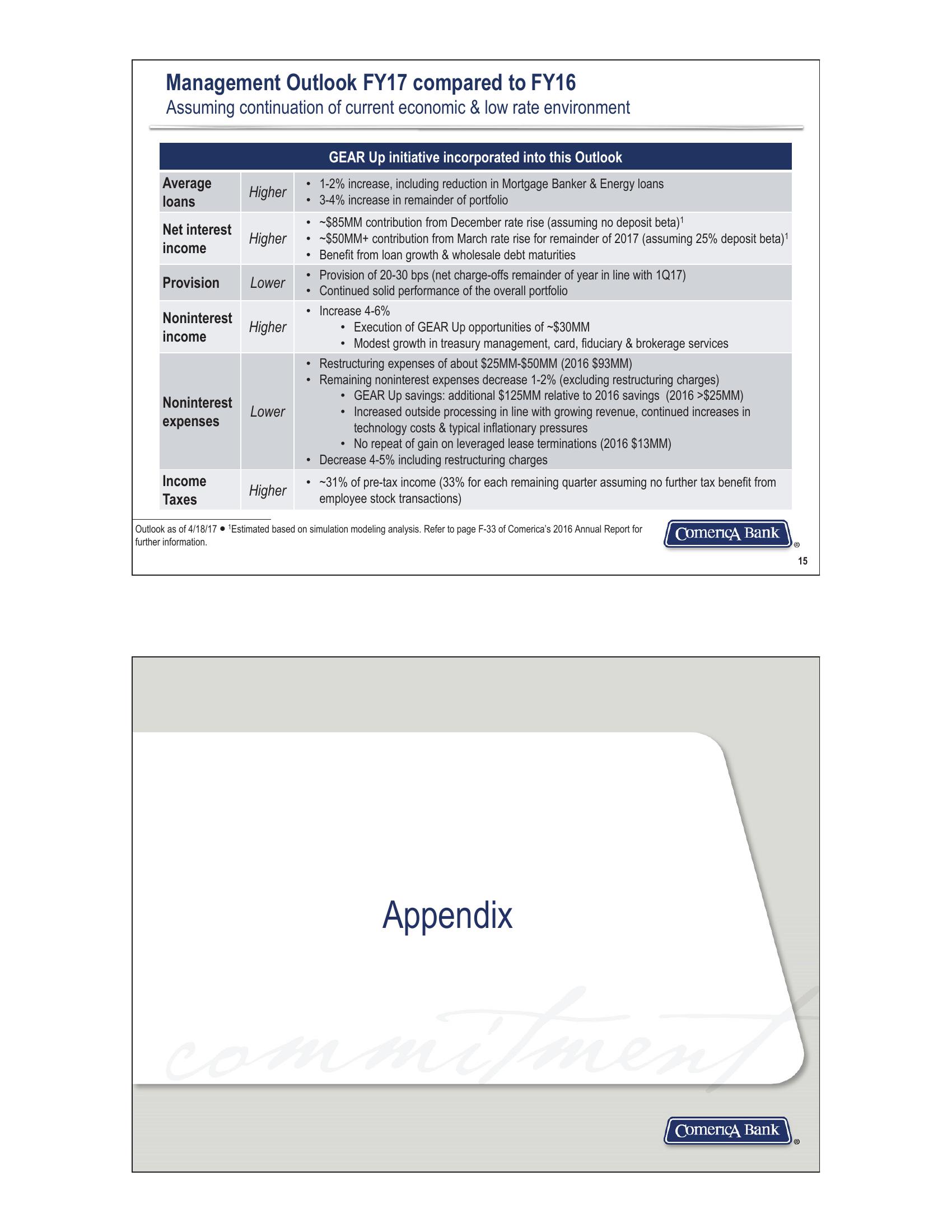

Management Outlook FY17 compared to FY16

Assuming continuation of current economic & low rate environment

GEAR Up initiative incorporated into this Outlook

~$50MM+ contribution from March rate rise for remainder of 2017 (assuming 25% deposit beta)1

Benefit from loan growth & wholesale debt maturities

Average

loans

1-2% increase, including reduction in Mortgage Banker & Energy loans

Higher

•

3-4% increase in remainder of portfolio

•

-$85MM contribution from December rate rise (assuming no deposit beta)1

Net interest

income

Higher

•

Provision

Lower

Noninterest

income

Higher

Noninterest

Lower

expenses

Income

Taxes

Higher

•

Provision of 20-30 bps (net charge-offs remainder of year in line with 1Q17)

Continued solid performance of the overall portfolio

Increase 4-6%

•

Execution of GEAR Up opportunities of ~$30MM

Modest growth in treasury management, card, fiduciary & brokerage services

Restructuring expenses of about $25MM-$50MM (2016 $93MM)

Remaining noninterest expenses decrease 1-2% (excluding restructuring charges)

.

•

GEAR Up savings: additional $125MM relative to 2016 savings (2016>$25MM)

Increased outside processing in line with growing revenue, continued increases in

technology costs & typical inflationary pressures

No repeat of gain on leveraged lease terminations (2016 $13MM)

Decrease 4-5% including restructuring charges

~31% of pre-tax income (33% for each remaining quarter assuming no further tax benefit from

employee stock transactions)

Outlook as of 4/18/17 1Estimated based on simulation modeling analysis. Refer to page F-33 of Comerica's 2016 Annual Report for

further information.

Comerica Bank

Ⓡ

com

Appendix

mitment

Comerica Bank

15View entire presentation