Investor Deep Dive Corporate Bank

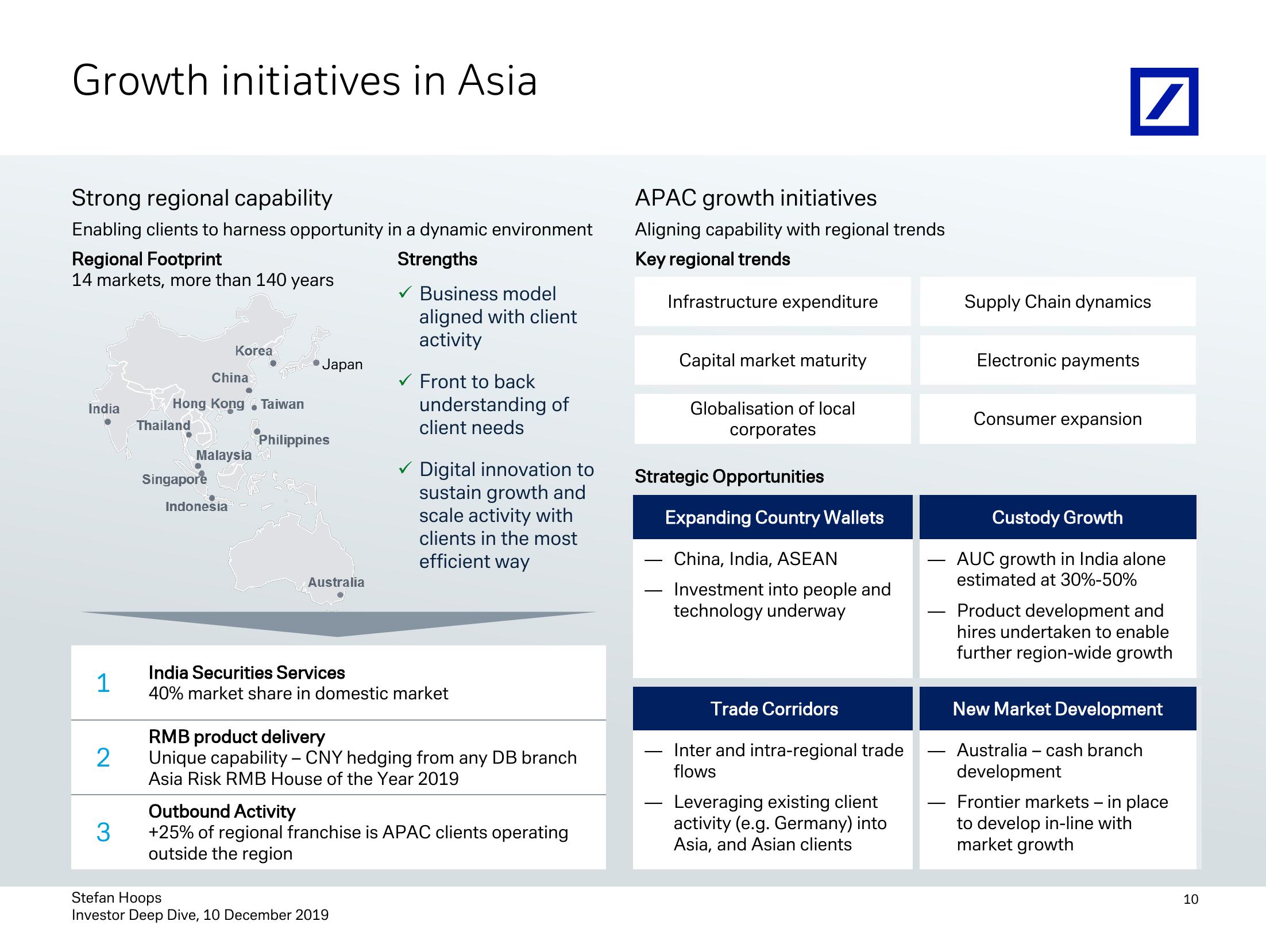

Growth initiatives in Asia

Strong regional capability

Enabling clients to harness opportunity in a dynamic environment

Regional Footprint

14 markets, more than 140 years

Korea

Japan

China

Hong Kong ⚫ Taiwan

India

Thailand

Philippines

Malaysia

Singapore

Indonesia

Strengths

✓ Business model

aligned with client

activity

✓ Front to back

understanding of

client needs

Digital innovation to

sustain growth and

scale activity with

clients in the most

efficient way

Australia

India Securities Services

1

40% market share in domestic market

RMB product delivery

2

Unique capability - CNY hedging from any DB branch

Asia Risk RMB House of the Year 2019

Outbound Activity

3

+25% of regional franchise is APAC clients operating

outside the region

APAC growth initiatives

Aligning capability with regional trends

Key regional trends

Infrastructure expenditure

Capital market maturity

Supply Chain dynamics

Electronic payments

Globalisation of local

corporates

Consumer expansion

Strategic Opportunities

Expanding Country Wallets

China, India, ASEAN

Investment into people and

technology underway

-

Trade Corridors

Inter and intra-regional trade

flows

Leveraging existing client

activity (e.g. Germany) into

Asia, and Asian clients

-

Custody Growth

AUC growth in India alone

estimated at 30%-50%

Product development and

hires undertaken to enable

further region-wide growth

New Market Development

Australia - cash branch

development

Frontier markets - in place

to develop in-line with

market growth

Stefan Hoops

Investor Deep Dive, 10 December 2019

100

10View entire presentation