Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

CAPITAL

& LEVERAGE

DIVISIONS

& LEGAL ENTITIES

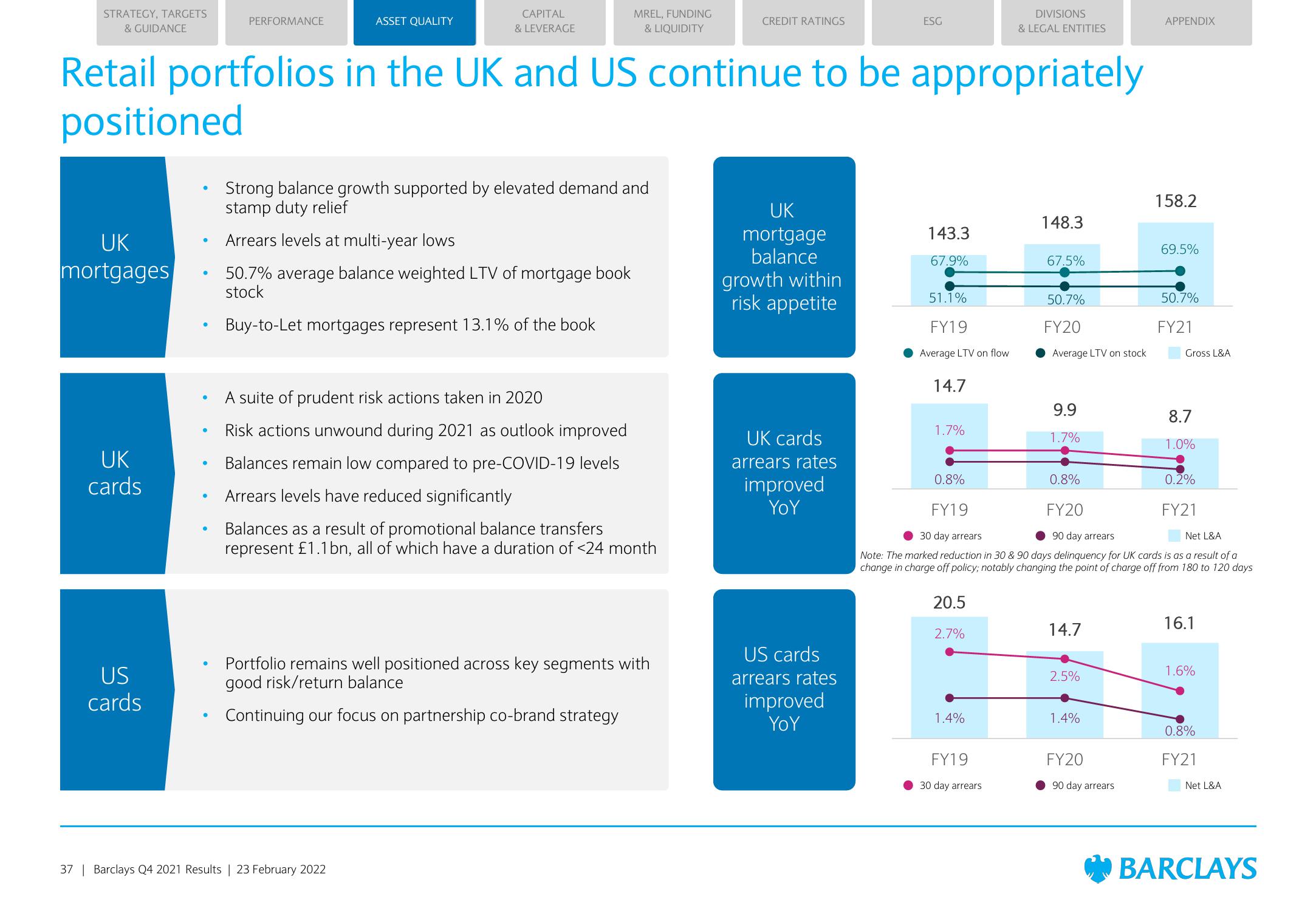

Retail portfolios in the UK and US continue to be appropriately

positioned

UK

mortgages

UK

cards

US

cards

●

●

●

●

●

●

PERFORMANCE

ASSET QUALITY

Strong balance growth supported by elevated demand and

stamp duty relief

Arrears levels at multi-year lows

50.7% average balance weighted LTV of mortgage book

stock

Buy-to-Let mortgages represent 13.1% of the book

MREL, FUNDING

& LIQUIDITY

A suite of prudent risk actions taken in 2020

Risk actions unwound during 2021 as outlook improved

Balances remain low compared to pre-COVID-19 levels

Arrears levels have reduced significantly

Balances as a result of promotional balance transfers

represent £1.1 bn, all of which have a duration of <24 month

37 | Barclays Q4 2021 Results | 23 February 2022

Portfolio remains well positioned across key segments with

good risk/return balance

Continuing our focus on partnership co-brand strategy

CREDIT RATINGS

UK

mortgage

balance

growth within

risk appetite

UK cards

arrears rates

improved

YoY

US cards

arrears rates

improved

YoY

ESG

143.3

67.9%

51.1%

FY19

Average LTV on flow

14.7

1.7%

0.8%

20.5

2.7%

1.4%

148.3

FY19

30 day arrears

67.5%

50.7%

FY20

Average LTV on stock

9.9

1.7%

14.7

0.8%

FY19

FY20

30 day arrears

90 day arrears

Net L&A

Note: The marked reduction in 30 & 90 days delinquency for UK cards is as a result of a

change in charge off policy; notably changing the point of charge off from 180 to 120 days

2.5%

1.4%

APPENDIX

FY20

90 day arrears

158.2

69.5%

50.7%

FY21

Gross L&A

8.7

1.0%

0.2%

FY21

16.1

1.6%

0.8%

FY21

Net L&A

BARCLAYSView entire presentation