Credit Suisse Results Presentation Deck

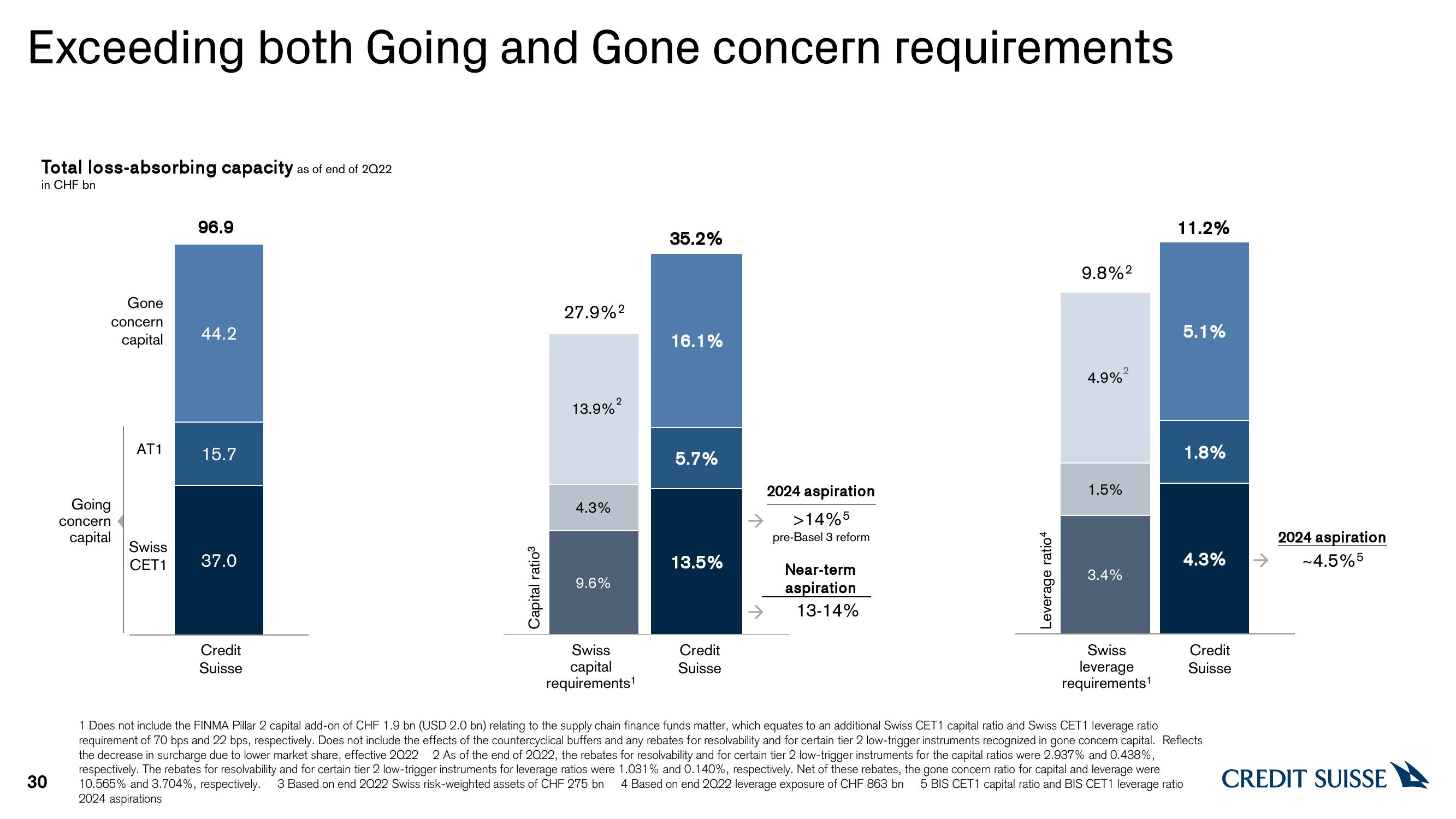

Exceeding both Going and Gone concern requirements

Total loss-absorbing capacity as of end of 2022

in CHF bn.

30

Going

concern

capital

Gone

concern

capital

AT1

Swiss

CET1

96.9

44.2

15.7

37.0

Credit

Suisse

Capital ratio³

27.9%²

2

13.9%²

4.3%

9.6%

Swiss

capital

requirements¹

35.2%

16.1%

5.7%

13.5%

Credit

Suisse

→

2024 aspiration

>14%5

pre-Basel 3 reform

Near-term

aspiration

13-14%

Leverage ratio

9.8%²

4.9%

1.5%

3.4%

2

Swiss

leverage

requirements¹

11.2%

5.1%

1.8%

4.3%

Credit

Suisse

1 Does not include the FINMA Pillar 2 capital add-on of CHF 1.9 bn (USD 2.0 bn) relating to the supply chain finance funds matter, which equates to an additional Swiss CET1 capital ratio and Swiss CET1 leverage ratio

requirement of 70 bps and 22 bps, respectively. Does not include the effects of the countercyclical buffers and any rebates for resolvability and for certain tier 2 low-trigger instruments recognized in gone concern capital. Reflects

the decrease in surcharge due to lower market share, effective 2022 2 As of the end of 2022, the rebates for resolvability and for certain tier 2 low-trigger instruments for the capital ratios were 2.937% and 0.438%,

respectively. The rebates for resolvability and for certain tier 2 low-trigger instruments for leverage ratios were 1.031% and 0.140%, respectively. Net of these rebates, the gone concern ratio for capital and leverage were

10.565% and 3.704%, respectively. 3 Based on end 2022 Swiss risk-weighted assets of CHF 275 bn 4 Based on end 2022 leverage exposure of CHF 863 bn 5 BIS CET1 capital ratio and BIS CET1 leverage ratio

2024 aspirations

→

2024 aspiration

~4.5%5

CREDIT SUISSEView entire presentation