Main Street Capital Investor Presentation Deck

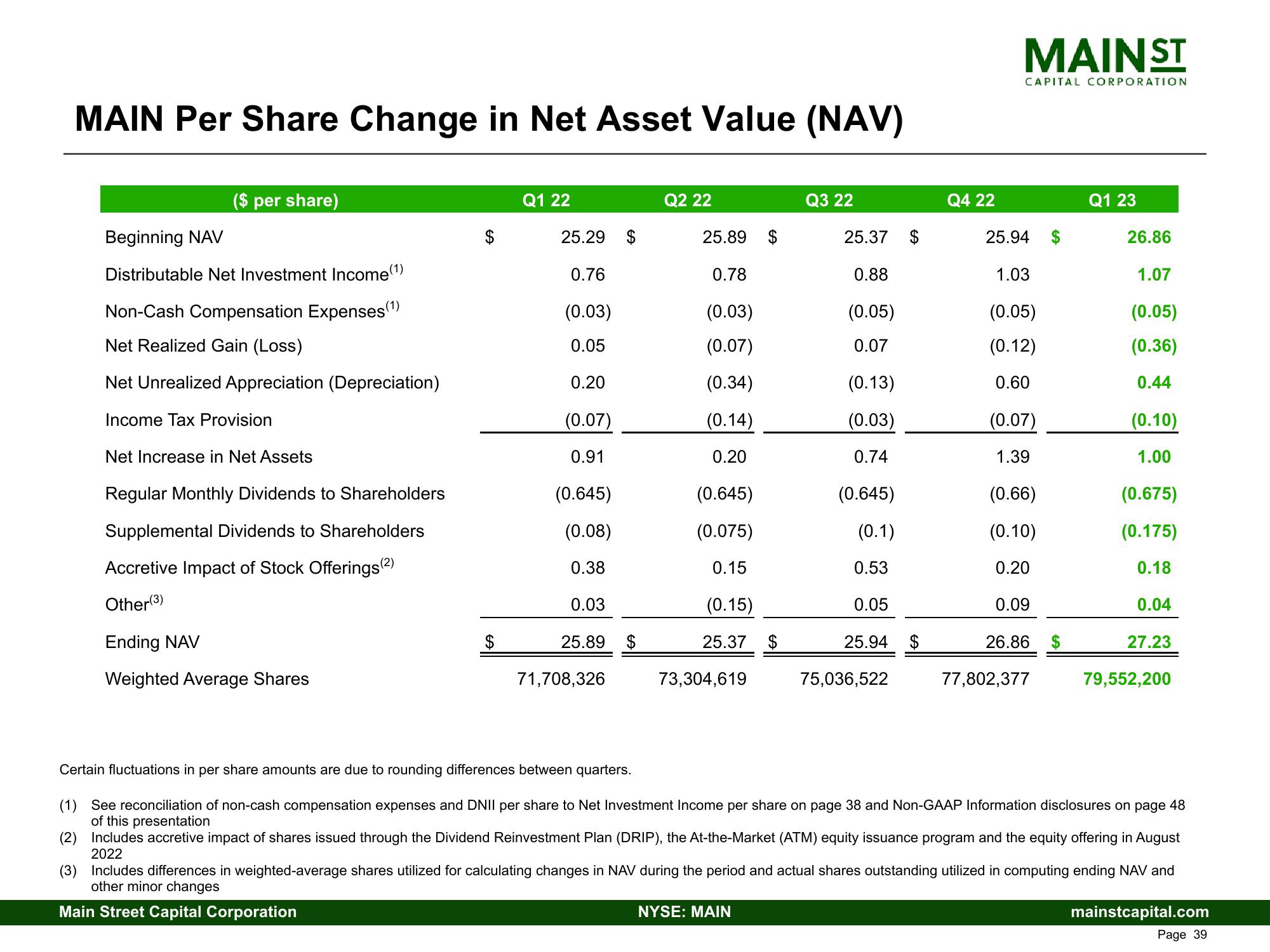

MAIN Per Share Change in Net Asset Value (NAV)

($ per share)

Beginning NAV

Distributable Net Investment Income (1)

Non-Cash Compensation Expenses(¹)

Net Realized Gain (Loss)

Net Unrealized Appreciation (Depreciation)

Income Tax Provision

Net Increase in Net Assets

Regular Monthly Dividends to Shareholders

Supplemental Dividends to Shareholders

Accretive Impact of Stock Offerings (2)

Other (3)

Ending NAV

Weighted Average Shares

Q1 22

25.29

0.76

(0.03)

0.05

0.20

(0.07)

0.91

(0.645)

(0.08)

0.38

0.03

25.89 $

71,708,326

Q2 22

25.89 $

0.78

(0.03)

(0.07)

(0.34)

(0.14)

0.20

(0.645)

(0.075)

0.15

(0.15)

25.37 $

73,304,619

Q3 22

25.37

0.88

(0.05)

0.07

NYSE: MAIN

(0.13)

(0.03)

0.74

(0.645)

(0.1)

0.53

0.05

25.94 $

75,036,522

Q4 22

MAINST

CAPITAL CORPORATION

25.94

1.03

(0.05)

(0.12)

0.60

(0.07)

1.39

(0.66)

(0.10)

0.20

0.09

26.86

77,802,377

$

Q1 23

26.86

1.07

(0.05)

(0.36)

0.44

(0.10)

1.00

(0.675)

(0.175)

0.18

0.04

27.23

79,552,200

Certain fluctuations in per share amounts are due to rounding differences between quarters.

(1) See reconciliation of non-cash compensation expenses and DNII per share to Net Investment Income per share on page 38 and Non-GAAP Information disclosures on page 48

of this presentation

(2) Includes accretive impact of shares issued through the Dividend Reinvestment Plan (DRIP), the At-the-Market (ATM) equity issuance program and the equity offering in August

2022

(3) Includes differences in weighted-average shares utilized for calculating changes in NAV during the period and actual shares outstanding utilized in computing ending NAV and

other minor changes

Main Street Capital Corporation

mainstcapital.com

Page 39View entire presentation