Melrose Results Presentation Deck

Pensions

Melrose

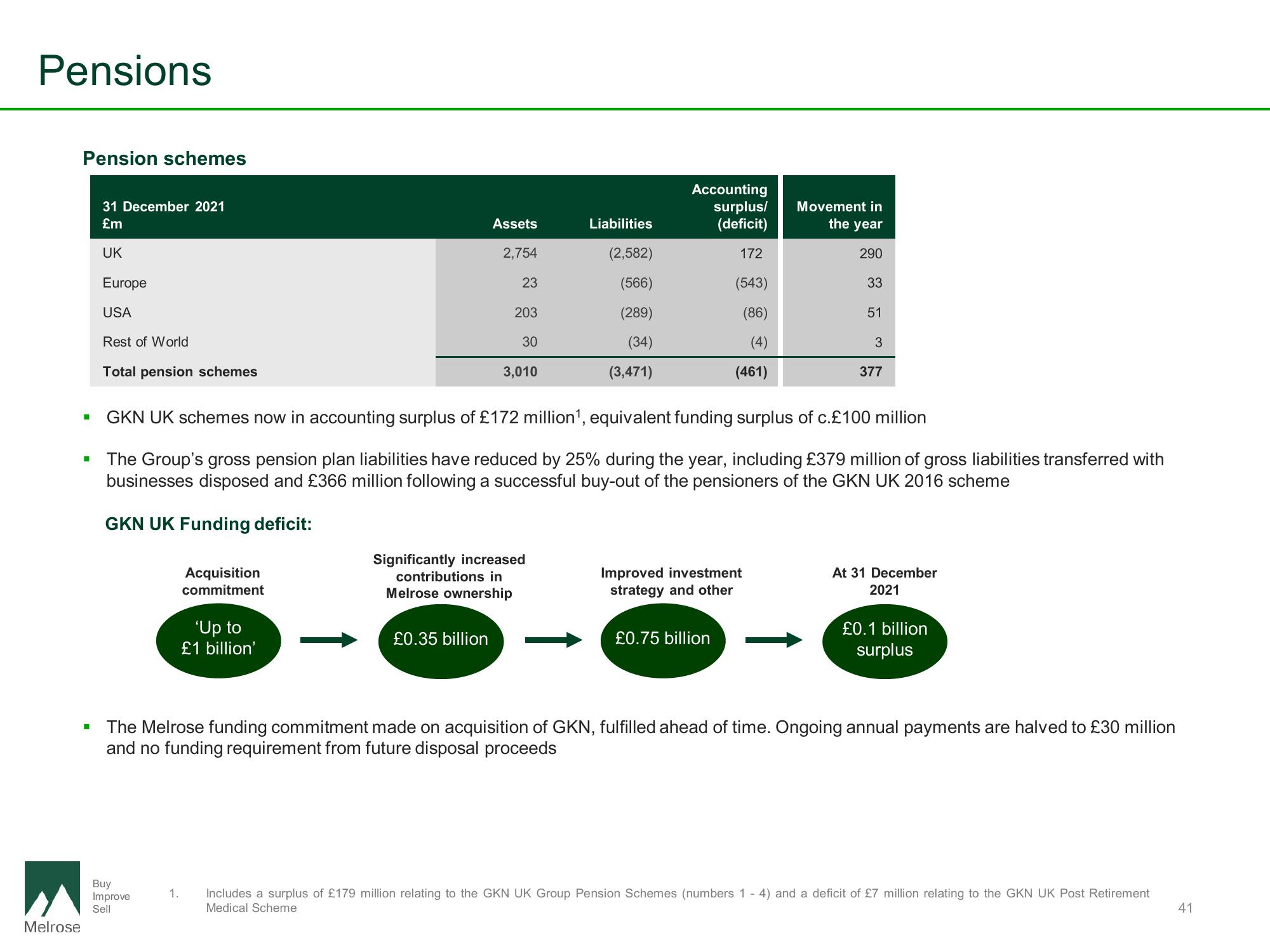

Pension schemes

I

I

31 December 2021

£m

UK

Europe

USA

Rest of World

Total pension schemes

Acquisition

commitment

Buy

Improve

Sell

'Up to

£1 billion'

Assets

2,754

23

203

30

£0.35 billion

3,010

Significantly increased

contributions in

Melrose ownership

Liabilities

(2,582)

(566)

(289)

(34)

(3,471)

GKN UK schemes now in accounting surplus of £172 million¹, equivalent funding surplus of c.£100 million

The Group's gross pension plan liabilities have reduced by 25% during the year, including £379 million of gross liabilities transferred with

businesses disposed and £366 million following a successful buy-out of the pensioners of the GKN UK 2016 scheme

GKN UK Funding deficit:

Accounting

surplus/ Movement in

the year

(deficit)

172

290

33

51

(543)

(86)

(4)

(461)

£0.75 billion

Improved investment

strategy and other

3

377

At 31 December

2021

£0.1 billion

surplus

The Melrose funding commitment made on acquisition of GKN, fulfilled ahead of time. Ongoing annual payments are halved to £30 million

and no funding requirement from future disposal proceeds

1. Includes a surplus of £179 million relating to the GKN UK Group Pension Schemes (numbers 1-4) and a deficit of £7 million relating to the GKN UK Post Retirement

Medical Scheme

41View entire presentation