Vici Investor Presentation

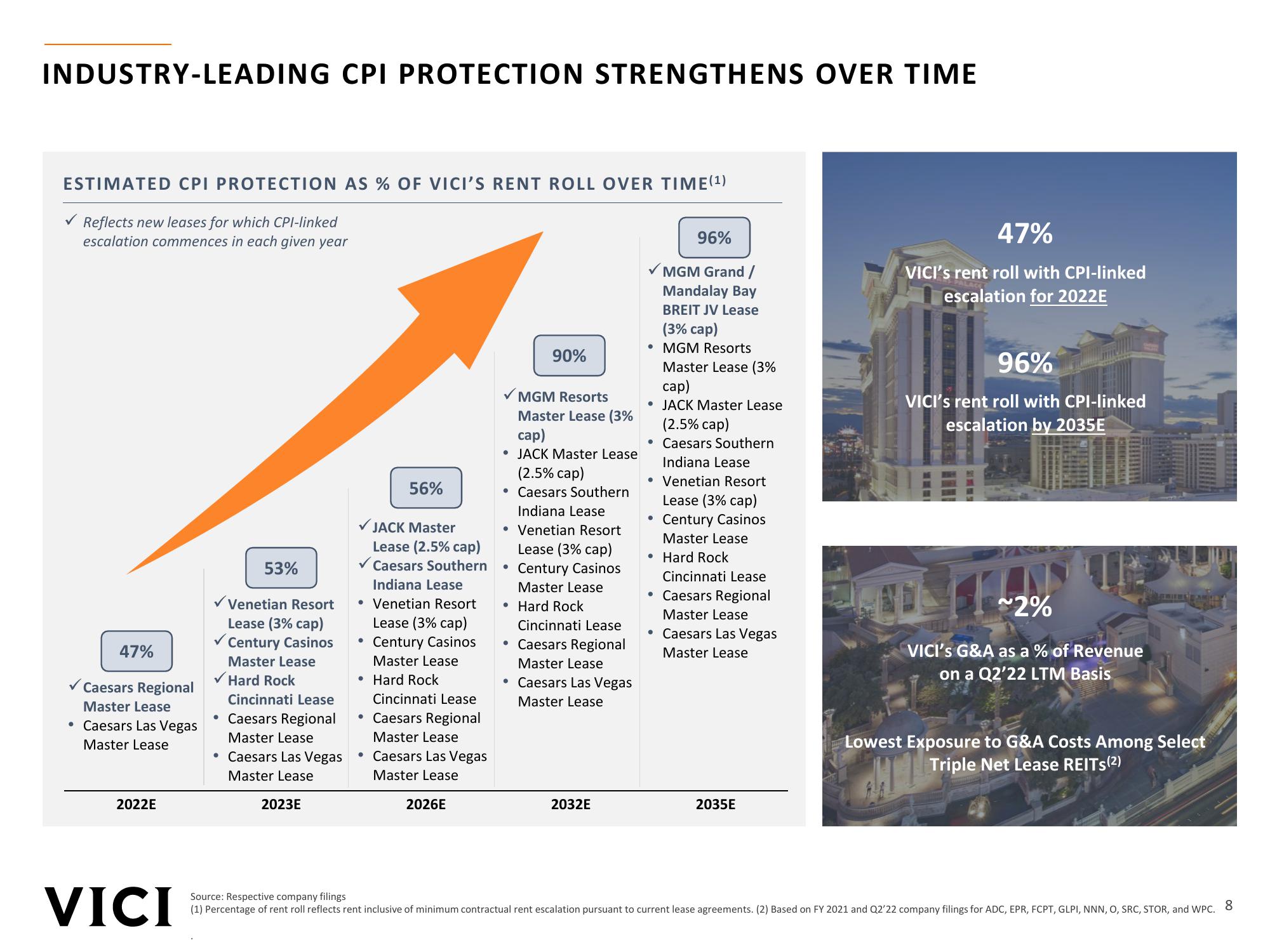

INDUSTRY-LEADING CPI PROTECTION STRENGTHENS OVER TIME

ESTIMATED CPI PROTECTION AS % OF VICI'S RENT ROLL OVER TIME (¹)

✓ Reflects new leases for which CPI-linked

escalation commences in each given year

47%

Caesars Regional

Master Lease

• Caesars Las Vegas

Master Lease

2022E

VICI

53%

✓ Venetian Resort

Lease (3% cap)

Century Casinos

Master Lease

✓Hard Rock

Cincinnati Lease

• Caesars Regional

Master Lease

• Caesars Las Vegas

Master Lease

2023E

✓

●

56%

• Venetian Resort

Lease (3% cap)

Century Casinos

Master Lease

Hard Rock

Cincinnati Lease

• Caesars Regional

Master Lease

• Caesars Las Vegas

Master Lease

●

JACK Master

Lease (2.5% cap)

Caesars Southern

Indiana Lease

2026E

90%

MGM Resorts

Master Lease (3%

cap)

• JACK Master Lease

(2.5% cap)

Caesars Southern

Indiana Lease

• Venetian Resort

Lease (3% cap)

Century Casinos

Master Lease

• Hard Rock

Cincinnati Lease

• Caesars Regional

Master Lease

Caesars Las Vegas

Master Lease

2032E

96%

MGM Grand /

Mandalay Bay

BREIT JV Lease

(3% cap)

• MGM Resorts

Master Lease (3%

cap)

JACK Master Lease

(2.5% cap)

Caesars Southern

Indiana Lease

• Venetian Resort

Lease (3% cap)

Century Casinos

Master Lease

Hard Rock

Cincinnati Lease

• Caesars Regional

Master Lease

• Caesars Las Vegas

Master Lease

●

2035E

47%

VICI's rent roll with CPI-linked

escalation for 2022E

96%

VICI's rent roll with CPI-linked

escalation by 2035E

~2%

VICI's G&A as a % of Revenue

on a Q2'22 LTM Basis

Lowest Exposure to G&A Costs Among Select

Triple Net Lease REITS (²)

Source: Respective company filings

(1) Percentage of rent roll reflects rent inclusive of minimum contractual rent escalation pursuant to current lease agreements. (2) Based on FY 2021 and Q2'22 company filings for ADC, EPR, FCPT, GLPI, NNN, O, SRC, STOR, and WPC. 8View entire presentation