Investor Presentation

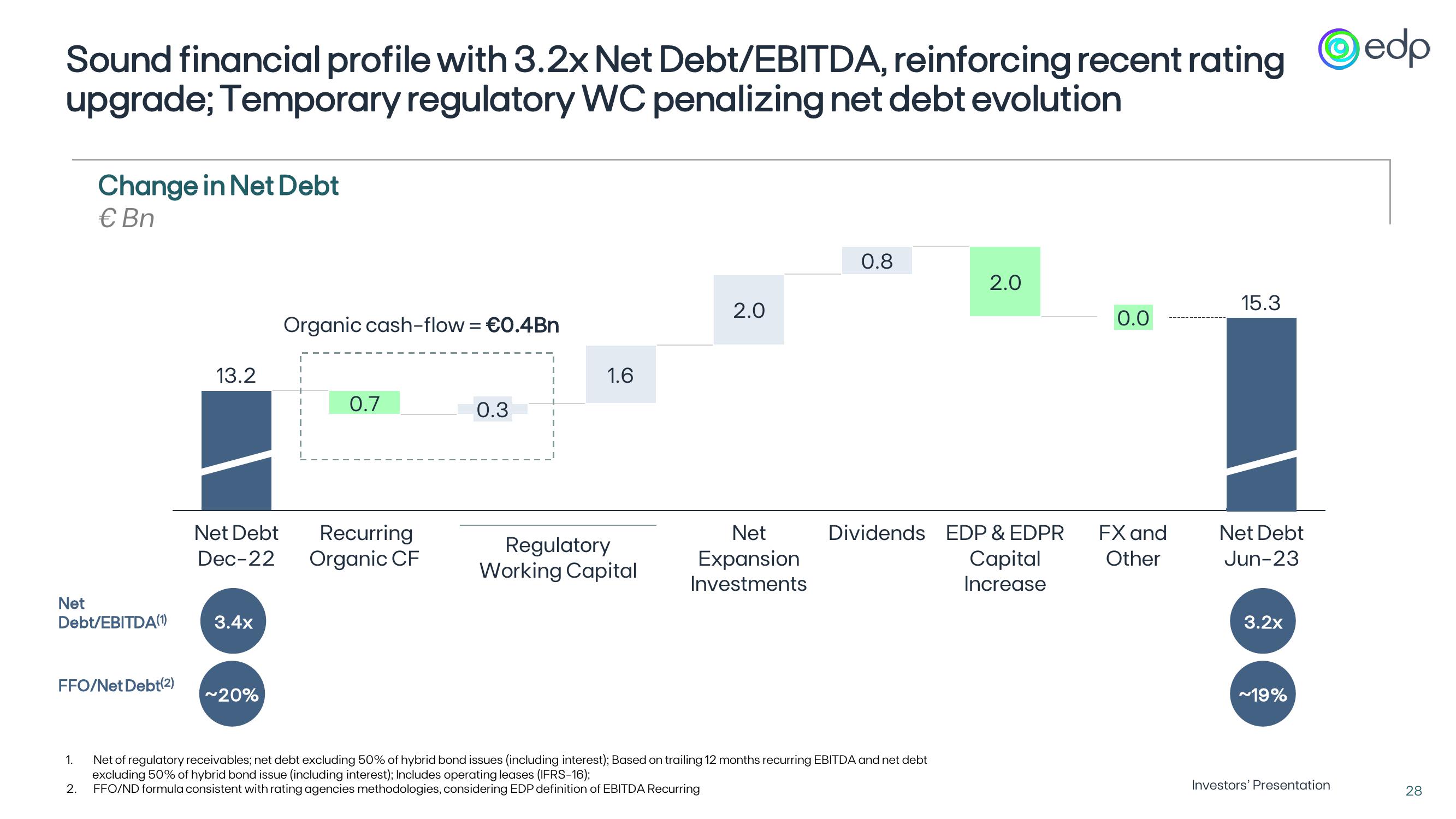

Sound financial profile with 3.2x Net Debt/EBITDA, reinforcing recent rating ①edp

upgrade; Temporary regulatory WC penalizing net debt evolution

Change in Net Debt

€ Bn

Organic cash-flow = €0.4Bn

13.2

1.6

+

I

0.7

0.3

I

0.8

2.0

2.0

15.3

0.0

Net Debt

Dec-22

Recurring

Organic CF

Regulatory

Working Capital

Net

Expansion

Investments

Dividends EDP & EDPR

Capital

Increase

FX and

Other

Net Debt

Jun-23

Net

Debt/EBITDA (1)

3.4x

FFO/Net Debt(2)

~20%

1.

Net of regulatory receivables; net debt excluding 50% of hybrid bond issues (including interest); Based on trailing 12 months recurring EBITDA and net debt

excluding 50% of hybrid bond issue (including interest); Includes operating leases (IFRS-16);

2.

FFO/ND formula consistent with rating agencies methodologies, considering EDP definition of EBITDA Recurring

3.2x

~19%

Investors' Presentation

28View entire presentation