Babylon SPAC Presentation Deck

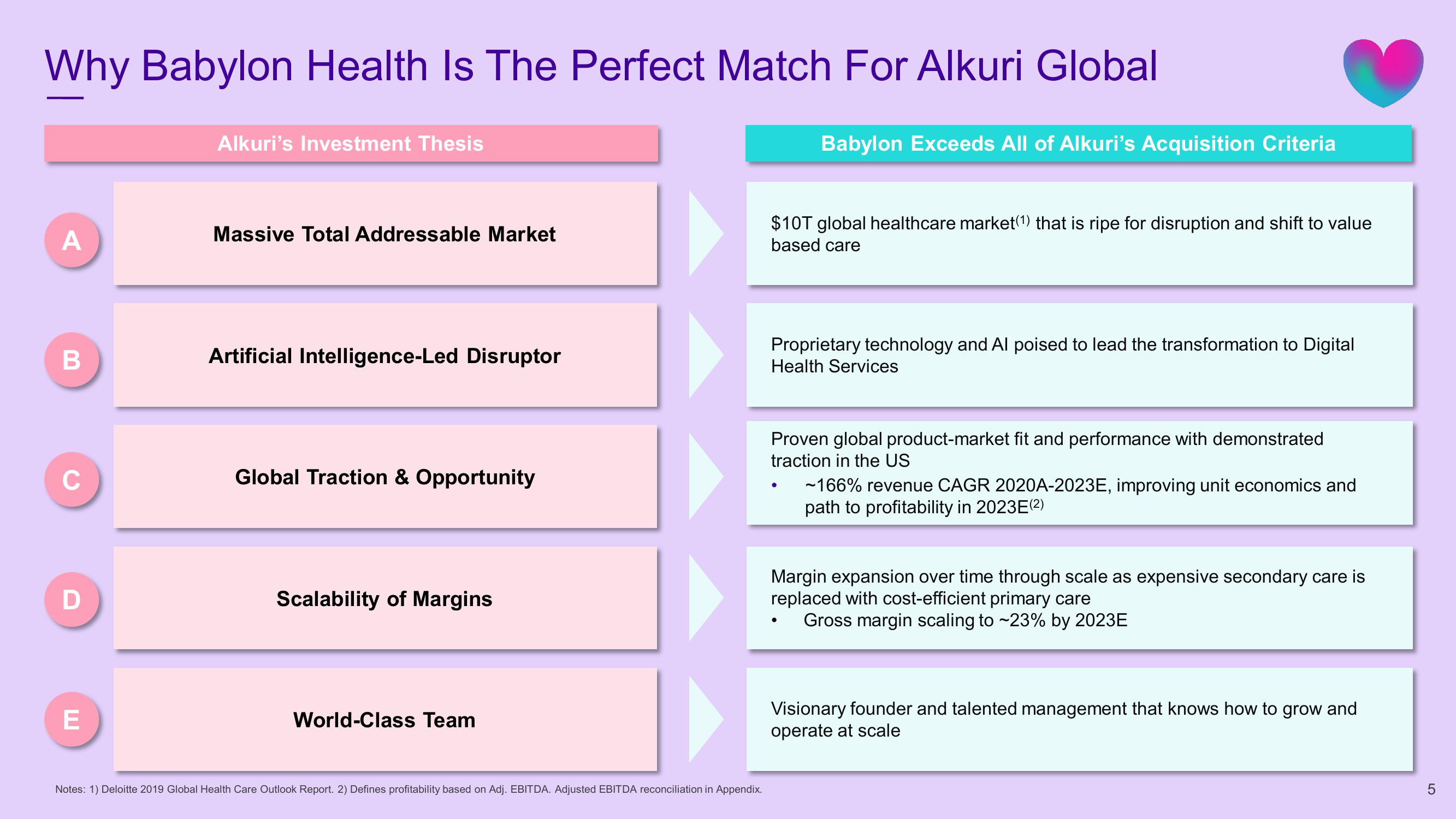

Why Babylon Health Is The Perfect Match For Alkuri Global

A

B

C

D

E

Alkuri's Investment Thesis

Massive Total Addressable Market

Artificial Intelligence-Led Disruptor

Global Traction & Opportunity

Scalability of Margins

World-Class Team

Notes: 1) Deloitte 2019 Global Health Care Outlook Report. 2) Defines profitability based on Adj. EBITDA. Adjusted EBITDA reconciliation in Appendix.

Babylon Exceeds All of Alkuri's Acquisition Criteria

$10T global healthcare market(1) that is ripe for disruption and shift to value

based care

Proprietary technology and Al poised to lead the transformation to Digital

Health Services

Proven global product-market fit and performance with demonstrated

traction in the US

●

~166% revenue CAGR 2020A-2023E, improving unit economics and

path to profitability in 2023E(2)

Margin expansion over time through scale as expensive secondary care is

replaced with cost-efficient primary care

Gross margin scaling to ~23% by 2023E

Visionary founder and talented management that knows how to grow and

operate at scale

5View entire presentation