Toyota Investor Presentation Deck

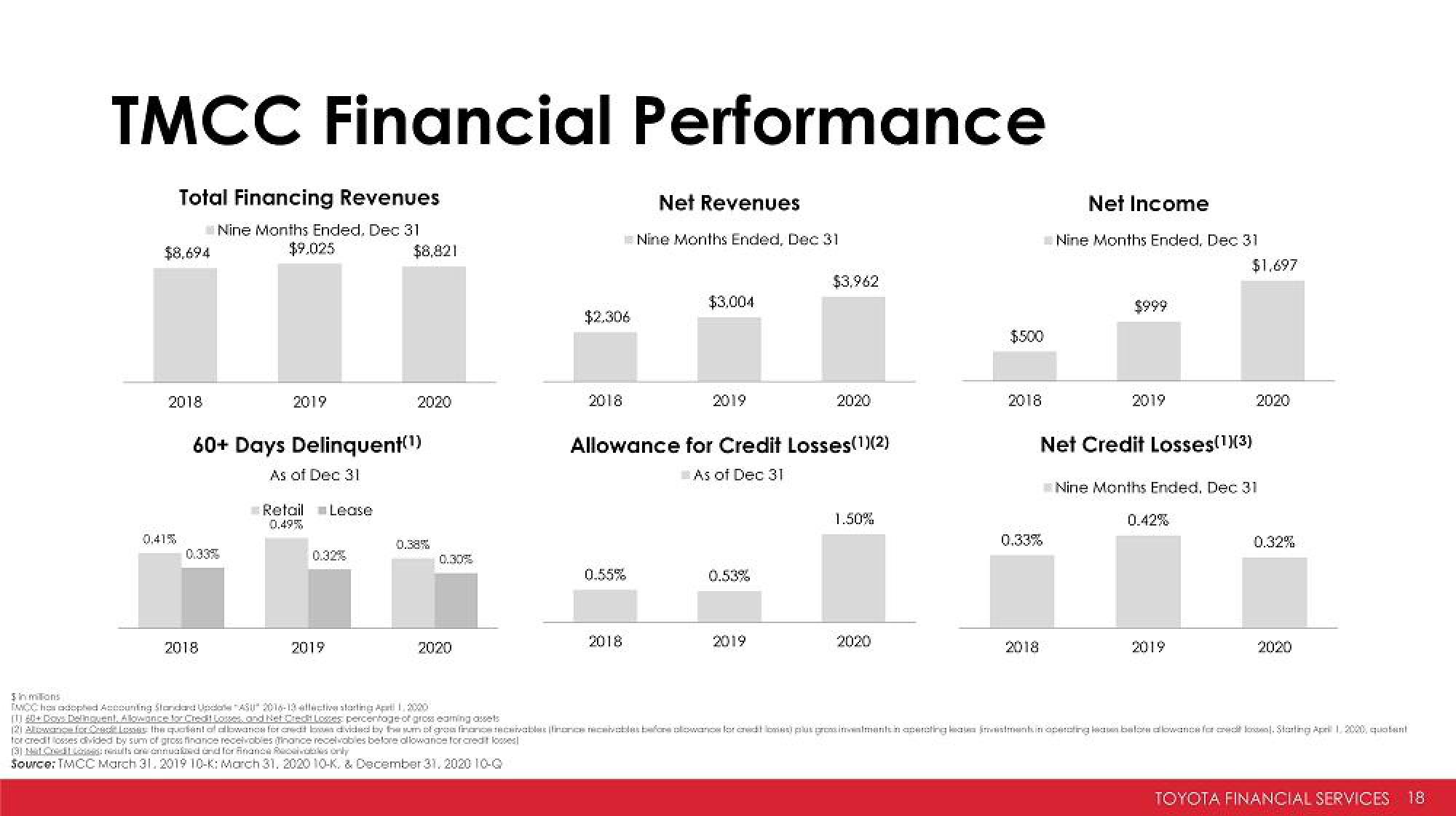

TMCC Financial Performance

Total Financing Revenues

Nine Months Ended. Dec 31

$9.025

$8,694

2018

0.41%

0.33%

2019

2018

60+ Days Delinquent(¹)

As of Dec 31

Retail Lease

0.49%

0.32%

$8,821

2019

2020

0.38%

0.30%

2020

$2.306

2018

0.55%

Net Revenues

Nine Months Ended, Dec 31

2018

$3.004

2019

Allowance for Credit Losses(1)(2)

As of Dec 31

0.53%

$3,962

2019

2020

1.50%

2020

$500

2018

0.33%

2018

Net Income

Nine Months Ended, Dec 31

$999

2019

Net Credit Losses(1)(3)

$1,697

0.42%

Nine Months Ended, Dec 31

2019

2020

0.32%

2020

$ in milions

IMCC has adopted Accounting Standard Update ASU" 2016-13 effective storting April 1, 2000

(1) 60+ Days Delinquent. Allowance for Credit Lowes, and Net Crech Losses percentage of gross eaming assets

(2) Alowance for Creat Losses the quotient al allowance for creat lowes divided by the sum of gros finance receivables (finonics receivables before clowance for credit lones) plus grossimestments in aperating keaje imestment in operating leases below allowance for and loss). Starting April 1, 2000, quotient

for credit losses divided by sum of gross finance receivables finance receivables before allowance for credit losses!

(3) NetOrd Lisad: results one annualed and for France Receivables only

Source: TMCC March 31, 2019 10-K: March 31, 2020 10-K. & December 31, 2020 10-G

TOYOTA FINANCIAL SERVICES 18View entire presentation