Evercore Investment Banking Pitch Book

Transaction Overview

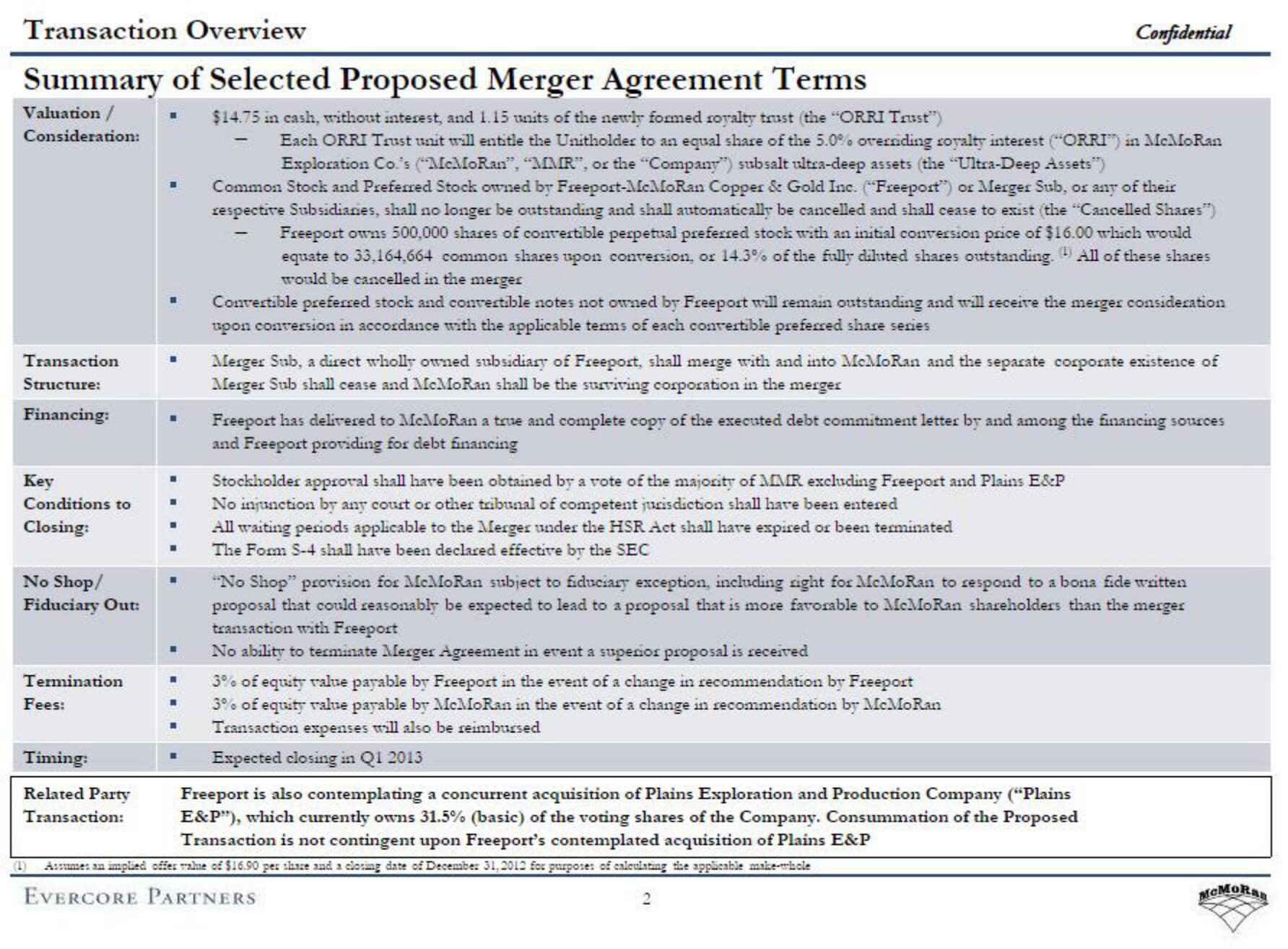

Summary of Selected Proposed Merger Agreement Terms

Valuation /

Consideration:

$14.75 in cash, without interest, and 1.15 units of the newly formed royalty trust (the "ORRI Trust")

Each ORRI Trust unit will entitle the Unitholder to an equal share of the 5.0% overnding royalty interest (ORRI") in McMoRan

Exploration Co.'s ("McMoRan", "MMR", or the "Company") subsalt ultra-deep assets (the "Ultra-Deep Assets")

Common Stock and Preferred Stock owned by Freeport-McMoRan Copper & Gold Inc. ("Freeport") or Merger Sub, or any of their

respective Subsidianes, shall no longer be outstanding and shall automatically be cancelled and shall cease to exist (the "Cancelled Shares")

Freeport owns 500,000 shares of convertible perpetual preferred stock with an initial conversion price of $16.00 which would

equate to 33,164,664 common shares upon conversion, or 14.3% of the fully diluted shares outstanding. All of these shares

would be cancelled in the merger

Transaction

Structure:

Financing:

Key

Conditions to

Closing:

No Shop/

Fiduciary Out:

Termination

Fees:

Timing:

Related Party

Transaction:

■

(1)

I

I

1

1

I

-

Convertible preferred stock and convertible notes not owned by Freeport will remain outstanding and will receive the merger consideration

upon conversion in accordance with the applicable terms of each convertible preferred share series

Merger Sub, a direct wholly owned subsidiary of Freeport, shall merge with and into McMoRan and the separate corporate existence of

Merger Sub shall cease and McMoRan shall be the surviving corporation in the merger

Freeport has delivered to McMoRan a true and complete copy of the executed debt commitment letter by and among the financing sources

and Freeport providing for debt financing

Stockholder approval shall have been obtained by a vote of the majority of MMR excluding Freeport and Plains E&P

No injunction by any court or other tribunal of competent jurisdiction shall have been entered

All waiting periods applicable to the Merger under the HSR Act shall have expired or been terminated

The Form S-4 shall have been declared effective by the SEC

Confidential

"No Shop" provision for McMoRan subject to fiduciary exception, including right for McMoRan to respond to a bona fide written

proposal that could reasonably be expected to lead to a proposal that is more favorable to McMoRan shareholders than the merger

transaction with Freeport

No ability to terminate Merger Agreement in event a superior proposal is received

3% of equity value payable by Freeport in the event of a change in recommendation by Freeport

3% of equity value payable by McMoRan in the event of a change in recommendation by McMoRan

Transaction expenses will also be reimbursed

Expected closing in Q1 2013

Freeport is also contemplating a concurrent acquisition of Plains Exploration and Production Company ("Plains

E&P"), which currently owns 31.5% (basic) of the voting shares of the Company. Consummation of the Proposed

Transaction is not contingent upon Freeport's contemplated acquisition of Plains E&P

Assumes an implied offer value of $16.90 per share and a closing date of December 31, 2012 for purposes of calculating the applicable make-whole

EVERCORE PARTNERS

MCMORANView entire presentation