GMS Results Presentation Deck

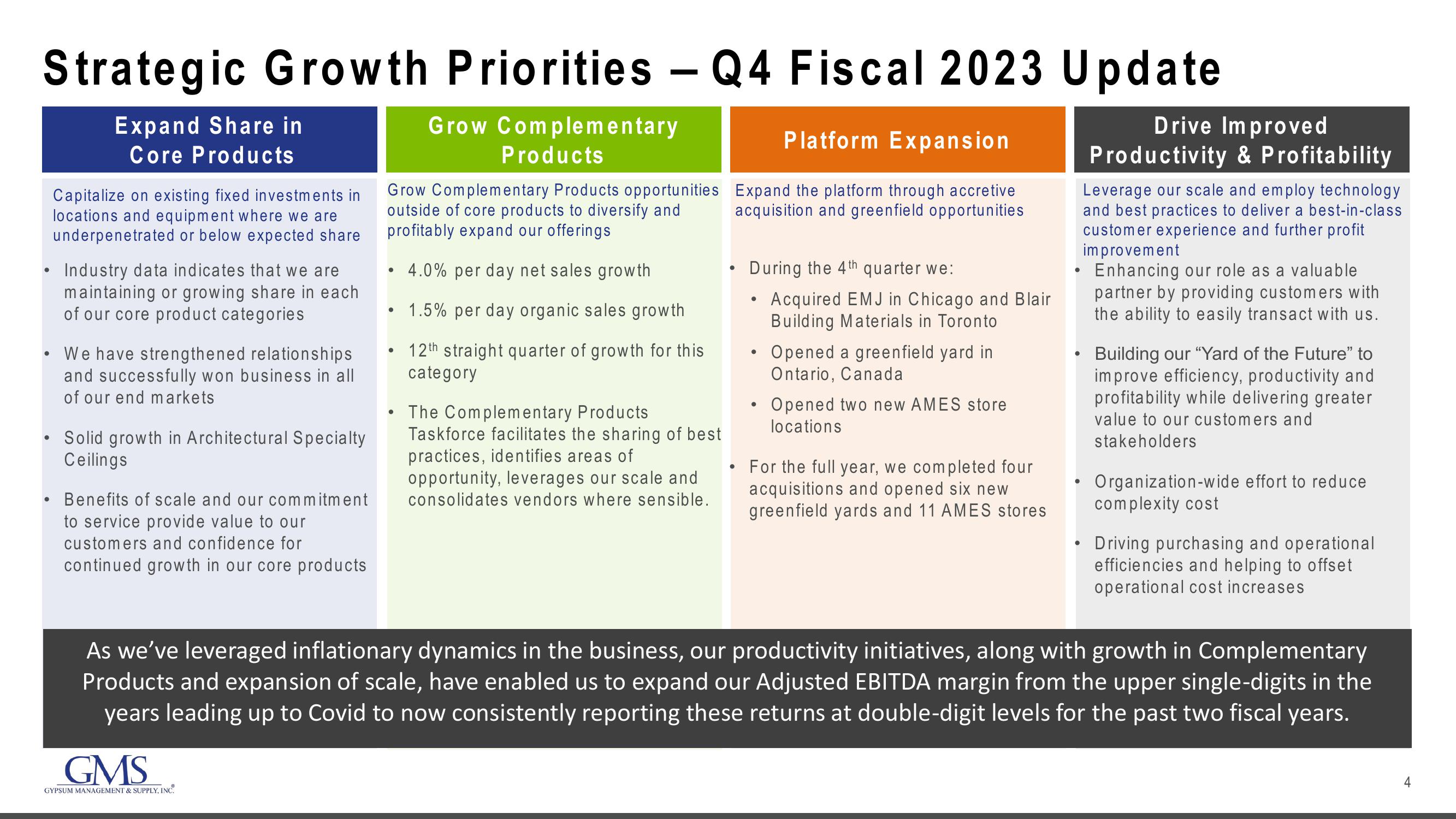

Strategic Growth Priorities - Q4 Fiscal 2023 Update

Expand Share in

Core Products

●

●

Capitalize on existing fixed investments in

locations and equipment where we are

underpenetrated or below expected share

Industry data indicates that we are

maintaining or growing share in each

of our core product categories

We have strengthened relationships

and successfully won business in all

of our end markets

Solid growth in Architectural Specialty

Ceilings

Benefits of scale and our commitment

to service provide value to our

customers and confidence for

continued growth in our core products

GMS

GYPSUM MANAGEMENT & SUPPLY, INC.

Grow Complementary

Products

Grow Complementary Products opportunities

outside of core products to diversify and

profitably expand our offerings

●

• 4.0% per day net sales growth

●

1.5% per day organic sales growth

12th straight quarter of growth for this

category

The Complementary Products

Taskforce facilitates the sharing of best

practices, identifies areas of

opportunity, leverages our scale and

consolidates vendors where sensible.

Platform Expansion

Expand the platform through accretive

acquisition and greenfield opportunities

During the 4th quarter we:

Acquired EMJ in Chicago and Blair

Building Materials in Toronto

●

Opened a greenfield yard in

Ontario, Canada

Opened two new AMES store

locations

For the full year, we completed four

acquisitions and opened six new

greenfield yards and 11 AMES stores

Drive Improved

Productivity & Profitability

Leverage our scale and employ technology

and best practices to deliver a best-in-class

customer experience and further profit

improvement

Enhancing our role as a valuable

partner by providing customers with

the ability to easily transact with us.

Building our "Yard of the Future" to

improve efficiency, productivity and

profitability while delivering greater

value to our customers and

stakeholders

Organization-wide effort to reduce

complexity cost

●

• Driving purchasing and operational

efficiencies and helping to offset

operational cost increases

As we've leveraged inflationary dynamics in the business, our productivity initiatives, along with growth in Complementary

Products and expansion of scale, have enabled us to expand our Adjusted EBITDA margin from the upper single-digits in the

years leading up to Covid to now consistently reporting these returns at double-digit levels for the past two fiscal years.

4View entire presentation