Kore Investor Presentation Deck

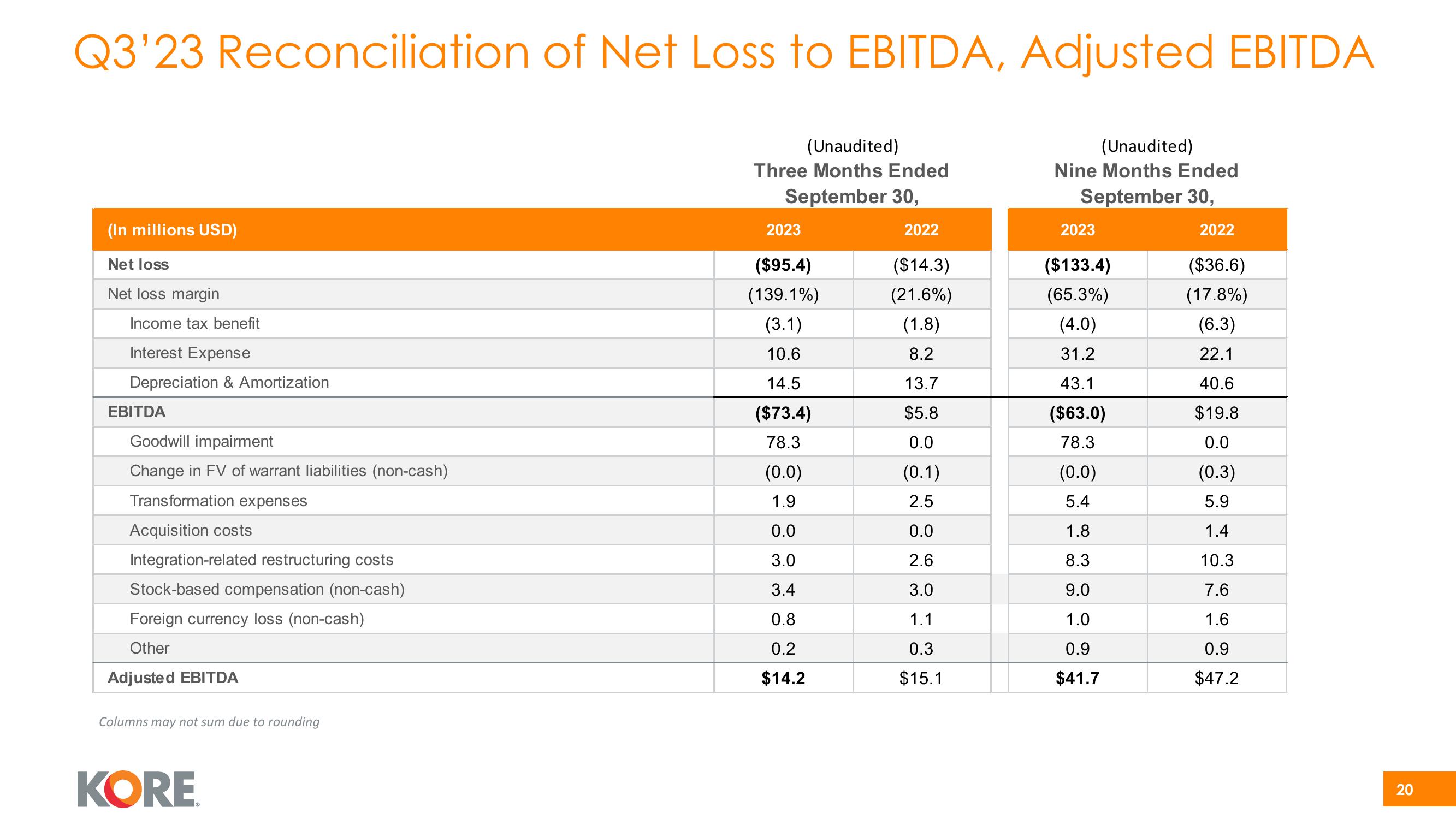

Q3'23 Reconciliation of Net Loss to EBITDA, Adjusted EBITDA

(Unaudited)

Three Months Ended

September 30,

(In millions USD)

Net loss

Net loss margin

Income tax benefit

Interest Expense

Depreciation & Amortization

EBITDA

Goodwill impairment

Change in FV of warrant liabilities (non-cash)

Transformation expenses

Acquisition costs

Integration-related restructuring costs

Stock-based compensation (non-cash)

Foreign currency loss (non-cash)

Other

Adjusted EBITDA

Columns may not sum due to rounding

KORE

2023

($95.4)

(139.1%)

(3.1)

10.6

14.5

($73.4)

78.3

(0.0)

1.9

0.0

3.0

3.4

0.8

0.2

$14.2

2022

($14.3)

(21.6%)

(1.8)

8.2

13.7

$5.8

0.0

(0.1)

2.5

0.0

2.6

3.0

1.1

0.3

$15.1

(Unaudited)

Nine Months Ended

September 30,

2023

($133.4)

(65.3%)

(4.0)

31.2

43.1

($63.0)

78.3

(0.0)

5.4

1.8

8.3

9.0

1.0

0.9

$41.7

2022

($36.6)

(17.8%)

(6.3)

22.1

40.6

$19.8

0.0

(0.3)

5.9

1.4

10.3

7.6

1.6

0.9

$47.2

20View entire presentation