Oaktree Real Estate Opportunities Fund VII, L.P.

Purchases

Sales and Refinancing

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

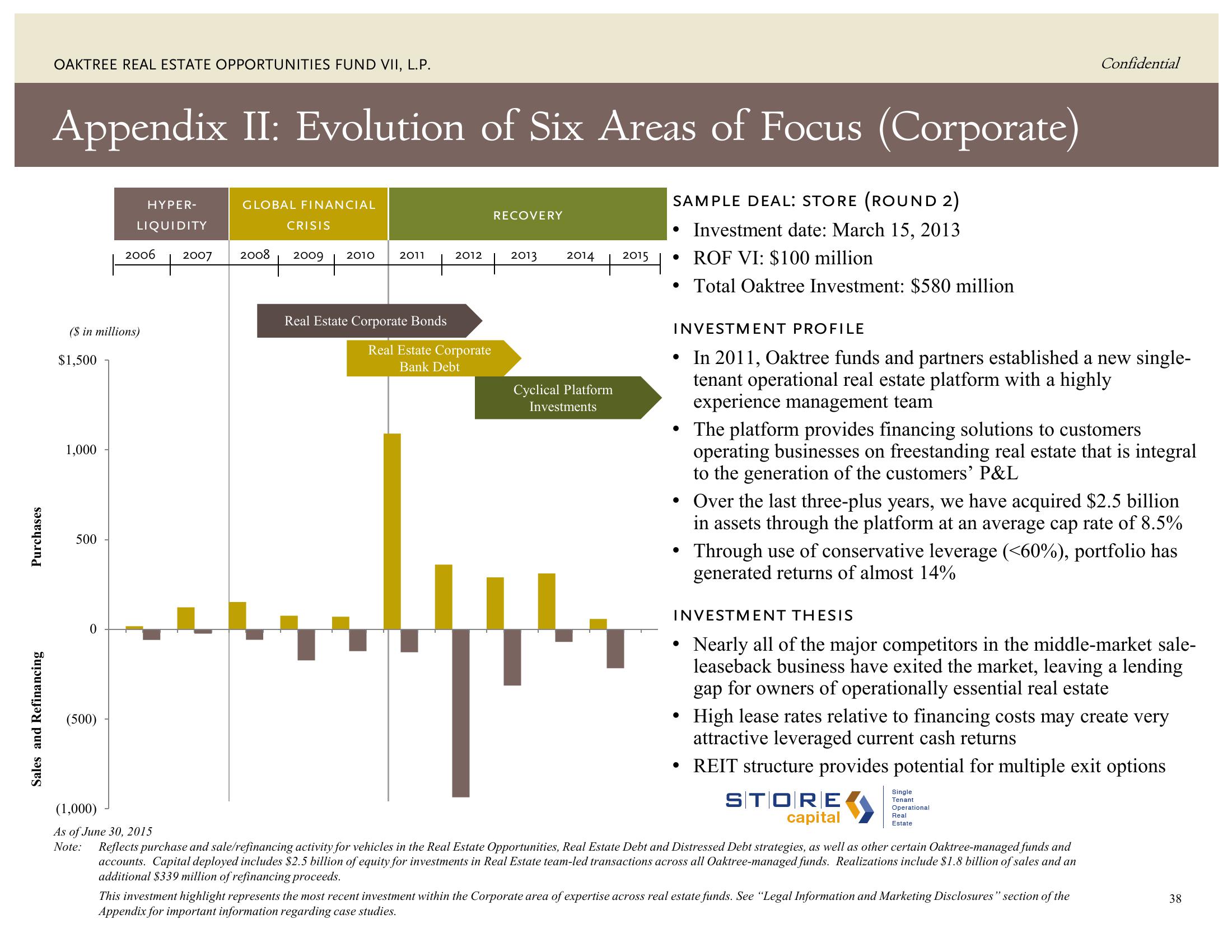

Appendix II: Evolution of Six Areas of Focus (Corporate)

1,000

($ in millions)

$1,500

500

HYPER-

LIQUIDITY

0

2006

(500)

2007

GLOBAL FINANCIAL

CRISIS

2008 2009 2010

2011

Real Estate Corporate Bonds

2012

Real Estate Corporate

Bank Debt

RECOVERY

2013

2014

Cyclical Platform

Investments

2015

+

SAMPLE DEAL: STORE (ROUND 2)

• Investment date: March 15, 2013

• ROF VI: $100 million

• Total Oaktree Investment: $580 million

INVESTMENT PROFILE

In 2011, Oaktree funds and partners established a new single-

tenant operational real estate platform with a highly

experience management team

• The platform provides financing solutions to customers

operating businesses on freestanding real estate that is integral

to the generation of the customers' P&L

• Over the last three-plus years, we have acquired $2.5 billion

in assets through the platform at an average cap rate of 8.5%

Through use of conservative leverage (<60%), portfolio has

generated returns of almost 14%

●

INVESTMENT THESIS

Nearly all of the major competitors in the middle-market sale-

leaseback business have exited the market, leaving a lending

gap for owners of operationally essential real estate

I'

High lease rates relative to financing costs may create very

attractive leveraged current cash returns

• REIT structure provides potential for multiple exit options

(1,000)

STORE

capital

As of June 30, 2015

Note: Reflects purchase and sale/refinancing activity for vehicles in the Real Estate Opportunities, Real Estate Debt and Distressed Debt strategies, as well as other certain Oaktree-managed funds and

accounts. Capital deployed includes $2.5 billion of equity for investments in Real Estate team-led transactions across all Oaktree-managed funds. Realizations include $1.8 billion of sales and an

additional $339 million of refinancing proceeds.

Confidential

●

●

Single

Tenant

Operational

Real

Estate

This investment highlight represents the most recent investment within the Corporate area of expertise across real estate funds. See "Legal Information and Marketing Disclosures" section of the

Appendix for important information regarding case studies.

38View entire presentation