Cannae SPAC Presentation Deck

CERIDIAN

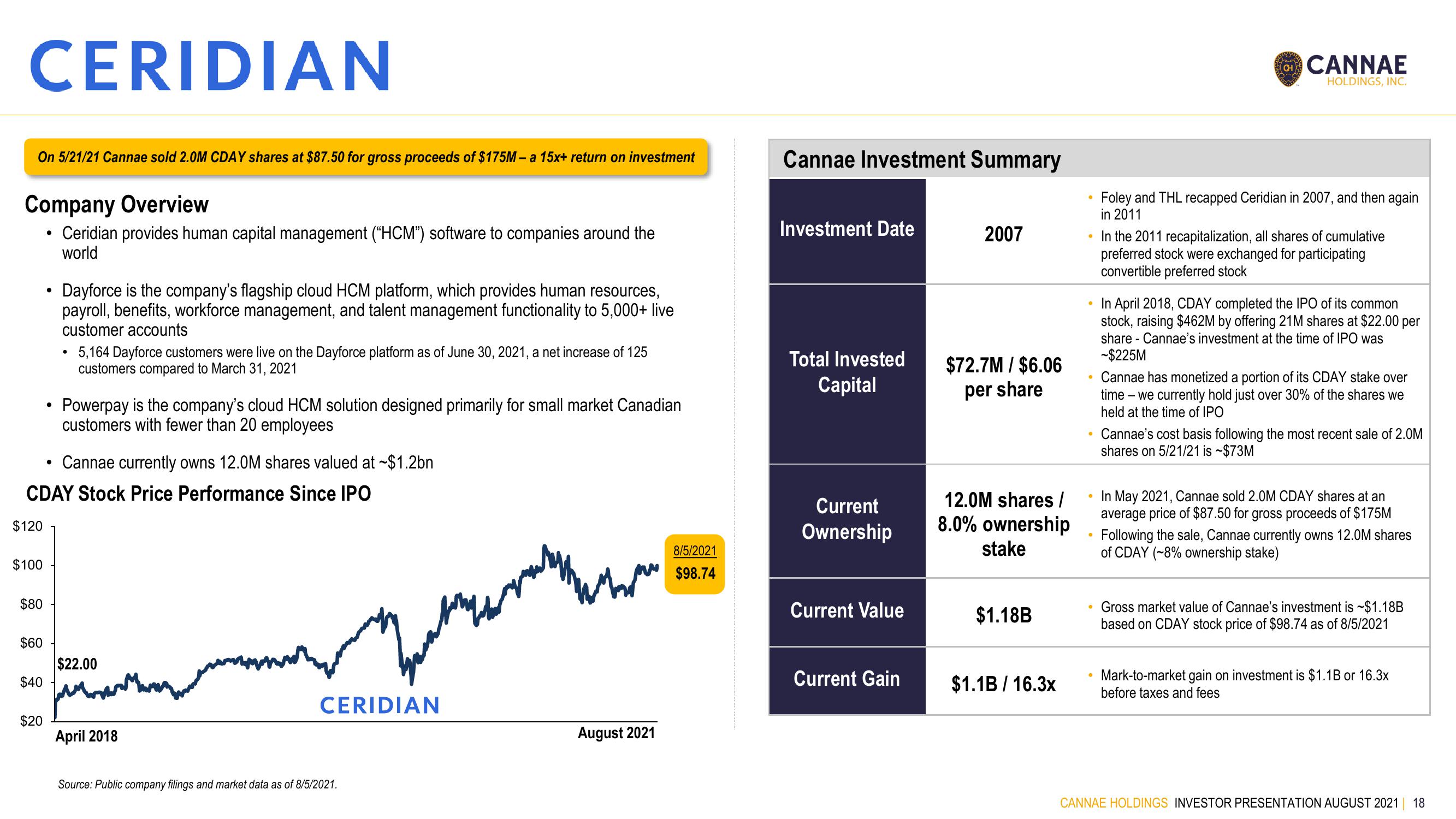

On 5/21/21 Cannae sold 2.0M CDAY shares at $87.50 for gross proceeds of $175M-a 15x+ return on investment

Company Overview

Ceridian provides human capital management ("HCM") software to companies around the

world

$120

$100

$80

$60

$40

●

Cannae currently owns 12.0M shares valued at $1.2bn

CDAY Stock Price Performance Since IPO

$20

●

●

Dayforce is the company's flagship cloud HCM platform, which provides human resources,

payroll, benefits, workforce management, and talent management functionality to 5,000+ live

customer accounts

●

5,164 Dayforce customers were live on the Dayforce platform as of June 30, 2021, a net increase of 125

customers compared to March 31, 2021

Powerpay is the company's cloud HCM solution designed primarily for small market Canadian

customers with fewer than 20 employees

$22.00

April 2018

CERIDIAN

Source: Public company filings and market data as of 8/5/2021.

August 2021

8/5/2021

$98.74

Cannae Investment Summary

Investment Date

Total Invested

Capital

Current

Ownership

Current Value

Current Gain

2007

$72.7M / $6.06

per share

12.0M shares /

8.0% ownership

stake

$1.18B

$1.1B / 16.3x

●

●

●

• In the 2011 recapitalization, all shares of cumulative

preferred stock were exchanged for participating

convertible preferred stock

●

CH

•

CANNAE

HOLDINGS, INC.

Foley and THL recapped Ceridian in 2007, and then again

in 2011

In April 2018, CDAY completed the IPO of its common

stock, raising $462M by offering 21M shares at $22.00 per

share Cannae's investment at the time of IPO was

-$225M

Cannae has monetized a portion of its CDAY stake over

time - we currently hold just over 30% of the shares we

held at the time of IPO

Cannae's cost basis following the most recent sale of 2.0M

shares on 5/21/21 is ~$73M

In May 2021, Cannae sold 2.0M CDAY shares at an

average price of $87.50 for gross proceeds of $175M

Following the sale, Cannae currently owns 12.0M shares

of CDAY (~8% ownership stake)

Gross market value of Cannae's investment is ~$1.18B

based on CDAY stock price of $98.74 as of 8/5/2021

Mark-to-market gain on investment is $1.1B or 16.3x

before taxes and fees

CANNAE HOLDINGS INVESTOR PRESENTATION AUGUST 2021 | 18View entire presentation