Babylon Investor Day Presentation Deck

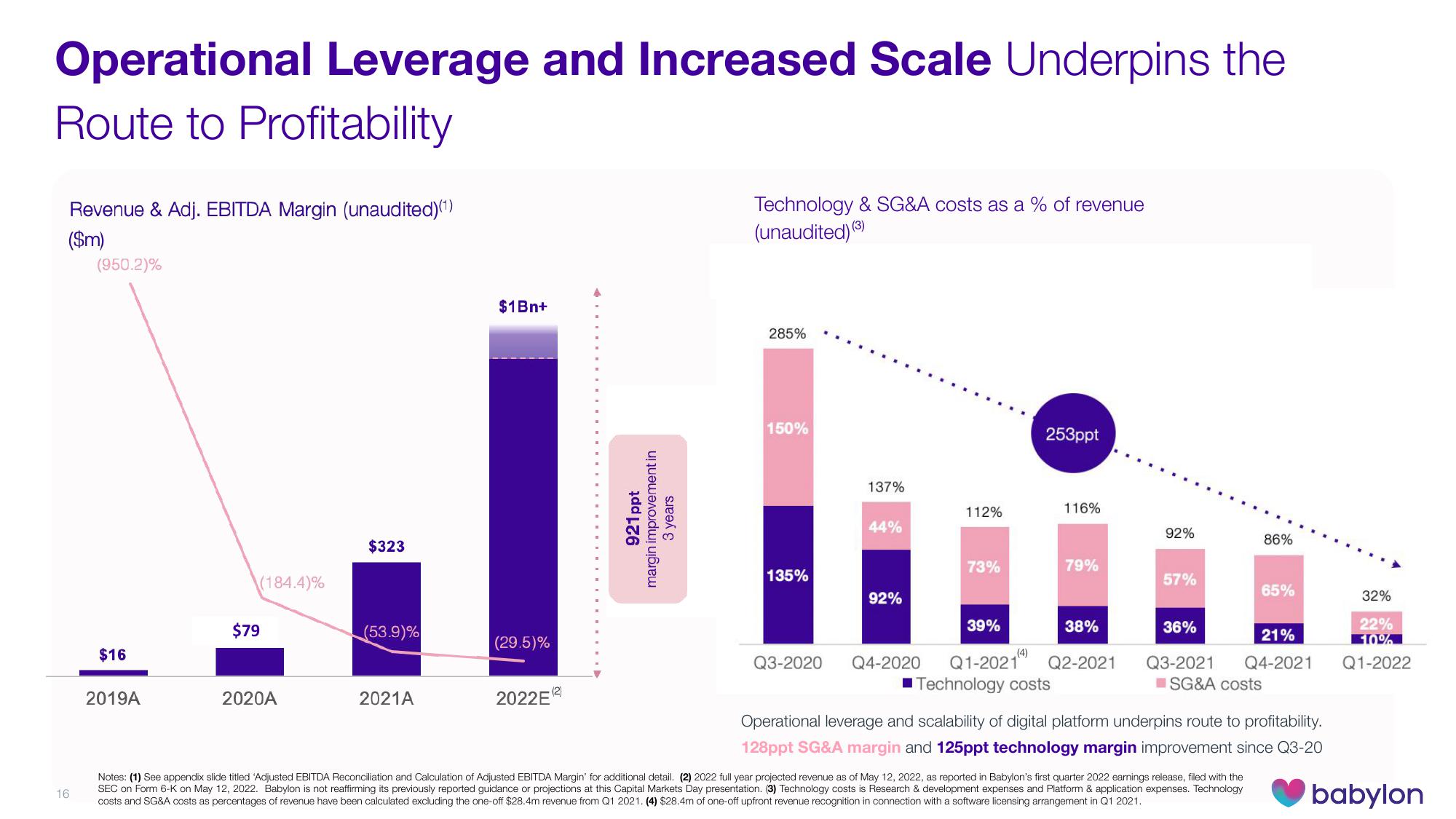

Operational Leverage and Increased Scale Underpins the

Route to Profitability

Revenue & Adj. EBITDA Margin (unaudited)(¹)

($m)

16

(950.2)%

$16

2019A

(184.4)%

$79

2020A

$323

(53.9)%

2021A

$1Bn+

(29.5)%

2022E

(2)

921 ppt

margin improvement in

3 years

Technology & SG&A costs as a % of revenue

(unaudited) (3)

285%

150%

135%

Q3-2020

137%

44%

92%

112%

Q4-2020

73%

253ppt

(4)

116%

39%

38%

Q1-2021 Q2-2021

Technology costs

79%

92%

57%

86%

65%

36%

21%

Q3-2021 Q4-2021

SG&A costs

Notes: (1) See appendix slide titled 'Adjusted EBITDA Reconciliation and Calculation of Adjusted EBITDA Margin' for additional detail. (2) 2022 full year projected revenue as of May 12, 2022, as reported in Babylon's first quarter 2022 earnings release, filed with the

SEC on Form 6-K on May 12, 2022. Babylon is not reaffirming its previously reported guidance or projections at this Capital Markets Day presentation. (3) Technology costs is Research & development expenses and Platform & application expenses. Technology

costs and SG&A costs as percentages of revenue have been calculated excluding the one-off $28.4m revenue from Q1 2021. (4) $28.4m of one-off upfront revenue recognition in connection with a software licensing arrangement in Q1 2021.

Operational leverage and scalability of digital platform underpins route to profitability.

128ppt SG&A margin and 125ppt technology margin improvement since Q3-20

32%

22%

10%

Q1-2022

babylonView entire presentation