Cadre Holdings IPO Presentation Deck

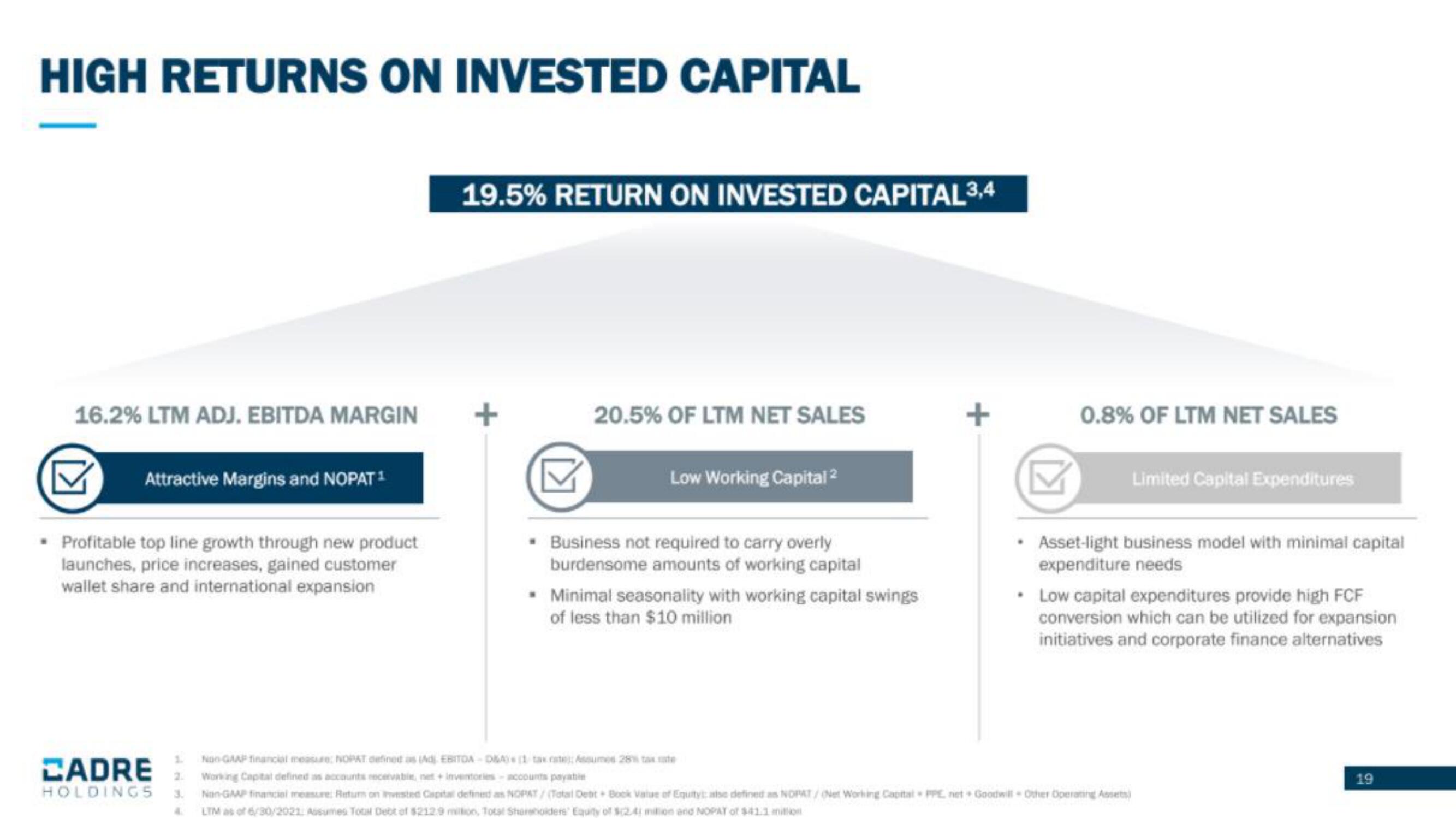

HIGH RETURNS ON INVESTED CAPITAL

16.2% LTM ADJ. EBITDA MARGIN

✈

Attractive Margins and NOPAT ¹

• Profitable top line growth through new product

launches, price increases, gained customer

wallet share and international expansion

CADRE 2.

HOLDINGS 3.

19.5% RETURN ON INVESTED CAPITAL 3,4

+

20.5% OF LTM NET SALES

Low Working Capital 2

• Business not required to carry overly

burdensome amounts of working capital

. Minimal seasonality with working capital swings

of less than $10 million

+

0.8% OF LTM NET SALES

✓

• Asset-light business model with minimal capital

expenditure needs

Limited Capital Expenditures

• Low capital expenditures provide high FCF

conversion which can be utilized for expansion

initiatives and corporate finance alternatives

Non GAAP financial measure: NOPAT defined as Adi EBITDA-DRAY (1 tax rate: Assumes 28% tax te

Working Capital defined as accounts receivable, net+ inventories-accounts payatin

Nan GAAP financial measure: Return on invested Capital defined as NOPAT/(Total Debit + Book Value of Equity; also defined as NOPAT/(Net Working Capital PPC net+ Goodwill - Other Operating Assets)

LTM as of 6/30/2021 Assumes Total Debt of $2129 million, Total Shareholders' Equity of $2.4 million and NOPATY of $41.1 million

19View entire presentation