Lyft Results Presentation Deck

Insurance Transaction Overview

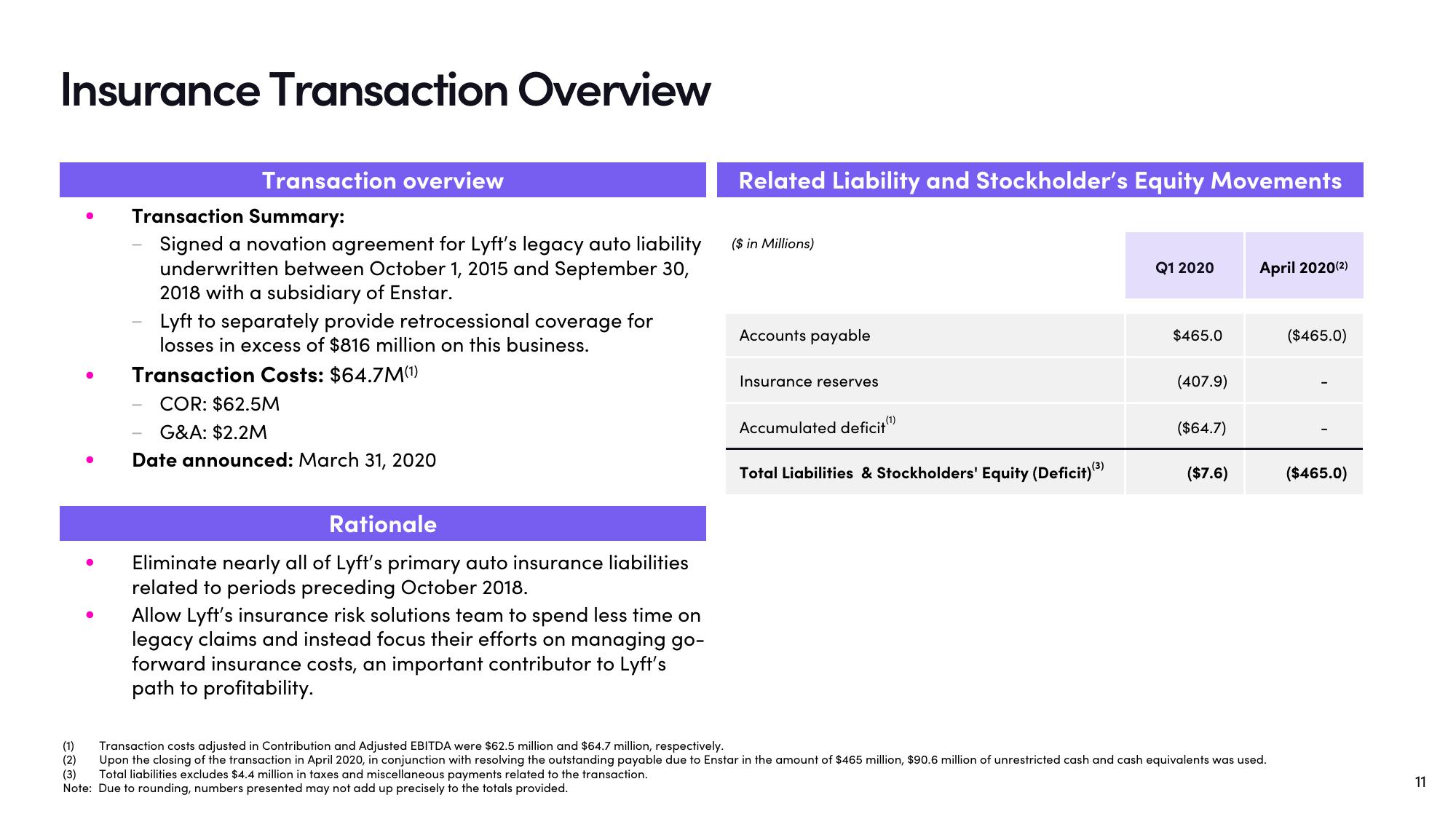

Transaction overview

Transaction Summary:

Signed a novation agreement for Lyft's legacy auto liability

underwritten between October 1, 2015 and September 30,

2018 with a subsidiary of Enstar.

Lyft to separately provide retrocessional coverage for

losses in excess of $816 million on this business.

Transaction Costs: $64.7M(¹)

COR: $62.5M

G&A: $2.2M

● Date announced: March 31, 2020

Rationale

Eliminate nearly all of Lyft's primary auto insurance liabilities

related to periods preceding October 2018.

Allow Lyft's insurance risk solutions team to spend less time on

legacy claims and instead focus their efforts on managing go-

forward insurance costs, an important contributor to Lyft's

path to profitability.

Related Liability and Stockholder's Equity Movements

($ in Millions)

Accounts payable

Insurance reserves

, (1)

Accumulated deficit"

Total Liabilities & Stockholders' Equity (Deficit) (3)

Q1 2020

$465.0

(407.9)

($64.7)

($7.6)

April 2020(²)

(1) Transaction costs adjusted in Contribution and Adjusted EBITDA were $62.5 million and $64.7 million, respectively.

(2)

Upon the closing of the transaction in April 2020, in conjunction with resolving the outstanding payable due to Enstar in the amount of $465 million, $90.6 million of unrestricted cash and cash equivalents was used.

(3) Total liabilities excludes $4.4 million in taxes and miscellaneous payments related to the transaction.

Note: Due to rounding, numbers presented may not add up precisely to the totals provided.

($465.0)

($465.0)

11View entire presentation