Inovalon Results Presentation Deck

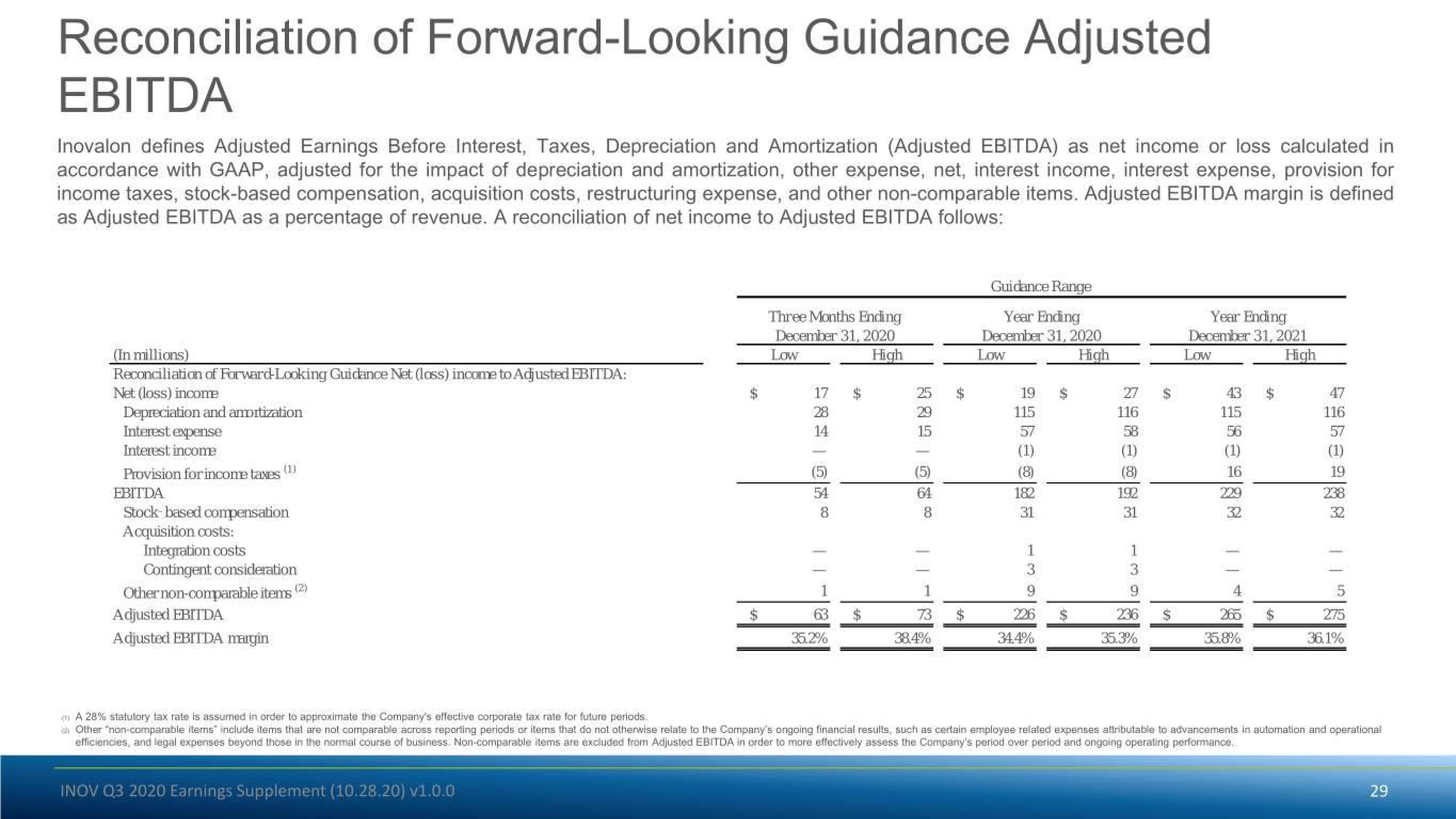

Reconciliation of Forward-Looking Guidance Adjusted

EBITDA

Inovalon defines Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) as net income or loss calculated in

accordance with GAAP, adjusted for the impact of depreciation and amortization, other expense, net, interest income, interest expense, provision for

income taxes, stock-based compensation, acquisition costs, restructuring expense, and other non-comparable items. Adjusted EBITDA margin is defined

as Adjusted EBITDA as a percentage of revenue. A reconciliation of net income to Adjusted EBITDA follows:

(In millions)

Reconciliation of Forward-Looking Guidance Net (loss) income to Adjusted EBITDA:

Net (loss) income

Depreciation and amortization

Interest expense

Interest income

(1)

Provision for income taxes

EBITDA

Stock-based compensation

Acquisition costs:

Integration costs

Contingent consideration

Other non-comparable items (2)

Adjusted EBITDA

Adjusted EBITDA margin

Three Months Ending

December 31, 2020

Low

High

INOV Q3 2020 Earnings Supplement (10.28.20) v1.0.0

17

28

14

54

8

I

||

35.2%

389108°

15

73

38.4%

60-

Guidance Range

Year Ending

December 31, 2020

Low

High

19

115

57

(1)

(8)

182

31

1

3

34.4%

116

(8)

192

31

236

35.3%

100

Year Ending

December 31, 2021

Low

High

115

(1)

16

1

265

35.8%

47

116

57

(1)

19

32

11

275

36.1%

A 28% statutory tax rate is assumed in order to approximate the Company's effective corporate tax rate for future periods.

Other "non-comparable items include items that are not comparable across reporting periods or items that do not otherwise relate to the Company's ongoing financial results, such as certain employee related expenses attributable to advancements in automation and operational

efficiencies, and legal expenses beyond those in the normal course of business. Non-comparable items are excluded from Adjusted EBITDA in order to more effectively assess the Company's period over period and ongoing operating performance.

29View entire presentation