Gorilla Technology Group SPAC Presentation Deck

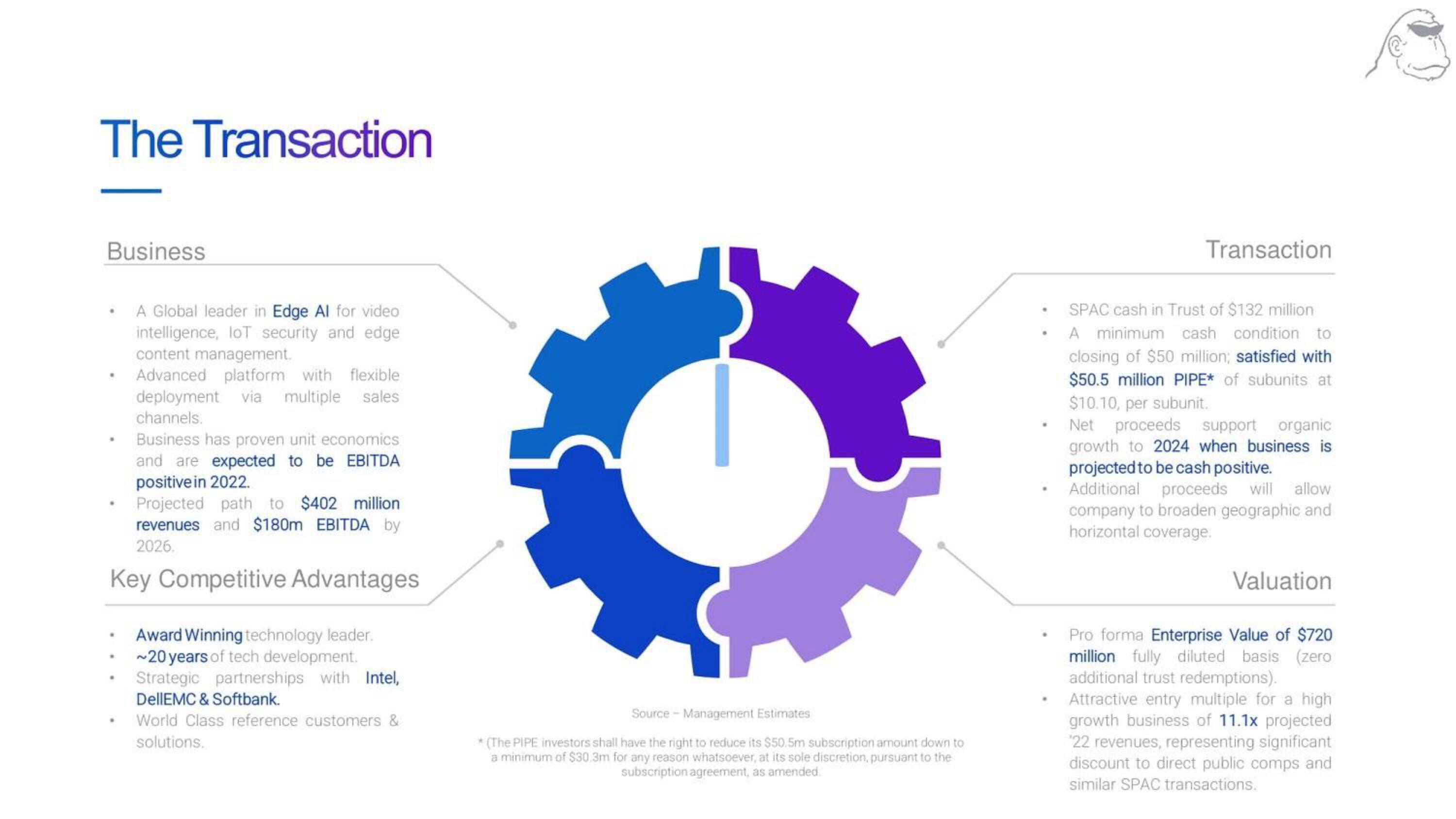

The Transaction

Business

A Global leader in Edge Al for video

intelligence, loT security and edge

content management.

Advanced platform with flexible

deployment via multiple sales

channels.

Business has proven unit economics

and are expected to be EBITDA

positive in 2022.

Projected path to $402 million

revenues and $180m EBITDA by

2026.

Key Competitive Advantages

.

Award Winning technology leader.

~20 years of tech development.

Strategic partnerships with Intel,

DellEMC & Softbank.

World Class reference customers &

solutions.

Source - Management Estimates

* (The PIPE investors shall have the right to reduce its $50.5m subscription amount down to

a minimum of $30.3m for any reason whatsoever, at its sole discretion, pursuant to the

subscription agreement, as amended.

.

.

Transaction

SPAC cash in Trust of $132 million

A minimum cash condition to

closing of $50 million; satisfied with

$50.5 million PIPE* of subunits at

$10.10, per subunit.

Net proceeds support organic

growth to 2024 when business is

projected to be cash positive.

Additional proceeds will allow

company to broaden geographic and

horizontal coverage.

Valuation

Pro forma Enterprise Value of $720

million fully diluted basis (zero

additional trust redemptions).

Attractive entry multiple for a high

growth business of 11.1x projected

'22 revenues, representing significant

discount to direct public comps and

similar SPAC transactions.View entire presentation