Cerberus Global NPL Fund, L.P.

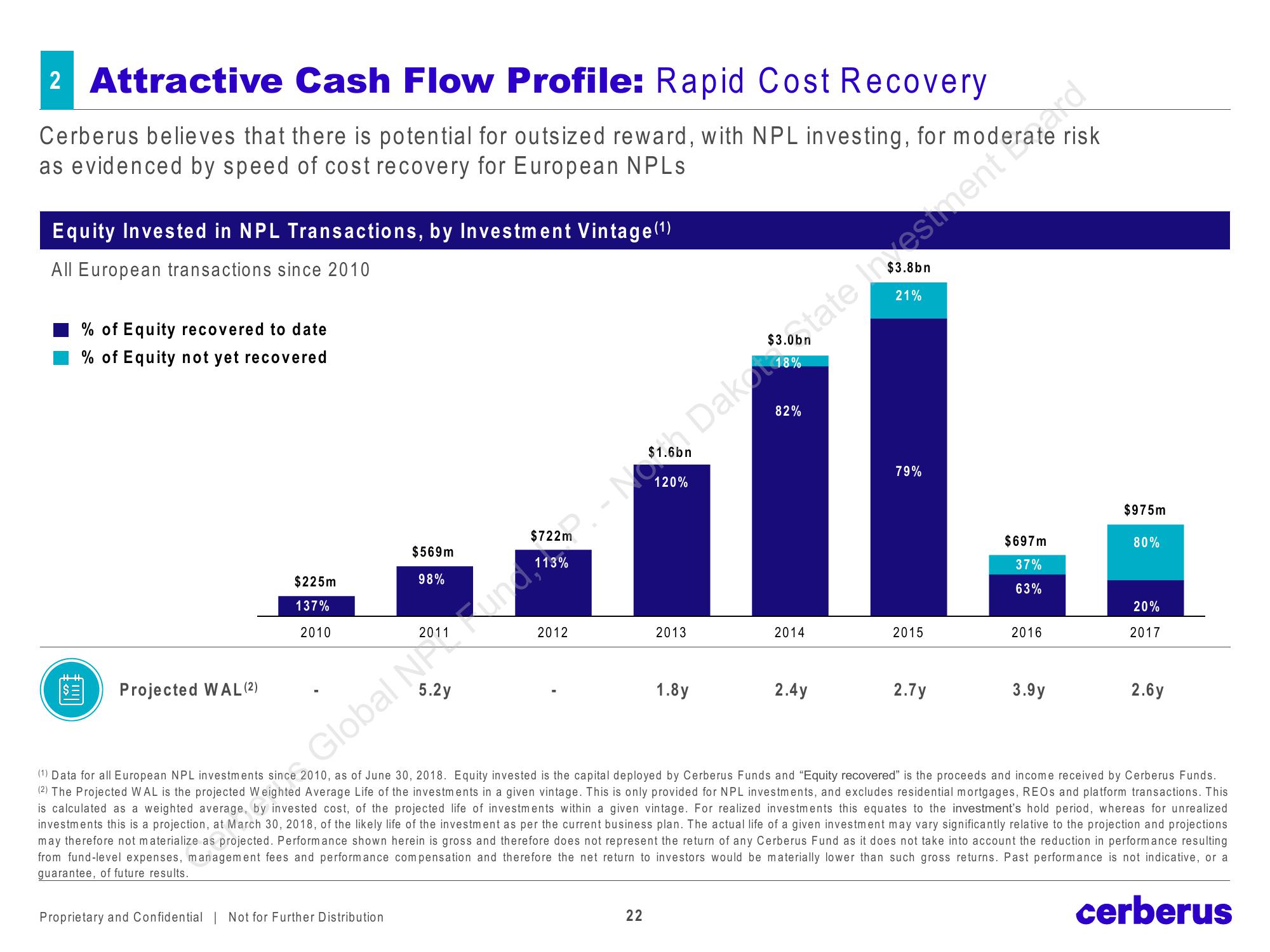

2 Attractive Cash Flow Profile: Rapid Cost Recovery

Cerberus believes that there is potential for outsized reward, with NPL investing, for

as evidenced by speed of cost recovery for European NPLs

Equity Invested in NPL Transactions, by Investment Vintage (¹)

All European transactions since 2010

% of Equity recovered to date

% of Equity not yet recovered

€!!

Projected WAL (2)

$225m

137%

2010

$569m

98%

5.2y

Proprietary and Confidential | Not for Further Distribution

2012

2013

1.8y

22

82%

2014

2.4y

21%

79%

2015

2.7y

$697m

37%

63%

2016

3.9y

risk

$975m

80%

20%

2017

Global Nound 2.- No Dakot, tate in sestment feraxd

2.6y

(1) Data for all European NPL investments since 2010, as of June 30, 2018. Equity invested is the capital deployed by Cerberus Funds and "Equity recovered" is the proceeds and income received by Cerberus Funds.

(2) The Projected WAL is the projected Weighted Average Life of the investments in a given vintage. This is only provided for NPL investments, and excludes residential mortgages, REOs and platform transactions. This

is calculated as a weighted average, by invested cost, of the projected life of investments within a given vintage. For realized investments this equates to the investment's hold period, whereas for unrealized

investments this is a projection, at March 30, 2018, of the likely life of the investment as per the current business plan. The actual life of a given investment may vary significantly relative to the projection and projections

may therefore not materialize as projected. Performance shown herein is gross and therefore does not represent the return of any Cerberus Fund as it does not take into account the reduction in performance resulting

from fund-level expenses, management fees and performance compensation and therefore the net return to investors would be materially lower than such gross returns. Past performance is not indicative, or a

guarantee, of future results.

cerberusView entire presentation