THOR Industries Results Presentation Deck

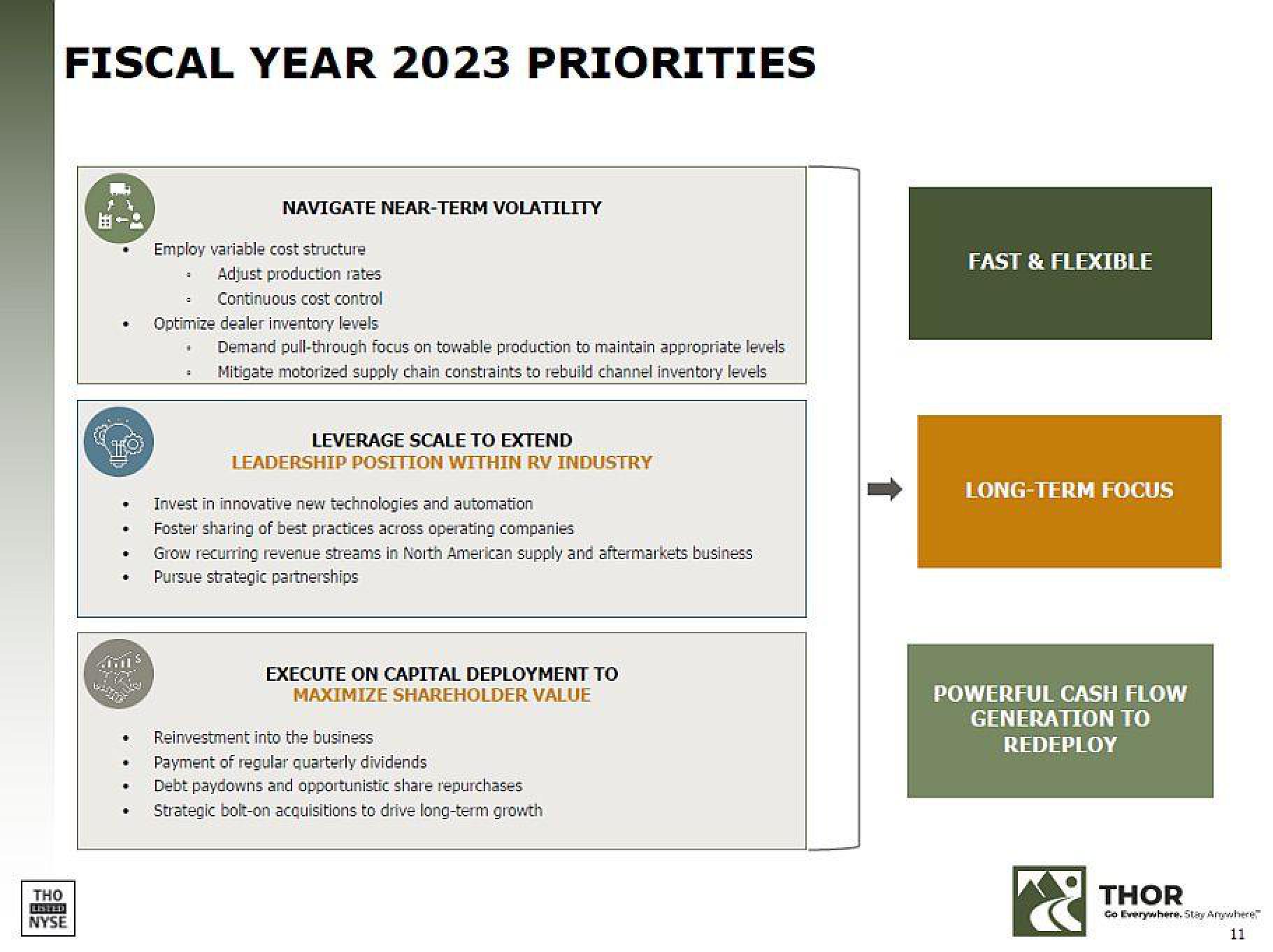

FISCAL YEAR 2023 PRIORITIES

THO

LISTED

NYSE

1711 S

Employ variable cost structure

Adjust production rates

Continuous cost control

Optimize dealer inventory levels

=

NAVIGATE NEAR-TERM VOLATILITY

i

Demand pull-through focus on towable production to maintain appropriate levels

Mitigate motorized supply chain constraints to rebuild channel inventory levels

LEVERAGE SCALE TO EXTEND

LEADERSHIP POSITION WITHIN RV INDUSTRY

Invest in innovative new technologies and automation

Foster sharing of best practices across operating companies

Grow recurring revenue streams in North American supply and aftermarkets business

Pursue strategic partnerships

EXECUTE ON CAPITAL DEPLOYMENT TO

MAXIMIZE SHAREHOLDER VALUE

Reinvestment into the business

Payment of regular quarterly dividends

Debt paydowns and opportunistic share repurchases

Strategic bolt-on acquisitions to drive long-term growth

FAST & FLEXIBLE

LONG-TERM FOCUS

POWERFUL CASH FLOW

GENERATION TO

REDEPLOY

X

THOR

Co Everywhere. Stay Anywhere

11View entire presentation