OpenText Investor Presentation Deck

Strong Cash Flows and Balance Sheet

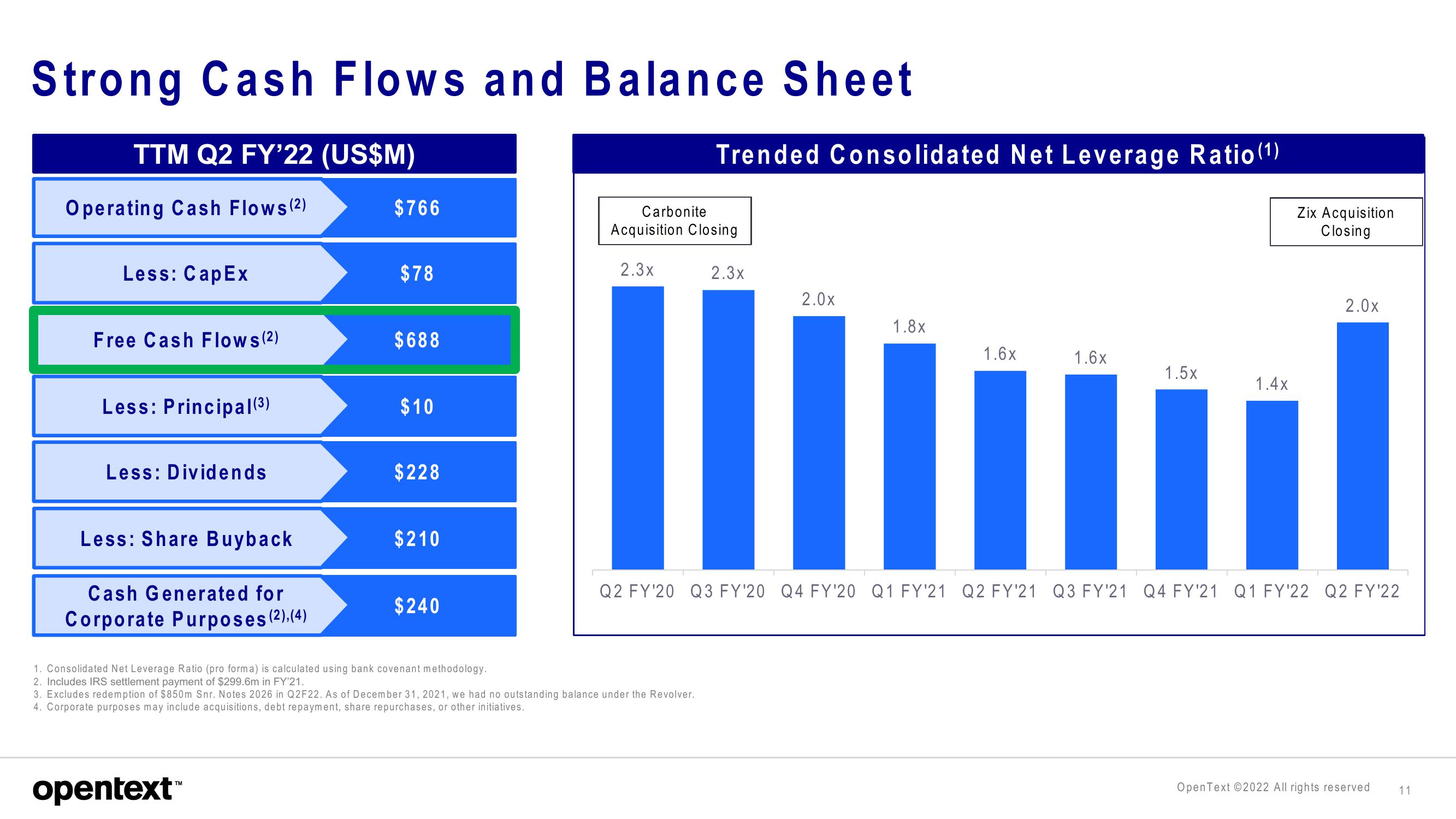

TTM Q2 FY'22 (US$M)

Operating Cash Flows (2)

Less: CapEx

Free Cash Flows (2)

Less: Principal(³)

Less: Dividends

Less: Share Buyback

Cash Generated for

Corporate Purposes (2).(4)

$766

opentext™

$78

$688

$10

$228

$210

$240

Carbonite

Acquisition Closing

2.3x

Trended Consolidated Net Leverage Ratio (1)

1. Consolidated Net Leverage Ratio (pro forma) is calculated using bank covenant methodology.

2. Includes IRS settlement payment of $299.6m in FY'21.

3. Excludes redemption of $850m Snr. Notes 2026 in Q2F22. As of December 31, 2021, we had no outstanding balance under the Revolver.

4. Corporate purposes may include acquisitions, debt repayment, share repurchases, or other initiatives.

2.3x

2.0x

1.8x

1.6x

1.6x

1.5x

1.4x

Zix Acquisition

Closing

2.0x

Q2 FY'20 Q3 FY'20 Q4 FY'20 Q1 FY'21 Q2 FY'21 Q3 FY'21 Q4 FY'21 Q1 FY'22 Q2 FY'22

Open Text ©2022 All rights reserved

11View entire presentation