Hilltop Holdings Results Presentation Deck

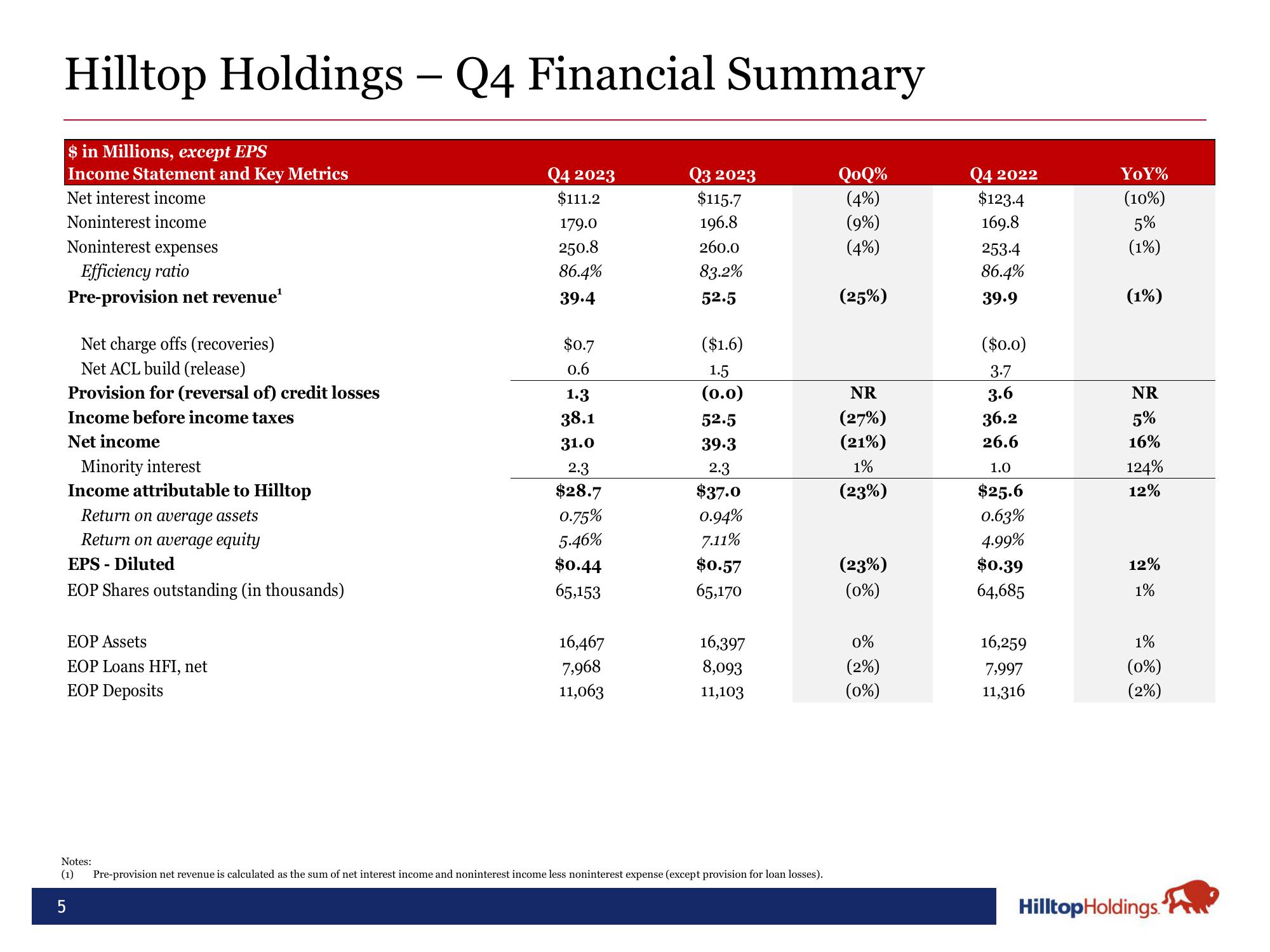

Hilltop Holdings - Q4 Financial Summary

$ in Millions, except EPS

Income Statement and Key Metrics

Net interest income

Noninterest income

Noninterest expenses

Efficiency ratio

Pre-provision net revenue¹

Net charge offs (recoveries)

Net ACL build (release)

Provision for (reversal of) credit losses

Income before income taxes

Net income

Minority interest

Income attributable to Hilltop

Return on average assets

Return on average equity

EPS - Diluted

EOP Shares outstanding (in thousands)

EOP Assets

EOP Loans HFI, net

EOP Deposits

Q4 2023

$111.2

179.0

250.8

86.4%

39.4

5

$0.7

0.6

1.3

38.1

31.0

2.3

$28.7

0.75%

5.46%

$0.44

65,153

16,467

7,968

11,063

Q3 2023

$115.7

196.8

260.0

83.2%

52.5

($1.6)

1.5

(0.0)

52.5

39.3

2.3

$37.0

0.94%

7.11%

$0.57

65,170

16,397

8,093

11,103

Notes:

(1) Pre-provision net revenue is calculated as the sum of net interest income and noninterest income less noninterest expense (except provision for loan losses).

QoQ%

(4%)

(9%)

(4%)

(25%)

NR

(27%)

(21%)

1%

(23%)

(23%)

(0%)

0%

(2%)

(0%)

Q4 2022

$123.4

169.8

253.4

86.4%

39.9

($0.0)

3.7

3.6

36.2

26.6

1.0

$25.6

0.63%

4.99%

$0.39

64,685

16,259

7,997

11,316

YOY%

(10%)

5%

(1%)

(1%)

NR

5%

16%

124%

12%

12%

1%

1%

(0%)

(2%)

Hilltop Holdings.View entire presentation