Kering Investor Presentation Deck

●

●

●

KEY HIGHLIGHTS

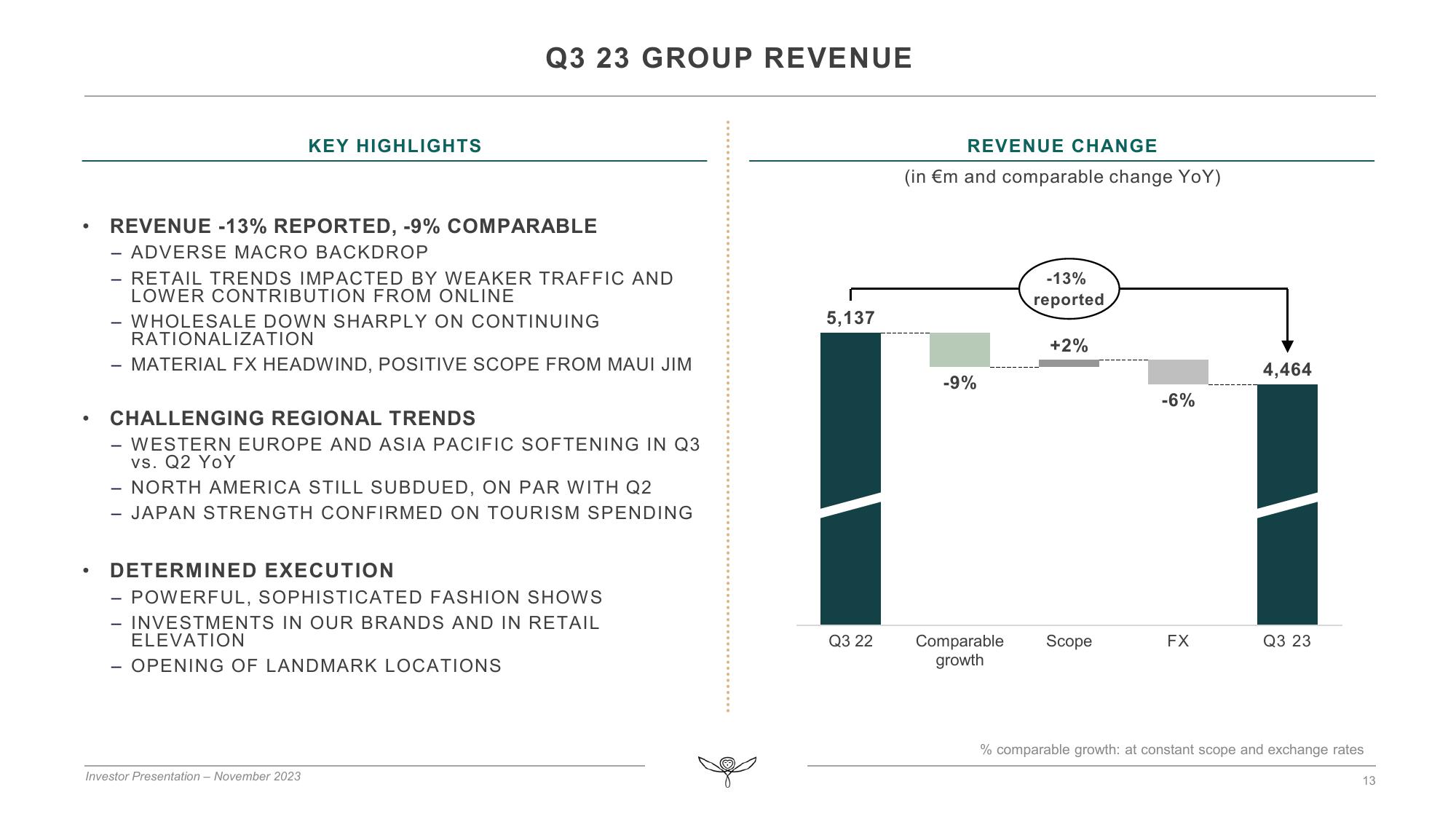

REVENUE -13% REPORTED, -9% COMPARABLE

- ADVERSE MACRO BACKDROP

- RETAIL TRENDS IMPACTED BY WEAKER TRAFFIC AND

LOWER CONTRIBUTION FROM ONLINE

WHOLESALE DOWN SHARPLY ON CONTINUING

RATIONALIZATION

MATERIAL FX HEADWIND, POSITIVE SCOPE FROM MAUI JIM

Q3 23 GROUP REVENUE

CHALLENGING REGIONAL TRENDS

WESTERN EUROPE AND ASIA PACIFIC SOFTENING IN Q3

vs. Q2 YoY

NORTH AMERICA STILL SUBDUED, ON PAR WITH Q2

JAPAN STRENGTH CONFIRMED ON TOURISM SPENDING

DETERMINED EXECUTION

POWERFUL, SOPHISTICATED FASHION SHOWS

INVESTMENTS IN OUR BRANDS AND IN RETAIL

ELEVATION

- OPENING OF LANDMARK LOCATIONS

-

Investor Presentation - November 2023

5,137

Q3 22

REVENUE CHANGE

(in Em and comparable change YoY)

-9%

Comparable

growth

-13%

reported

+2%

Scope

-6%

FX

4,464

Q3 23

% comparable growth: at constant scope and exchange rates

13View entire presentation