Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

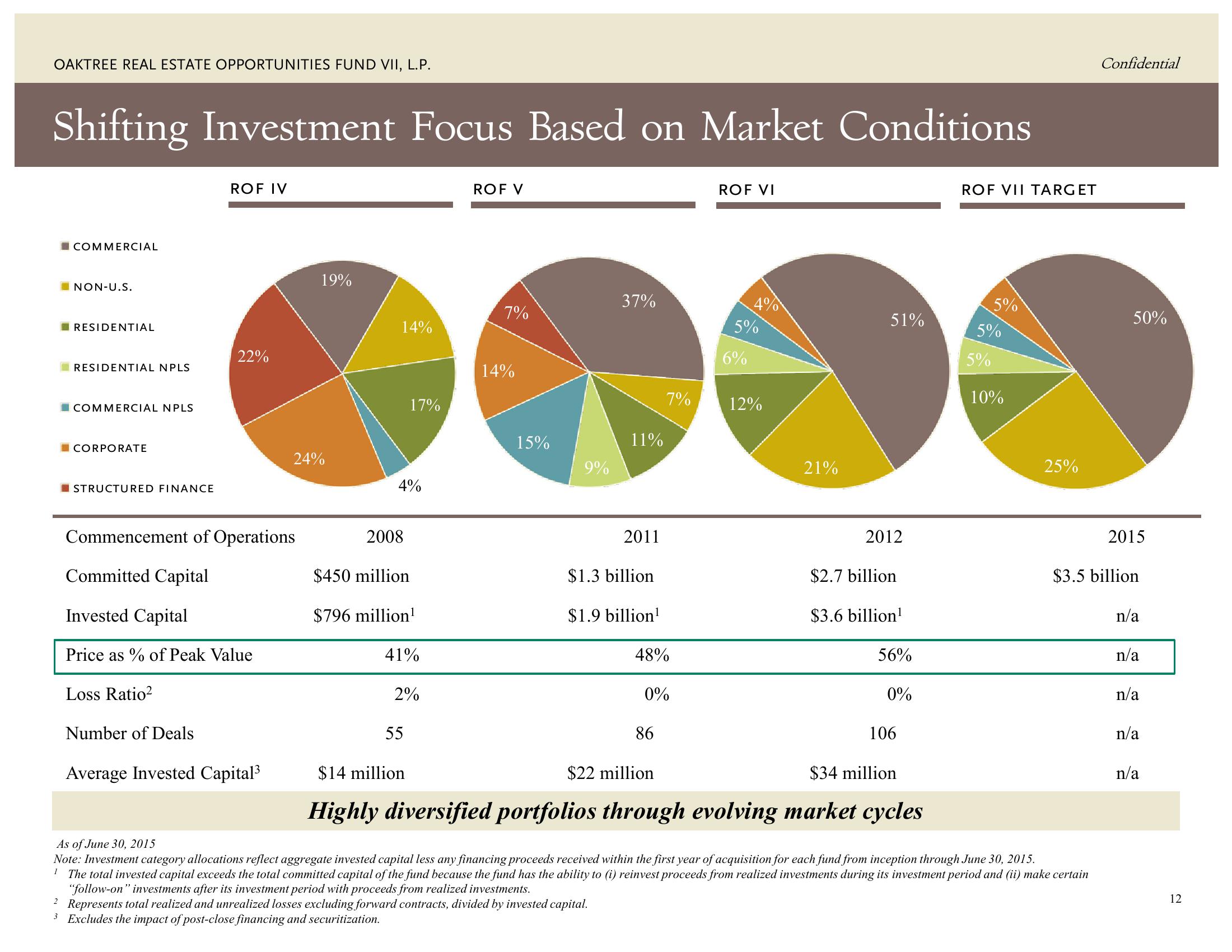

Shifting Investment Focus Based on Market Conditions

COMMERCIAL

NON-U.S.

RESIDENTIAL

RESIDENTIAL NPLS

COMMERCIAL NPLS

CORPORATE

STRUCTURED FINANCE

Loss Ratio²

ROF IV

Number of Deals

22%

Commencement of Operations

Committed Capital

Invested Capital

Price as % of Peak Value

Average Invested Capital³

19%

24%

14%

4%

2008

17%

$450 million

$796 million¹

41%

2%

55

ROF V

7%

14%

15%

9%

37%

11%

2011

$1.3 billion

$1.9 billion¹

2 Represents total realized and unrealized losses excluding forward contracts, divided by invested capital.

3 Excludes the impact of post-close financing and securitization.

7%

48%

0%

86

ROF VI

4%

5%

6%

12%

21%

51%

2012

$2.7 billion

$3.6 billion¹

56%

0%

106

$14 million

$22 million

$34 million

Highly diversified portfolios through evolving market cycles

ROF VII TARGET

5%

5%

5%

10%

25%

As of June 30, 2015

Note: Investment category allocations reflect aggregate invested capital less any financing proceeds received within the first year of acquisition for each fund from inception through June 30, 2015.

1 The total invested capital exceeds the total committed capital of the fund because the fund has the ability to (i) reinvest proceeds from realized investments during its investment period and (ii) make certain

"follow-on" investments after its investment period with proceeds from realized investments.

Confidential

50%

2015

$3.5 billion

n/a

n/a

n/a

n/a

n/a

12View entire presentation