Kinnevik Results Presentation Deck

Intro

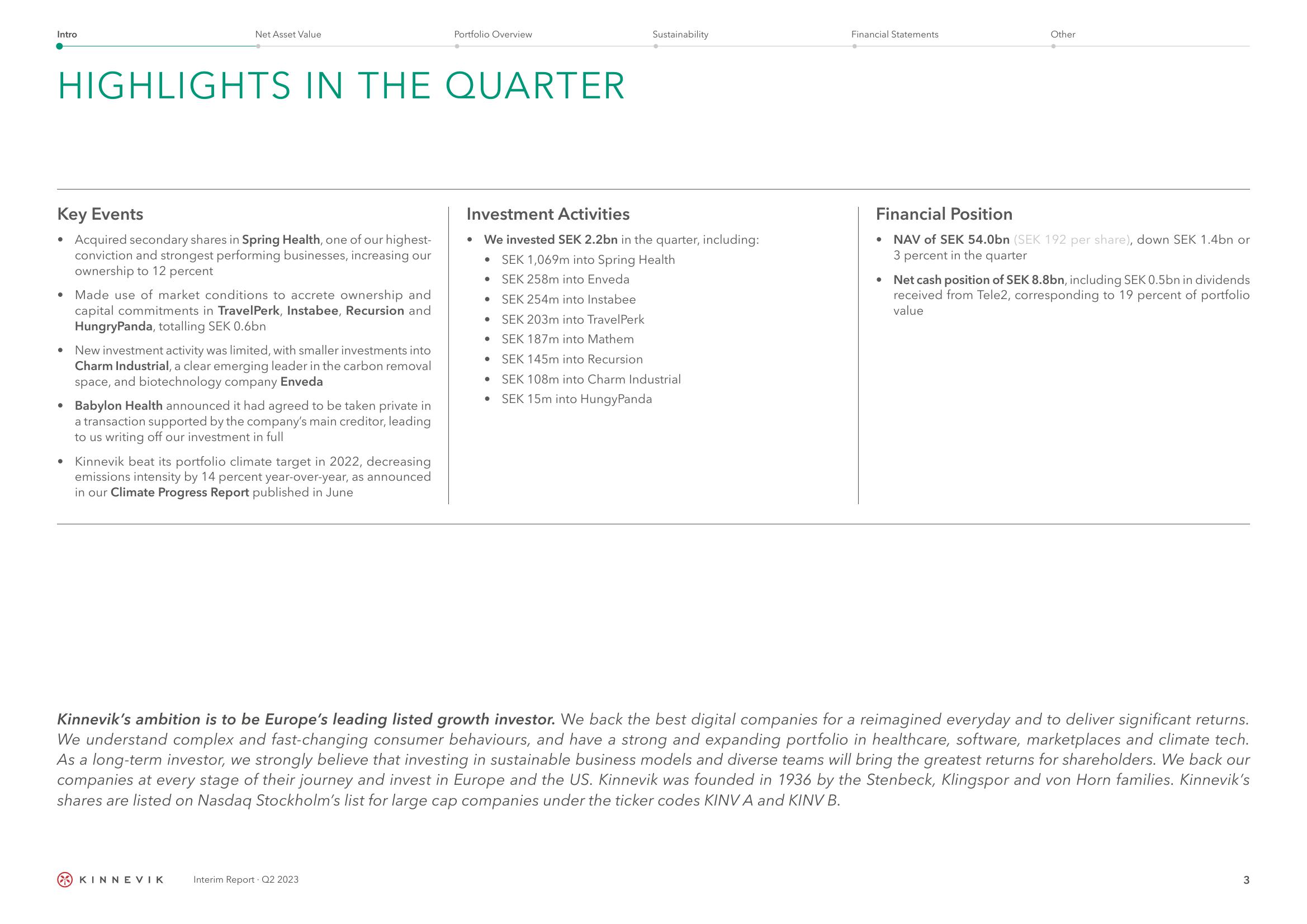

HIGHLIGHTS IN THE QUARTER

Key Events

Acquired secondary shares in Spring Health, one of our highest-

conviction and strongest performing businesses, increasing our

ownership to 12 percent

●

Net Asset Value

●

Made use of market conditions to accrete ownership and

capital commitments in TravelPerk, Instabee, Recursion and

HungryPanda, totalling SEK 0.6bn

New investment activity was limited, with smaller investments into

Charm Industrial, a clear emerging leader in the carbon removal

space, and biotechnology company Enveda

Babylon Health announced it had agreed to be taken private in

a transaction supported by the company's main creditor, leading

to us writing off our investment in full

Kinnevik beat its portfolio climate target in 2022, decreasing

emissions intensity by 14 percent year-over-year, as announced

in our Climate Progress Report published in June

KINNEVIK

Portfolio Overview

Interim Report Q2 2023

Investment Activities

We invested SEK 2.2bn in the quarter, including:

SEK 1,069m into Spring Health

● SEK 258m into Enveda

●

Sustainability

● SEK 254m into Instabee

• SEK 203m into TravelPerk

• SEK 187m into Mathem

● SEK 145m into Recursion

SEK 108m into Charm Industrial

SEK 15m into HungyPanda

●

●

Financial Statements

Other

Financial Position

• NAV of SEK 54.0bn (SEK 192 per share), down SEK 1.4bn or

3 percent in the quarter

Kinnevik's ambition is to be Europe's leading listed growth stor. We back the best digital companies for a reimagined everyday and to deliver significant returns.

We understand complex and fast-changing consumer behaviours, and have a strong and expanding portfolio in healthcare, software, marketplaces and climate tech.

As a long-term investor, we strongly believe that investing in sustainable business models and diverse teams will bring the greatest returns for shareholders. We back our

companies at every stage of their journey and invest in Europe and the US. Kinnevik was founded in 1936 by the Stenbeck, Klingspor and von Horn families. Kinnevik's

shares are listed on Nasdaq Stockholm's list for large cap companies under the ticker codes KINV A and KINV B.

• Net cash position of SEK 8.8bn, including SEK 0.5bn in dividends

received from Tele2, corresponding to 19 percent of portfolio

value

3View entire presentation