Appreciate SPAC Presentation Deck

COMPANY OVERVIEW

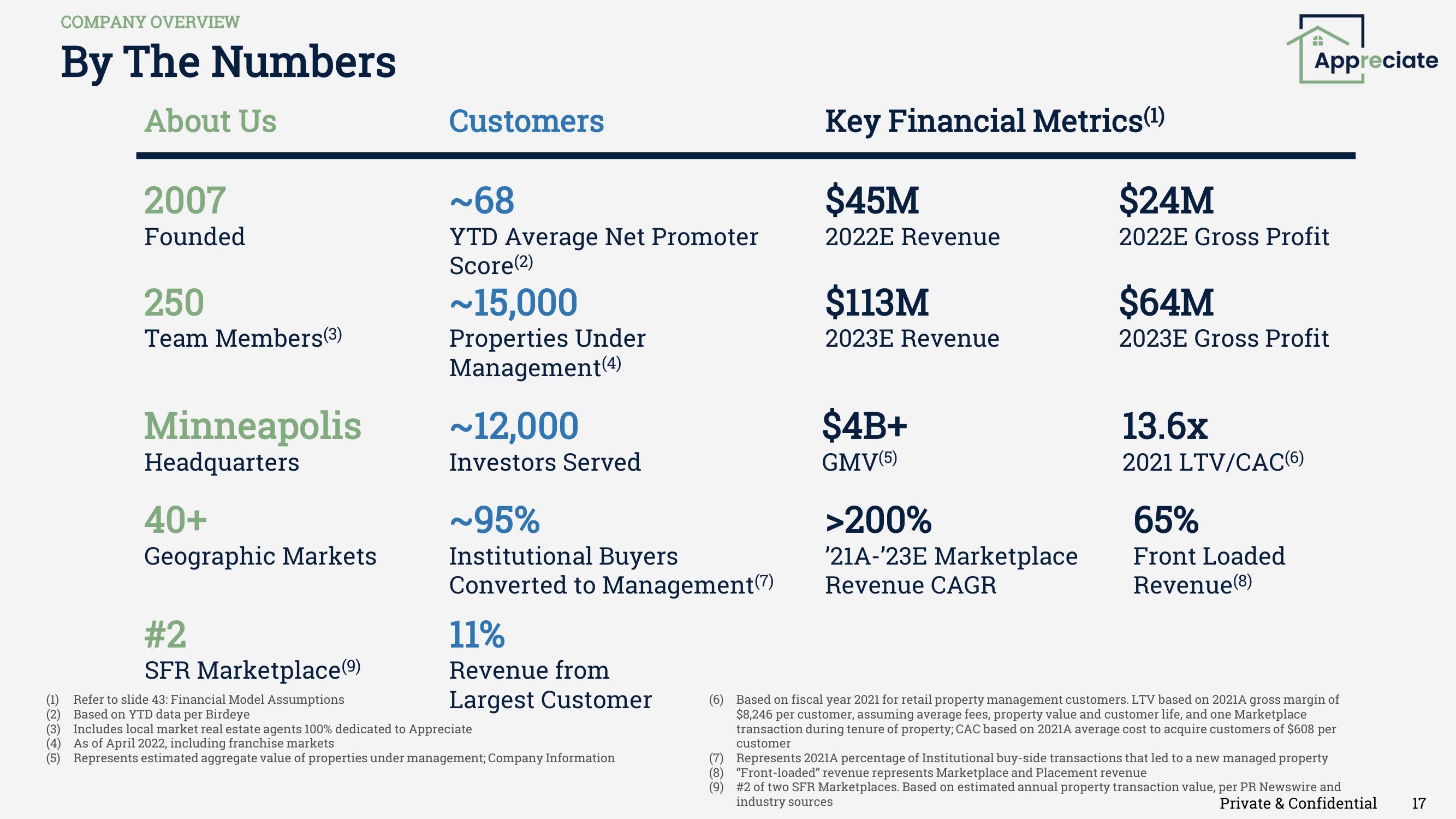

By The Numbers

About Us

(2)

(3)

(4)

(5)

2007

Founded

250

Team Members(3)

Minneapolis

Headquarters

40+

Geographic Markets

#2

SFR Marketplace (9)

Refer to slide 43: Financial Model Assumptions

Based on YTD data per Birdeye

Customers

~68

YTD Average Net Promoter

Score(2)

~15,000

Properties Under

Management (4)

~12,000

Investors Served

~95%

Institutional Buyers

Converted to Management (7)

11%

Revenue from

Largest Customer

Includes local market real estate agents 100% dedicated to Appreciate

As of April 2022, including franchise markets

Represents estimated aggregate value of properties under management; Company Information

Key Financial Metrics(¹)

$45M

2022E Revenue

$113M

2023E Revenue

$4B+

GMV(5)

>200%

'21A-'23E Marketplace

Revenue CAGR

4

ww

$24M

2022E Gross Profit

13.6x

2021 LTV/CAC(6)

Appreciate

$64M

2023E Gross Profit

65%

Front Loaded

Revenue (8)

(6) Based on fiscal year 2021 for retail property management customers. LTV based on 2021A gross margin of

$8,246 per customer, assuming average fees, property value and customer life, and one Marketplace

transaction during tenure of property; CAC based on 2021A average cost to acquire customers of $608 per

customer

(7) Represents 2021A percentage of Institutional buy-side transactions that led to a new managed property

(8) "Front-loaded" revenue represents Marketplace and Placement revenue

(9)

#2 of two SFR Marketplaces. Based on estimated annual property transaction value, per PR Newswire and

industry sources

Private & Confidential

17View entire presentation