Mesirow Private Equity

Sector

Stage

Headquarters

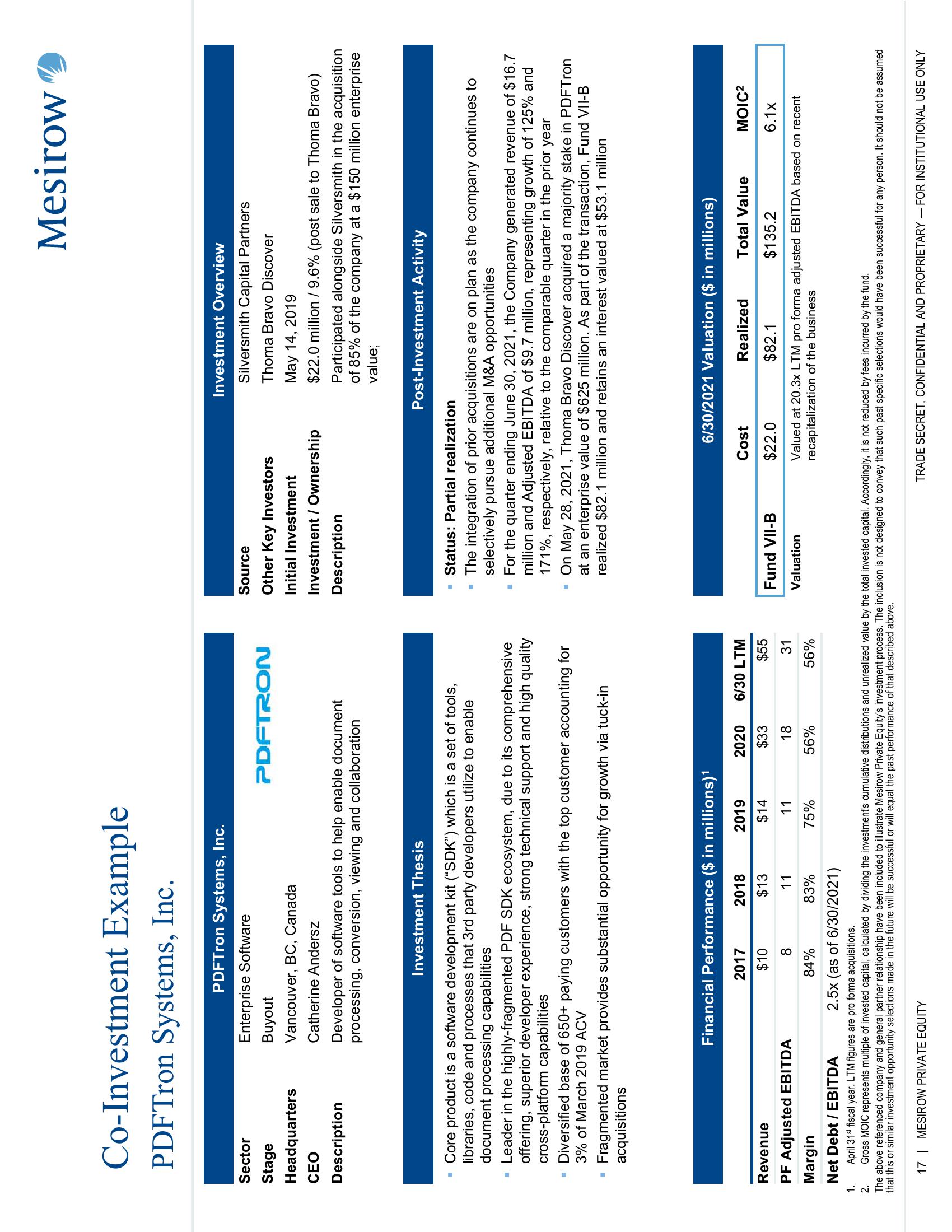

Co-Investment Example

PDFTron Systems, Inc.

CEO

Description

M

PDFTron Systems, Inc.

■

Enterprise Software

Buyout

Vancouver, BC, Canada

Catherine Andersz

Developer of software tools to help enable document

processing, conversion, viewing and collaboration

Investment Thesis

■ Core product is a software development kit ("SDK") which is a set of tools,

libraries, code and processes that 3rd party developers utilize to enable

document processing capabilities

▪ Leader in the highly-fragmented PDF SDK ecosystem, due to its comprehensive

offering, superior developer experience, strong technical support and high quality

cross-platform capabilities

PDFTRON

Diversified base of 650+ paying customers with the top customer accounting for

3% of March 2019 ACV

Fragmented market provides substantial opportunity for growth via tuck-in

acquisitions

Financial Performance ($ in millions)¹

2019

$14

11

75%

2017

$10

8

84%

2.5x (as of 6/30/2021)

2018

$13

11

83%

2020

$33

18

56%

6/30 LTM

$55

31

56%

Source

Other Key Investors

Initial Investment

Investment / Ownership

Description

■

■

Mesirow

Status: Partial realization

▪ The integration of prior acquisitions are on plan as the company continues to

selectively pursue additional M&A opportunities

Investment Overview

Silversmith Capital Partners

Thoma Bravo Discover

May 14, 2019

$22.0 million / 9.6% (post sale to Thoma Bravo)

Participated alongside Silversmith in the acquisition

of 85% of the company at a $150 million enterprise

value;

Post-Investment Activity

For the quarter ending June 30, 2021, the Company generated revenue of $16.7

million and Adjusted EBITDA of $9.7 million, representing growth of 125% and

171%, respectively, relative to the comparable quarter in the prior year

Fund VII-B

Valuation

▪ On May 28, 2021, Thoma Bravo Discover acquired a majority stake in PDFTron

at an enterprise value of $625 million. As part of the transaction, Fund VII-B

realized $82.1 million and retains an interest valued at $53.1 million

6/30/2021 Valuation ($ in millions)

Realized

Total Value

Cost

$22.0

MOIC²

6.1x

$82.1

$135.2

Valued at 20.3x LTM pro forma adjusted EBITDA based on recent

recapitalization of the business

Revenue

PF Adjusted EBITDA

Margin

Net Debt / EBITDA

1.

April 31st fiscal year. LTM figures are pro forma acquisitions.

2.

Gross MOIC represents multiple of invested capital, calculated by dividing the investment's cumulative distributions and unrealized value by the total invested capital. Accordingly, it is not reduced by fees incurred by the fund.

The above referenced company and general partner relationship have been included to illustrate Mesirow Private Equity's investment process. The inclusion is not designed to convey that such past specific selections would have been successful for any person. It should not be assumed

that this or similar investment opportunity selections made in the future will be successful or will equal the past performance of that described above.

17 | MESIROW PRIVATE EQUITY

TRADE SECRET, CONFIDENTIAL AND PROPRIETARY FOR INSTITUTIONAL USE ONLYView entire presentation