Crocs Results Presentation Deck

APPENDIX

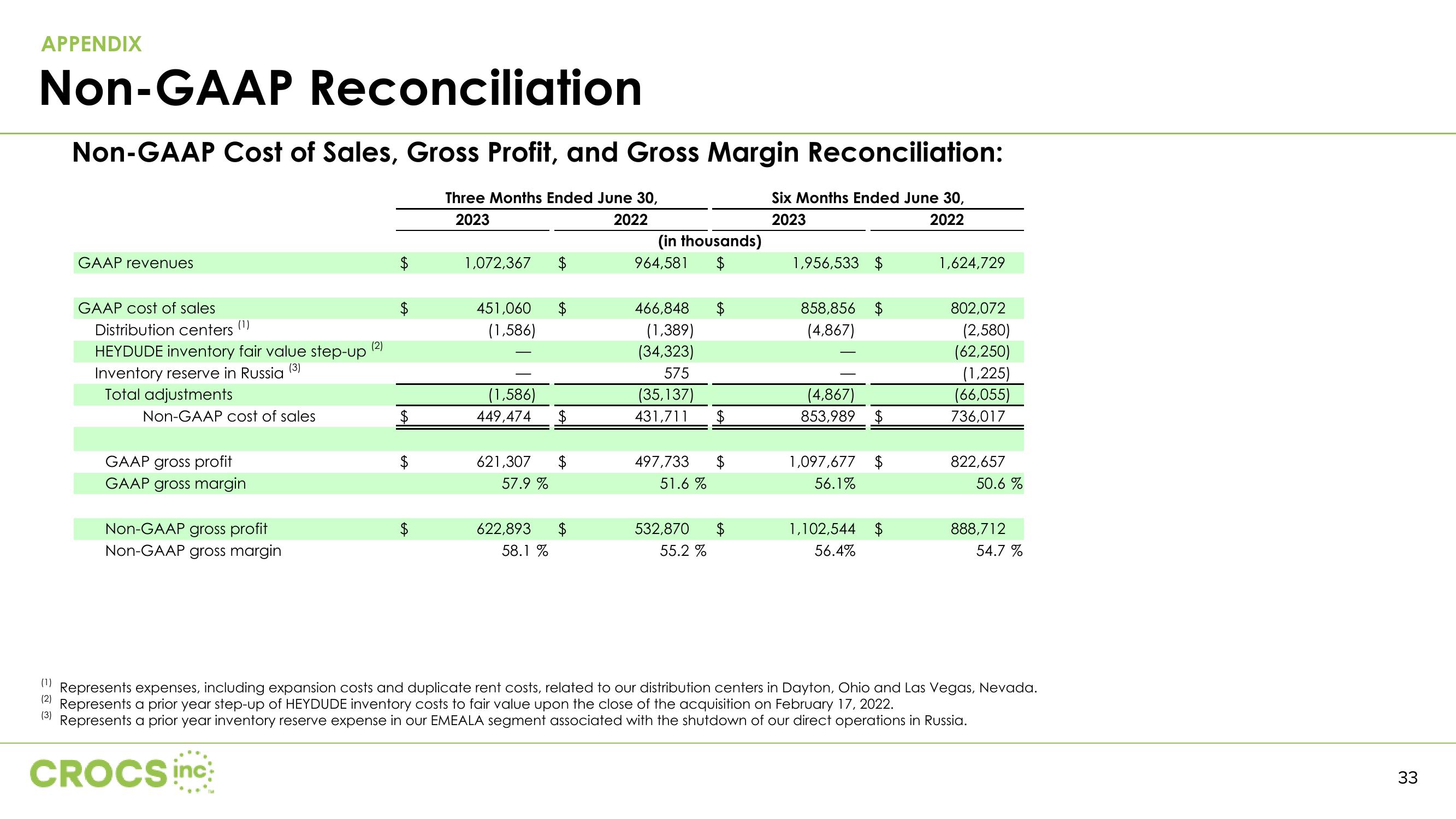

Non-GAAP Reconciliation

Non-GAAP Cost of Sales, Gross Profit, and Gross Margin Reconciliation:

Six Months Ended June 30,

2023

2022

(1)

(2)

(3)

GAAP revenues

GAAP cost of sales

Distribution centers (¹)

HEYDUDE inventory fair value step-up

(3)

Inventory reserve in Russia

Total adjustments

Non-GAAP cost of sales

GAAP gross profit

GAAP gross margin

Non-GAAP gross profit

Non-GAAP gross margin

(2)

Three Months Ended June 30,

2023

2022

1,072,367

451,060

(1,586)

$

(1,586)

449,474 $

621,307 $

57.9 %

622,893 $

58.1 %

(in thousands)

964,581

466,848

(1,389)

(34,323)

575

(35,137)

431,711

497,733

51.6%

$

532,870 $

55.2 %

1,956,533 $

858,856 $

(4,867)

(4,867)

853,989 $

1,097,677 $

56.1%

1,102,544 $

56.4%

1,624,729

802,072

(2,580)

(62,250)

(1,225)

(66,055)

736,017

822,657

50.6 %

888,712

54.7 %

Represents expenses, including expansion costs and duplicate rent costs, related to our distribution centers in Dayton, Ohio and Las Vegas, Nevada.

Represents a prior year step-up of HEYDUDE inventory costs to fair value upon the close of the acquisition on February 17, 2022.

Represents a prior year inventory reserve expense in our EMEALA segment associated with the shutdown of our direct operations in Russia.

CROCS inc

33View entire presentation