Cipher Mining Investor Presentation Deck

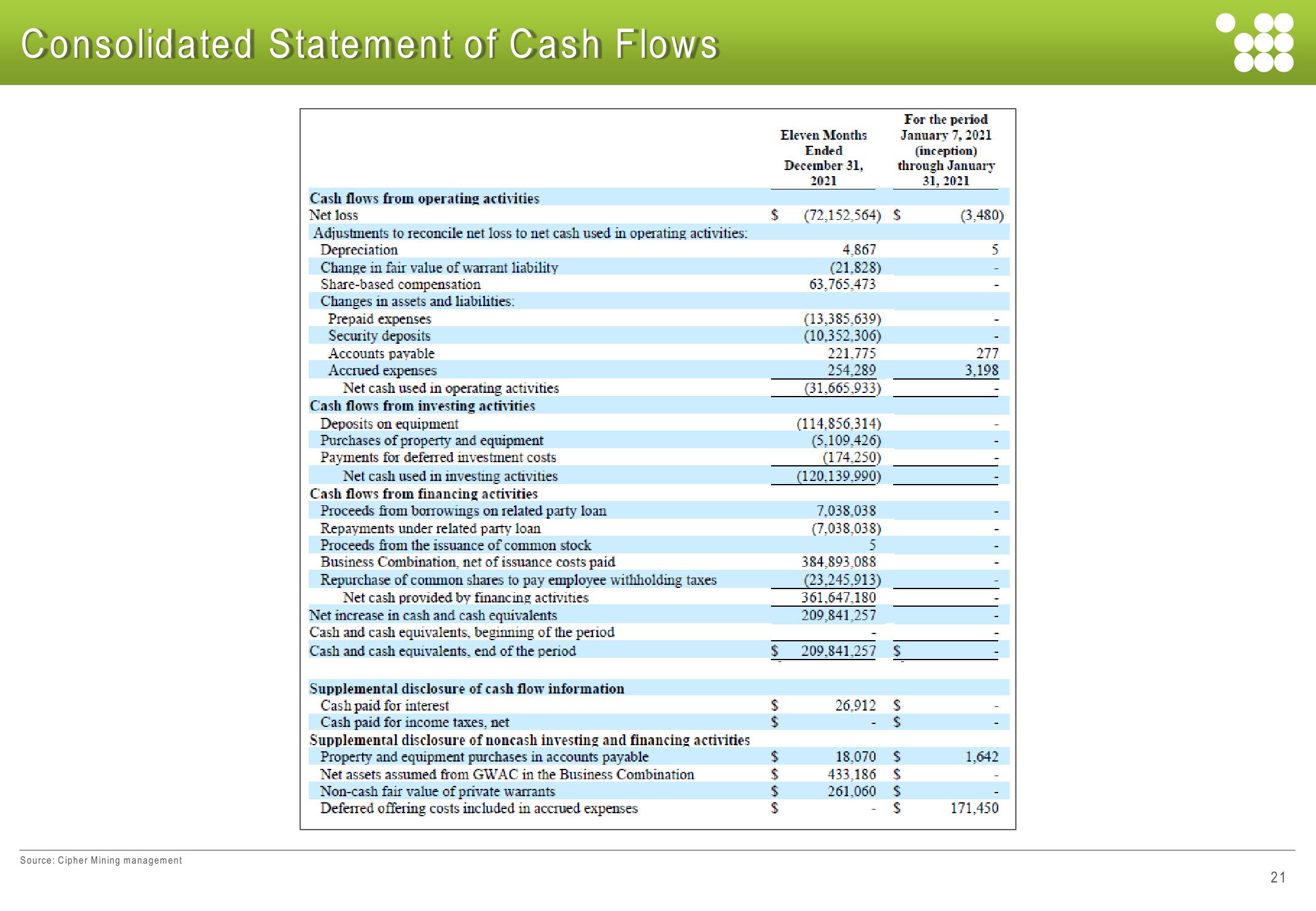

Consolidated Statement of Cash Flows

Source: Cipher Mining management

Cash flows from operating activities

Net loss

Adjustments to reconcile net loss to net cash used in operating activities:

Depreciation

Change in fair value of warrant liability

Share-based compensation

Changes in assets and liabilities:

Prepaid expenses

Security deposits

Accounts payable

Accrued expenses

Net cash used in operating activities

Cash flows from investing activities

Deposits on equipment

Purchases of property and equipment

Payments for deferred investment costs

Net cash used in investing activities

Cash flows from financing activities

Proceeds from borrowings on related party loan

Repayments under related party loan

Proceeds from the issuance of common stock

Business Combination, net of issuance costs paid.

Repurchase of common shares to pay employee withholding taxes

Net cash provided by financing activities

Net increase in cash and cash equivalents

Cash and cash equivalents, beginning of the period

Cash and cash equivalents, end of the period

Supplemental disclosure of cash flow information

Cash paid for interest

Cash paid for income taxes, net

Supplemental disclosure of noncash investing and financing activities

Property and equipment purchases in accounts payable

Net assets assumed from GWAC in the Business Combination

Non-cash fair value of private warrants

Deferred offering costs included in accrued expenses

$

$

LA LA LA LA

$

$

Eleven Months

Ended

December 31,

2021

(72,152,564) $

4,867

(21,828)

63,765,473

(13,385,639)

(10,352,306)

221,775

254,289

(31,665,933)

(114,856,314)

(5,109,426)

(174,250)

(120,139,990)

7,038,038

(7,038,038)

5

384,893,088

(23,245,913)

361,647,180

209,841,257

For the period

January 7, 2021

(inception)

through January

31, 2021

209,841,257

$

26.912 $

$

18,070 $

433,186 $

261,060 $

69 69 69 69

$

(3,480)

5

277

3.198

1,642

171.450

21View entire presentation