Antero Midstream Partners Investor Presentation Deck

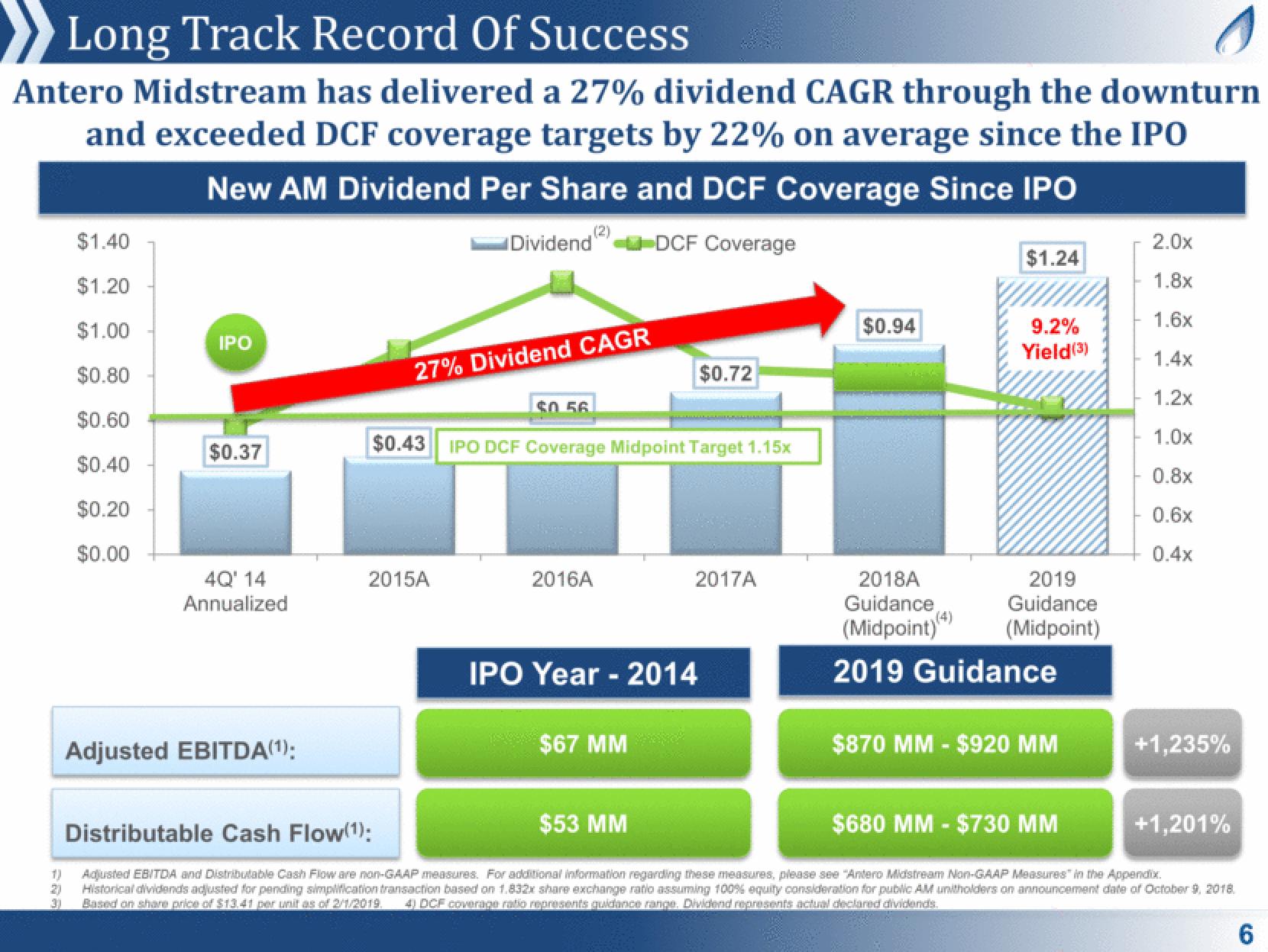

Long Track Record Of Success

0

Antero Midstream has delivered a 27% dividend CAGR through the downturn

and exceeded DCF coverage targets by 22% on average since the IPO

New AM Dividend Per Share and DCF Coverage Since IPO

(2)

Dividend DCF Coverage

1)

3)

$1.40

$1.20

$1.00

$0.80

$0.60

$0.40

$0.20

$0.00

IPO

$0.37

4Q' 14

Annualized

Adjusted EBITDA(1):

27% Dividend CAGR

$0.56

$0.43 IPO DCF Coverage Midpoint Target 1.15x

2015A

2016A

$0.72

IPO Year 2014

$67 MM

2017A

$0.94

$1.24

(4)

9.2%

Yield (3)

2018A

Guidance

(Midpoint)

2019 Guidance

2019

Guidance

(Midpoint)

$870 MM - $920 MM

2.0x

1.8x

1.6x

1.4x

1.2x

1.0x

0.8x

0.6x

0.4x

+1,235%

+1,201%

Distributable Cash Flow(¹):

$53 MM

$680 MM - $730 MM

Adjusted EBITDA and Distributable Cash Flow are non-GAAP measures. For additional information regarding these measures, please see "Antero Midstream Non-GAAP Measures in the Appendix.

Historical dividends adjusted for pending simplification transaction based on 1.832x share exchange ratio assuming 100% equity consideration for public AM unitholders on announcement date of October 9, 2018

Based on share price of $13.41 per unit as of 2/1/2019. 4) DCF coverage ratio represents guidance range. Dividend represents actual declared dividends.

6View entire presentation