SpringOwl Activist Presentation Deck

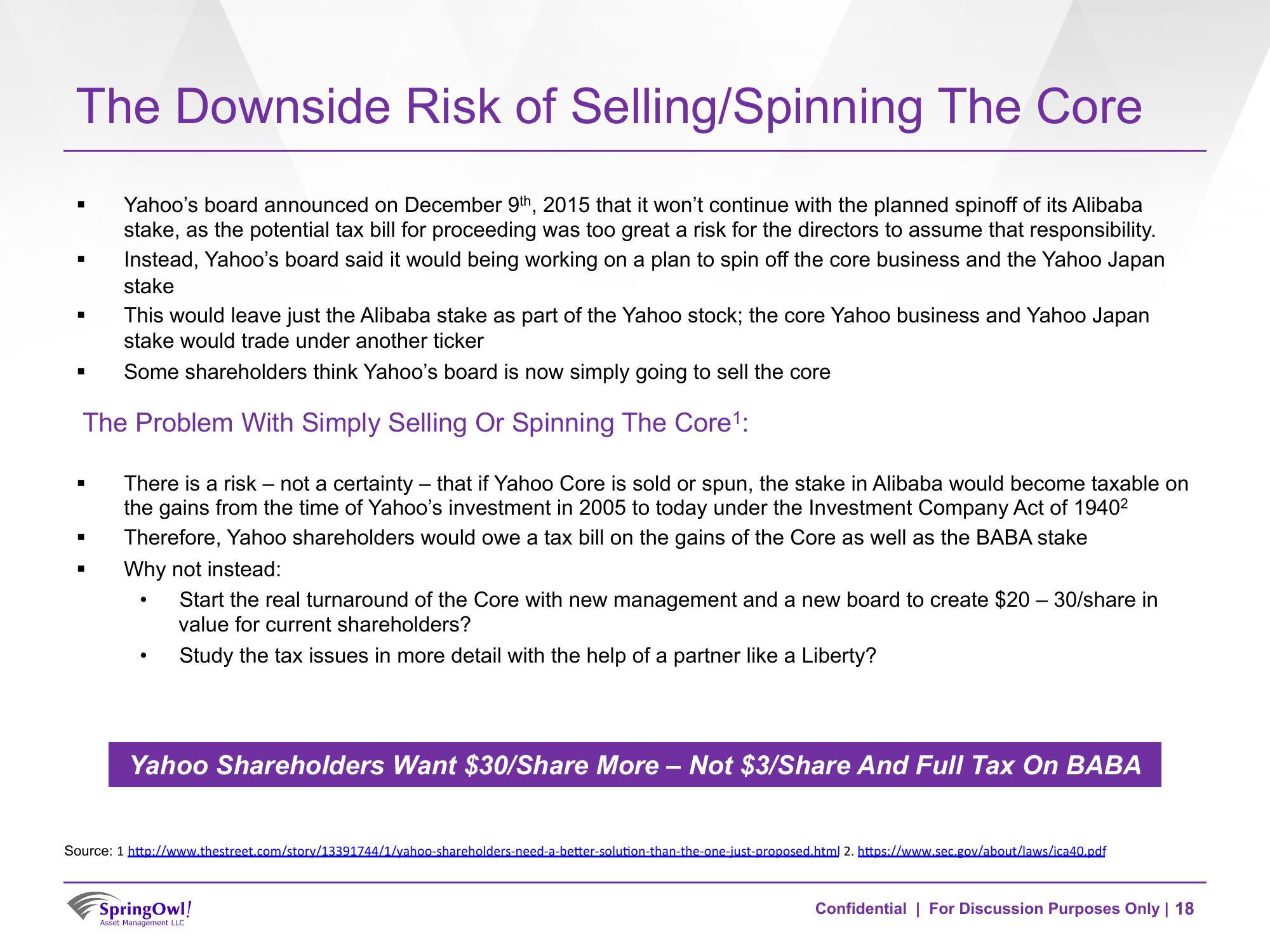

The Downside Risk of Selling/Spinning The Core

Yahoo's board announced on December 9th, 2015 that it won't continue with the planned spinoff of its Alibaba

stake, as the potential tax bill for proceeding was too great a risk for the directors to assume that responsibility.

Instead, Yahoo's board said it would being working on a plan to spin off the core business and the Yahoo Japan

stake

■

This would leave just the Alibaba stake as part of the Yahoo stock; the core Yahoo business and Yahoo Japan

stake would trade under another ticker

Some shareholders think Yahoo's board is now simply going to sell the core

The Problem With Simply Selling Or Spinning The Core¹:

■

■

■

There is a risk - not a certainty - that if Yahoo Core is sold or spun, the stake in Alibaba would become taxable on

the gains from the time of Yahoo's investment in 2005 to today under the Investment Company Act of 1940²

Therefore, Yahoo shareholders would owe a tax bill on the gains of the Core as well as the BABA stake

Why not instead:

●

Start the real turnaround of the Core with new management and a new board to create $20 - 30/share in

value for current shareholders?

Study the tax issues in more detail with the help of a partner like a Liberty?

Yahoo Shareholders Want $30/Share More - Not $3/Share And Full Tax On BABA

Source: 1 http://www.thestreet.com/story/13391744/1/yahoo-shareholders-need-a-better-solution-than-the-one-just-proposed.html 2. https://www.sec.gov/about/laws/ica40.pdf

Spring Owl!

Asset Management LLC

Confidential | For Discussion Purposes Only | 18View entire presentation