flyExclusive SPAC

V. FINANCIAL OVERVIEW

TRANSACTION

SUMMARY

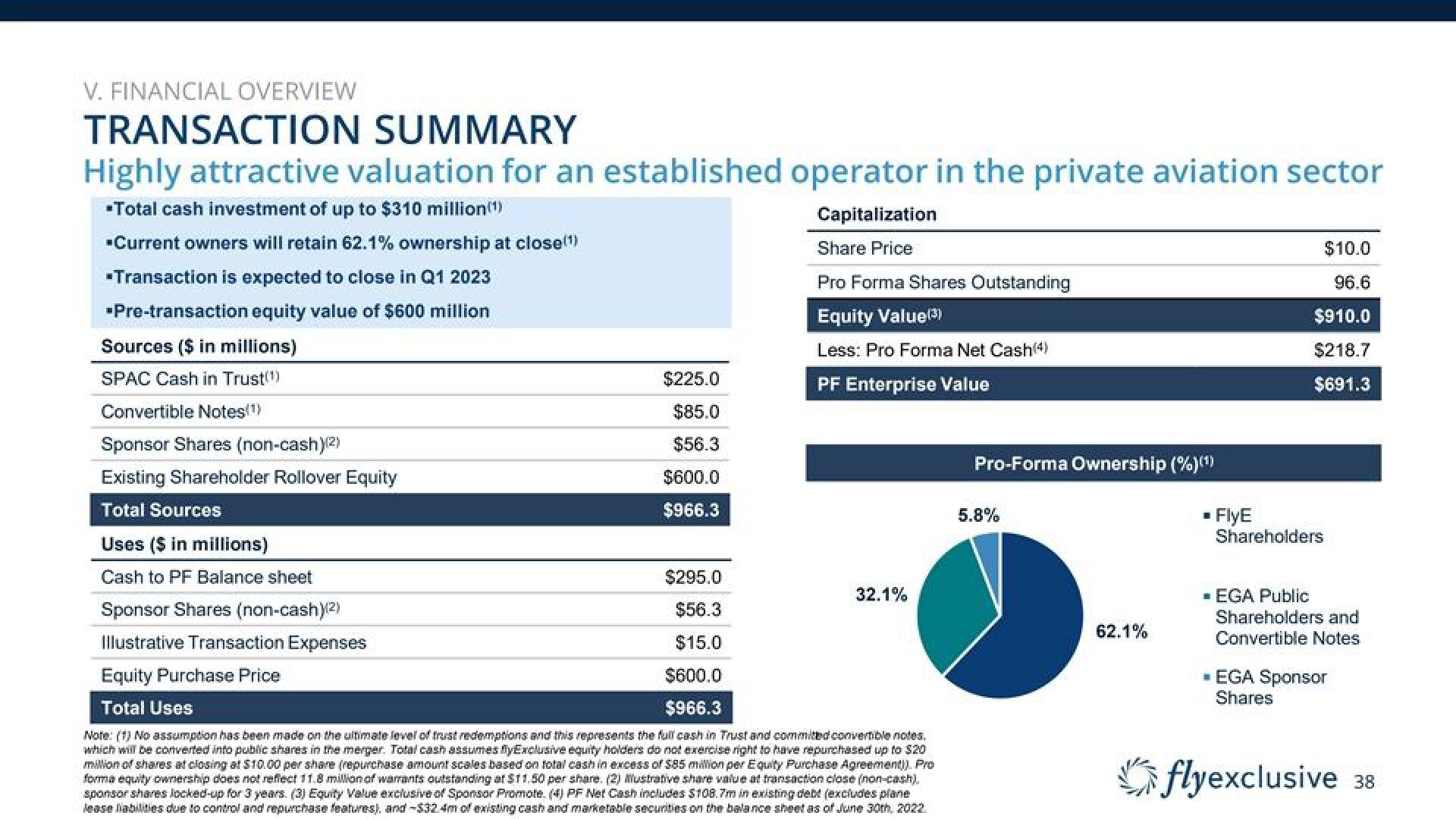

Highly attractive valuation for an established operator in the private aviation sector

▪Total cash investment of up to $310 million(¹)

Capitalization

▪Current owners will retain 62.1% ownership at close(¹)

Share Price

▪Transaction is expected to close in Q1 2023

Pro Forma Shares Outstanding

-Pre-transaction equity value of $600 million

Equity Value(³)

Sources ($ in millions)

Less: Pro Forma Net Cash(4)

SPAC Cash in Trust(1)

PF Enterprise Value

Convertible Notes(¹)

Sponsor Shares (non-cash)(2)

Existing Shareholder Rollover Equity

Total Sources

Uses ($ in millions)

Cash to PF Balance sheet

$225.0

$85.0

$56.3

$600.0

$966.3

$295.0

$56.3

$15.0

Equity Purchase Price

$600.0

$966.3

Total Uses

Note: (1) No assumption has been made on the ultimate level of trust redemptions and this represents the full cash in Trust and committed convertible notes.

which will be converted into public shares in the merger. Total cash assumes flyExclusive equity holders do not exercise right to have repurchased up to $20

million of shares at closing at $10.00 per share (repurchase amount scales based on total cash in excess of $85 million per Equity Purchase Agreement). Pro

forma equity ownership does not reflect 11.8 million of warrants outstanding at $11.50 per share. (2) Mustrative share value at transaction close (non-cash).

sponsor shares locked-up for 3 years. (3) Equity Value exclusive of Sponsor Promote. (4) PF Net Cash includes $108.7m in existing debt (excludes plane

lease liabilities due to control and repurchase features), and -$32 4m of existing cash and marketable securities on the balance sheet as of June 30th, 2022.

Sponsor Shares (non-cash)(2)

Illustrative Transaction Expenses

32.1%

Pro-Forma Ownership (%)(¹)

5.8%

62.1%

$10.0

96.6

$910.0

$218.7

$691.3

▪ FlyE

Shareholders

- EGA Public

Shareholders and

Convertible Notes

■ EGA Sponsor

Shares

flyexclusive 38View entire presentation